In a show of resilience, bitcoin has recovered from the crash of Black Thursday and rallied over 100% from the bottom at $3,850 to reclaim the high of $7,700.

The impending halving event, along with the prospect of Ethereum’s serenity upgrade in July, could be responsible for lifting the cryptocurrency markets higher — along with the influence of U.S. equities which have also pushed higher on fiscal stimulus news.

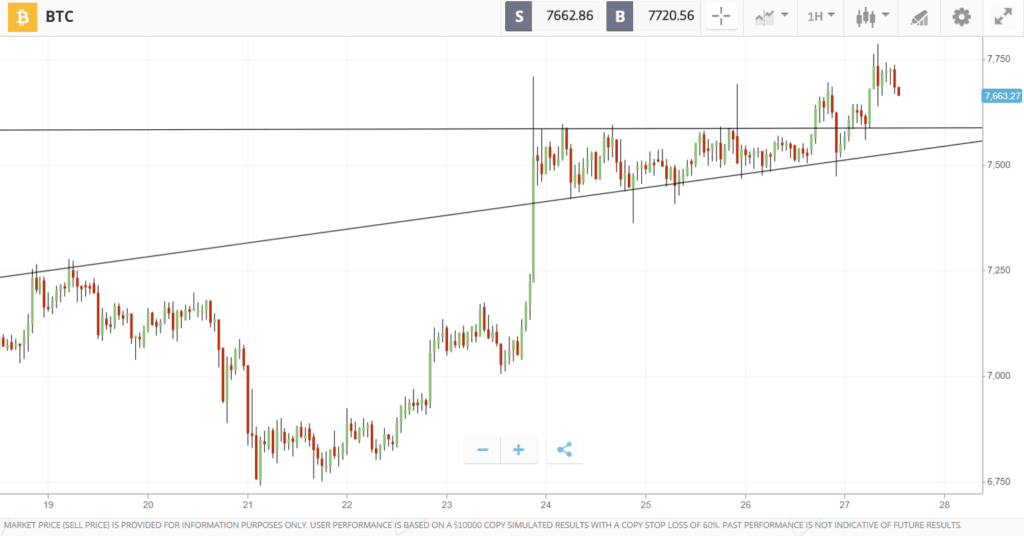

Bitcoin followed stock markets higher on Wednesday after the U.S. Senate approved $484 billion in new coronavirus relief. Then on Thursday, the leading cryptocurrency made its biggest gains of the week by breaking out of an ascending triangle pattern and shooting up 10% before Friday’s CME bitcoin futures expiry.

This Week’s Highlights

- Ether Taps $200 as Upgrade Nears

- Tezos Outpaces EOS

Ether Taps $200 as Upgrade Nears

Ether, the cryptocurrency that fuels the Ethereum network, is testing the $200 mark.

This comes as the blockchain gears up for the next stage of its evolution in the form of Ethereum 2.0, which is scheduled for July. Work towards the upgrade appears to be making solid progress, with the new Topaz testnet attracting 20,000 active validators since its launch on April 18th. In recognition, founder Vitalik Buterin observed on Twitter that the “trolls are already starting to ever so quietly walk back” their doubts about the project.

Tezos Outpaces EOS

“Ethereum killer” Tezos rallied 23% last week after knocking EOS off the top spot and becoming the cryptocurrency with the highest amount staked, according to data from Staking Rewards.

This comes as the cryptocurrency division of analytics firm Weiss Ratings marks Tezos and Caradano as the most promising blockchain projects in terms of technology. In market capitalization however, EOS still comes out on top with $2.5 billion compared to Tezos’ $1.9 billion.

The Week Ahead

Several events In the coming week threaten to stem global risk appetite and stall bitcoin’s uptrend.

Co

mage.

On the bullish side, uncertainty over the mysterious absence of North Korean leader Kim Jong-un could ignite bitcoin’s safe haven appeal, and prices continue to be buoyed internally by the immediate prospect of the halving.

For an indication of short-term momentum, traders are likely to be watching if bitcoin can hold on to its recent gains until the close of April’s monthly candle on Thursday 30th.