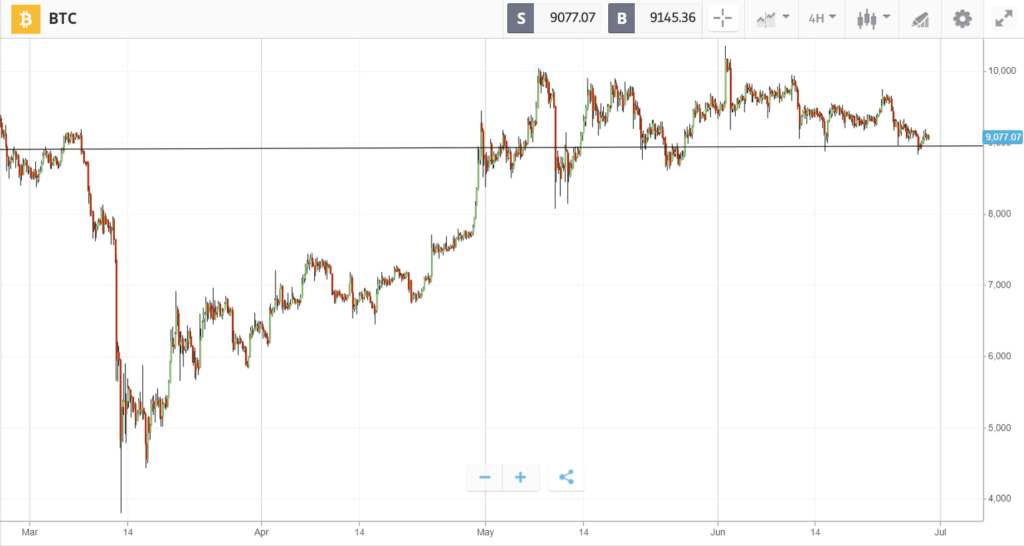

After another failed attempt to take $10k, Bitcoin has fallen to around the $9,000 mark.

Rumors of PayPal adopting cryptocurrency have failed to buoy the market. Instead, Bitcoin has followed stocks which are factoring in the increased likelihood of more lockdowns after the emergence of new Covid-19 clusters. Adding more downward pressure, Coca Cola, Starbucks, and several other multinationals have pulled the plug on Facebook advertising in a growing boycott.

Amid this risk-off climate, both Bitcoin and the S&P 500 have dropped 2% in the past week. Meanwhile, traditional safe haven asset gold has risen above $1,750 to hit highs not seen since 2012.

This Week’s Highlights

- Institutions Could Push Bitcoin to $50k

- PlusToken Ghost Spooks Traders

Institutions Could Push Bitcoin to $50k

New York blockchain research firm Messari has crunched the numbers to find out what happens if all institutions follow the example of Paul Tudor Jones and allocate a “low single-digit percentage” of their portfolios to Bitcoin.

The calculations show that a 1% allocation of institutional funds would result in a $480 billion inflow to Bitcoin, pushing the market cap to above $1 trillion—or more than $50,000 per BTC. Family offices, mutual funds, and endowments were all included in the study, but hedge funds are expected to be the first to widely invest.

PlusToken Ghost Spooks Traders

In an ominous sign that could foreshadow major volatility, a stash of cryptocurrency has been moved from wallets owned by the perpetrators of the PlusToken scam.

Blockchain detective firm Chainalysis identified the liquidation of more than $2 billion cryptocurrency from the Chinese ponzi scheme PlusToken as potentially being responsible for the downswings of 2019.

Since then, most of the scammers have been caught. But earlier this week, blockchain transactions showed that hundreds of millions dollars worth of cryptocurrency—including Bitcoin, Ethereum, and XRP—was on the move from PlusToken wallets to exchanges.

The Week Ahead

Despite the downturn, Bitcoin is still fluctuating within the same range that it has over the past five weeks. Over the weekend, a hammer candle formed on the daily chart suggesting that buyers have stepped in at the bottom of this region around $9,000.

Bitcoin’s ongoing correlation with the S&P 500 means price action in coming days is likely to be influenced by a bearish stock market. Major stock indices are set to open the week lower, and Morgan Stanley strategist Michael Wilson has said his previously bullish outlook will need to be revised unless Congress can step in with more stimulus.

Traders will also be watching for a change in global risk appetite on Tuesday when a three-day meeting on Hong Kong’s national security laws reaches its conclusion.