TINA is the most powerful woman on Wall Street.

Market experts name-drop her. Bonds fear her. Cash can’t get away from her.

Now, TINA may play a big role in the stock market’s success.

And you may have never heard of her.

So, who is she?

TINA — a Wall Street acronym that stands for “there is no alternative” — is the belief that money has flowed into the stock market simply because it can’t find adequate returns elsewhere. You’re forced to either accept measly yields in low-risk markets or better returns (plus the chance for swings) in high-risk markets.

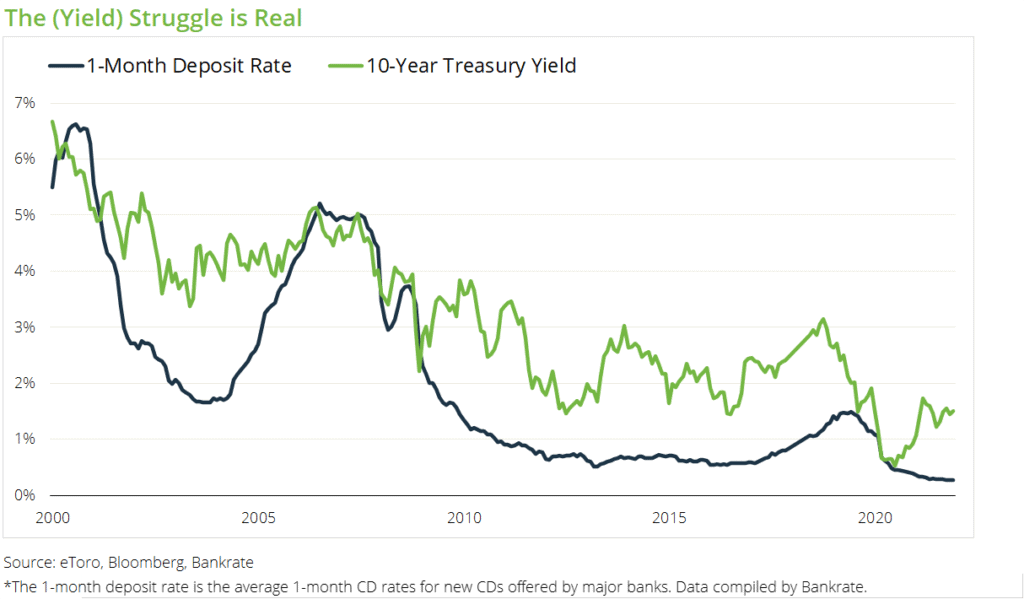

In a way, the Fed created TINA. TINA has been a familiar face for the past decade, showing up after the Fed cut its policy rate to zero in response to the fallout from the Great Financial Crisis. Cutting rates was a necessary step in that crisis, but it flipped the script on the tradeoff between risk and reward between markets. Bond yields fell to historic lows and savings account rates dwindled to close to nothing, leaving investors with fewer options. Cue one of the longest stock-market rallies in history.

Then, COVID came on the scene, and the Fed had to cut rates again, while instituting a massive bond-buying program to stabilize markets. At the same time, the S&P 500 has logged three straight years of gains, and crypto prices have soared.

Where is she now?

TINA is not only surviving in this environment. She’s thriving.

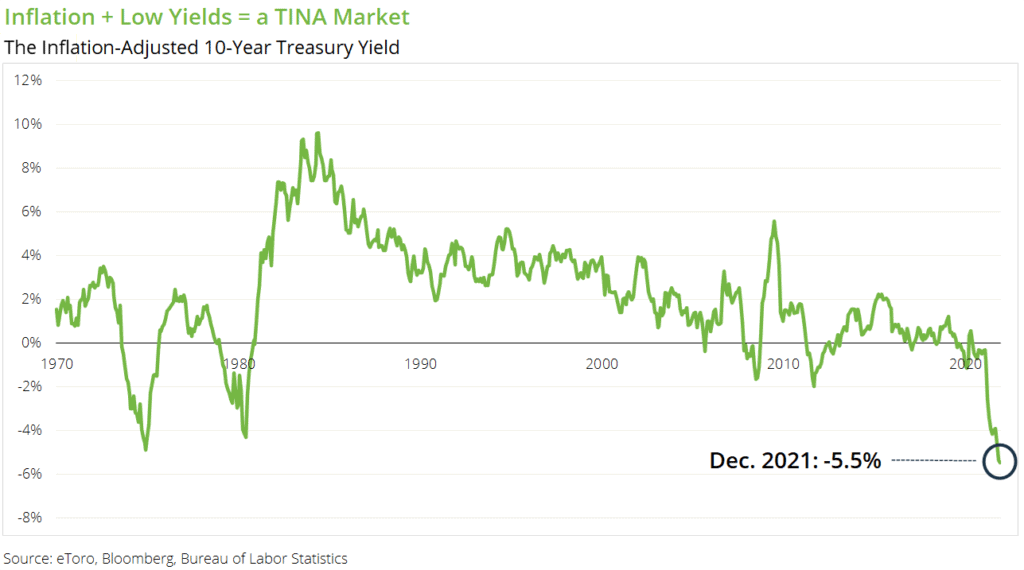

Inflation at a 40-year high has created extra pressure to invest as rising prices erode the value of a dollar, yet the 10-year yield is still limping just below 2%. In fact, the 10-year yield adjusted for inflation is sitting at -5.5%, near the lowest level in 50 years. Yep, you read that right: If you invest in a run-of-the-mill 10-year Treasury note, you’re likely still losing money due to inflation. So, with the value of the dollar decreasing, it seems like the options for growth are limited. Thus, TINA grows stronger.

It may not be a coincidence that the stock market has felt immune to the barrage of negative news. Over the past year, the S&P 500’s biggest decline from a record high has been just 5%, an unusual stretch of calm for an index that typically deals with much larger swings.

The Fed and TINA

However, the Fed’s newest policy plans could change the TINA equation. Theoretically, rate hikes and a higher Fed funds rate could lead to higher yields (and lower bond prices), which could boost the attractiveness of bonds long-term. We’re already seeing this happen, too. The 10-year Treasury yield popped 25 basis points last week — its biggest weekly gain in more than two years — as investors prepped for rate hikes down the road.

The Fed could make TINA less powerful, but she may still stick around for a while. Despite yields being on the move, investors might be overestimating how much a few rate hikes could actually change the market dynamic. Economists surveyed by Bloomberg expect year-over-year inflation growth to average more than 4% through the end of this year and the 10-year yield to barely break 2%.

Who she isn’t

TINA is not an invitation to throw caution to the wind. Even though stocks and crypto may seem more attractive than other markets, they still carry risk. And TINA doesn’t shield either market from swings. While the S&P 500 has averaged a 14% annual return over the past decade, it’s also gone through four drops of 10% or more over that same period.

The TINA tide hasn’t lifted all boats, either. Different stocks have different risk profiles, and that can make for an uneven market. Just this month, the Nasdaq 100 index of tech stocks is down 2.5%, even though the Dow Jones Industrial Average of larger, established companies is flat. And TINA has largely ignored small-cap stocks, which haven’t gained at all in 12 months.

Investing with TINA

TINA has changed the game in capital markets. In a vacuum, stocks are historically expensive compared to earnings. But on the other hand, everything else is historically expensive, and investors are gravitating to what’s largely worked in the past.

Still, it’s smart to think critically about how your investments fit your needs and goals. TINA is just one piece of a complicated market puzzle, not a foundation for an investment strategy. In the end, different investments serve important purposes in your portfolio.