You’ve probably heard the proverb “it takes a village to raise a child.” The idea is that an entire community of contributors is necessary for the positive growth and enrichment of the youth.

A similar point can be raised for the concept of social investing on eToro. What is social investing? First, let’s cover why it’s necessary in today’s personal finance landscape.

The 21st century has witnessed a retail investor revolution, in which everyday people can buy/sell stocks and other assets with ease, thanks to advancements in tech and legislative changes. Once reserved for the rich, investing is now accessible to all ― and with just a few taps on your phone.

The issue is, in most instances, investors are on their own. For the inexperienced investor, jumping into things solo can be intimidating and confusing. What assets should you choose? How do you allocate your funds or create a portfolio?

This is where social investing comes in. It’s the concept of combining an investing platform with a social network to form an interactive community of like-minded participants, allowing people to invest wisely and confidently by utilizing the many engaging resources available.

From stocks to crypto and beyond, at eToro, we understand the importance of a supportive and transparent user base. You’re not just another faceless name in the crowd. Instead, you are harnessing the “wisdom of the crowd” and making investment decisions based on thoughtful conversations, analysis, and invaluable market insights ― all in one place.

How much do people value these benefits when it comes to investing and their overall personal finance? In a nutshell, the answer is quite a lot. We surveyed 2,000 Americans to gauge the power of social investing, specifically the advantages it provides over traditional retail trading. The results tell a compelling story about what consumers want, or more accurately, “who” they want when it comes to making important decisions.

To assess the survey results, we’re going to break down the four key benefits of social investing: education, confidence, community, and convenience.

Education

For amateur investors, education is everything. So much so that nearly 40% of respondents pointed to lack of knowledge as a barrier that prevents them from investing.

Whether you’re hesitant or just too embarrassed to ask others, you’ll need to know the basics when it comes to different asset classes (e.g., stocks, bonds, options), how markets function, diversification, and so on.

In addition to eToro Academy, our expansive hub of guides and other articles, social investing means having a community of industry thought leaders, experienced investors, and everyday people always by your side. According to our survey, 66% of respondents feel they learn better with help from others.

Confidence

So after you’ve brushed up on investing 101, how confident are you to take action? Being informed on the basics is one thing, but financial markets are constantly changing to the point where every day brings new opportunities and challenges.

40% of respondents said their fear of losing money prevented them from investing. On the flip side, 66% said they would feel more confident investing with the help of a social community.

Through social investing, eToro users have the advantage of real-time engagement, being able to interact with millions of investors around the world at any time. Post questions and get answers to help you feel more assured about your choices. 83% of Americans feel more confident making investment decisions by leveraging the expertise of others.

Community

Through the thick of it all, investing is a shared experience on eToro, where people can relate to and rejoice with others who have similar financial aspirations. Whether markets are up, down, or sideways, the ability to connect to millions of people through social investing indicates that you are never alone.

And as the data shows, people like getting involved with groups for multiple reasons. 64% said involving others makes things easier and gets them more motivated, while 66% said it improves overall productivity and makes them feel part of a larger community.

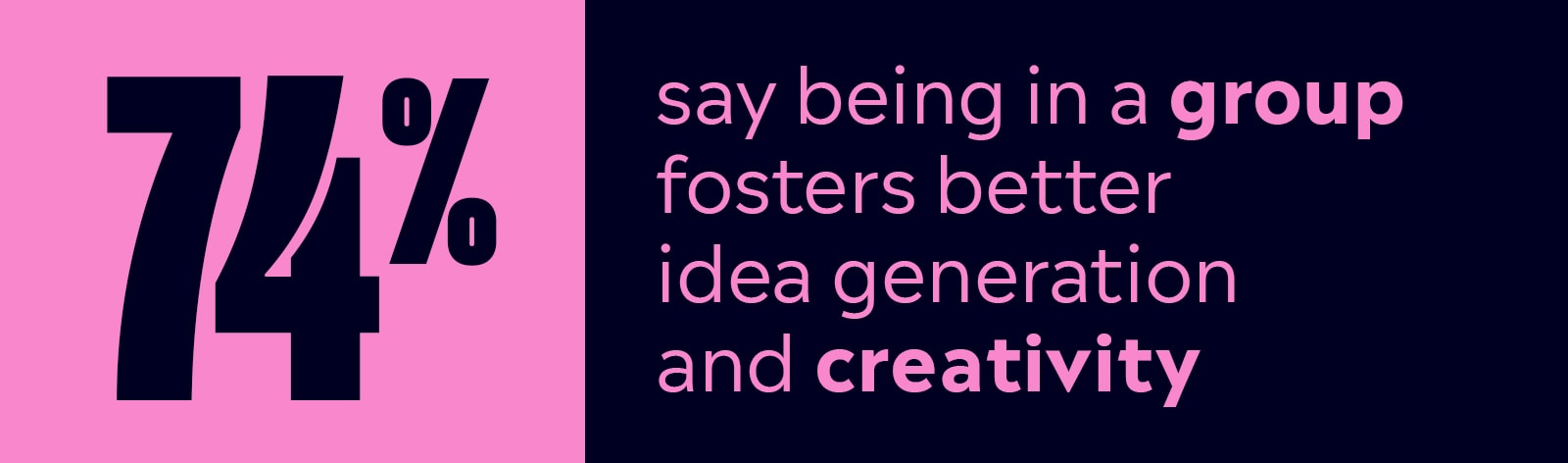

Group functions can also harvest strategies and conclusions that would be difficult to generate through a siloed experience. 74% of respondents said being in a group fosters better idea generation and creativity.

Convenience

Perhaps the biggest benefit of the digital revolution has been the convenience it brings to consumers. As stated above, everyday people can now invest from an app on their phone with ease, eliminating the need to call a broker, while also allowing them to manage their account and track performance instantly.

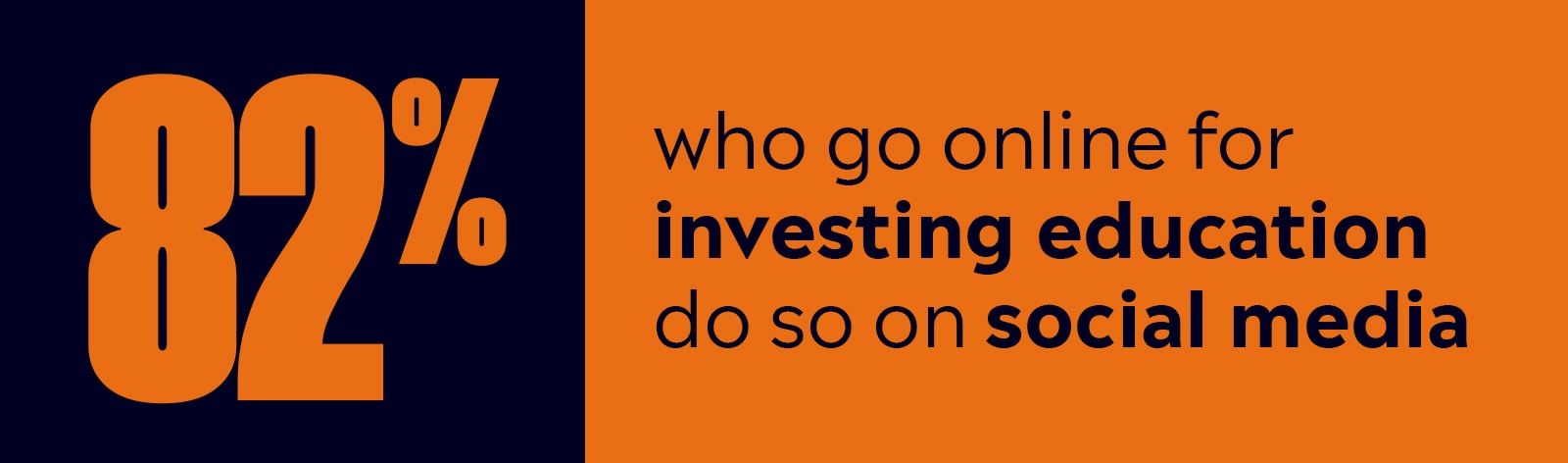

In addition to investing apps, people are also using an unlikely source for investing info ― social media. Of those who use online resources for investing education, 82% do so on sites like Twitter, Reddit, and YouTube.

Social investing combines the two, allowing people to invest and be part of a social community dedicated to investing, all on one convenient platform. This novel concept intrigues 64% of Americans, who agree it would be helpful to ask questions, share ideas, and follow other investors within an investing app.

Bottom Line

If our recent survey proves anything, it’s eToro’s broader mission statement ― social investing is the preferred way to invest in today’s connected world.

In addition to joining a thriving community, on eToro, you can access stocks, crypto, and other popular assets ― all on a single platform. Users can also copy the crypto moves of Popular Investors with a few clicks, eliminating the need to manually build portfolios or even reallocate funds.

If you’re interested in trying social investing, to see firsthand how it’s changing the way everyday Americans enter financial markets, join eToro today. You can start by experimenting with the Virtual Portfolio, available with all eToro accounts. This lets you invest with play money before depositing real funds. It’s a great way to dip your toes into the functions of the eToro platform without risking a dime.