Financial independence is something that many people dream of. After all, who would not want to retire earlier, travel the world, and not have to worry about having enough money to pay for everything they need? Financial freedom is great. But what does it really take to become financially independent? Is it even possible?

What is financial independence?

Practically speaking, financial independence might mean something slightly different for each person, depending on their desired lifestyle. Some feel comfortable with a minimalist way of life; others require luxury cars and sprawling real estate in order to feel “financially free.” However, the basic concept of financial independence remains the same: when an individual is in control of their own finances, deciding how they can create their own sources of income, independent of an employer, the government, or other external entities.

Is it possible to achieve financial independence?

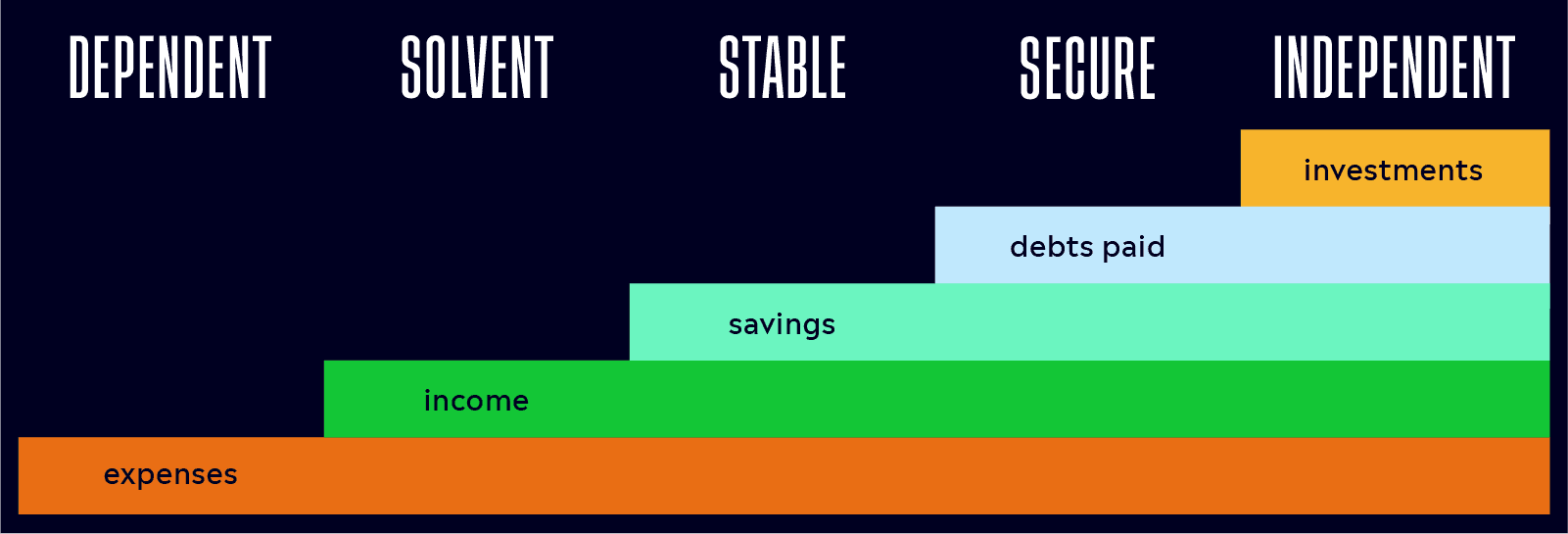

Financial independence is a worthy goal for anyone to pursue and can be seen as a process that is beneficial in itself. This is because there is a spectrum, ranging from financially dependent to financially independent, along which people progress towards the ultimate destination of financial freedom — it’s not all or nothing. Each level provides benefits, and the further along this spectrum you progress towards your goal, the more these benefits can affect your everyday life in a positive way.

Five levels of financial independence

Financially dependent

This is when your expenses are greater than your income, and, therefore, you are in one way or another dependent on someone or something else to help you. This is the level at which all of us start out, and it is sometimes referred to as level zero — since someone who is financially dependent has no financial independence.

Financially solvent

Your income is just sufficient enough that you are able to meet your financial commitments without any outside help to cover regular expenses.

Financially stable

Once you are able to consistently meet your financial commitments on your own, the next step is to start saving. Financial stability is usually reached when you have built an emergency fund — but you have not yet begun saving for the longer term. You may also be carrying some debt, such as a student loan or mortgage.

Financially secure

Financial security is achieved when your income can easily cover all basic living expenses, plus save enough money to allow you to stay afloat temporarily if necessary. For example, if you lost your job and had to look for a new one, you could support yourself for some time. Now is the time to rid yourself of any high-interest debts, so that you can begin to focus on building a solid investment base that will lead you to the next level.

Financially independent

At this point, you do not rely solely on your income to cover your expenses. You have made solid, long-term investments which are paying dividends that allow you to continue building your wealth. These investment earnings are enough to cover your desired lifestyle, whatever that is for you.

Getting practical

There are probably as many approaches to achieving financial independence as there are people. This is because each person’s needs and comfort levels vary. But all approaches can be broken down into two basic categories: decreasing expenses and increasing income. Most strategies for gaining financial independence will combine approaches from each category to maximize progress and minimize the timeline. This is simply common sense, since the higher your income and lower your expenses, the faster you can reach financial independence.

Examples of decreasing expenses include stricter budgeting and reducing debt. The unfortunate reality is that many households today are using credit to live beyond their means, a habit that needs to be addressed before any goal for financial independence can realistically be set. Living a more frugal lifestyle and tracking expenses consistently is usually necessary in order to get basic expenses under control. If, like many people, you are paying high interest rates on debt, it probably makes sense to create a debt payment strategy before focusing more on long-term investing.

Investing, whether in equities, real estate, or a business, is an example of increasing income — and it’s unlikely that financial independence could be achieved without it. Growing your earned income is another approach, whether as an employee or a business owner. This could include a job promotion, increasing your professional skills in order to charge higher fees, or expanding into new niches of business.

Each of these approaches requires dedication and creativity. Financial independence is certainly something everyone would like to achieve, but only taking practical steps will actually help you progress towards your goal.

How to retire early

In recent years, the term “financial independence” has often come to mean early retirement — when you are able to stop working at a young age. For some people, the goal is retiring in their forties, or perhaps even younger. The level where one is able to retire from working altogether may also be referred to as financial freedom.

Once again, there are many different approaches and strategies to retiring early. But the first step is figuring out how much money you need to retire early and maintain your desired lifestyle. Although there are many personal factors that could influence that number, an online retirement calculator can be helpful in giving you an initial ballpark estimate. But according to the FIRE method, which we will cover next, you will need to build up a net worth of 25 times your estimated annual spending in order to achieve this level of financial independence.

What is the FIRE method for early retirement?

Based on the best-selling book Your Money or Your Life by Vicki Robin and Joe Dominguez, FIRE stands for “Financial Independence Retire Early.” The FIRE investing method basically involves extreme saving — as much as 50-70% of your annual income — and then investing that savings to produce passive income. The idea is that over time, these investments will provide enough money to cover living expenses so that financial independence, including retirement if you choose, is attainable at a younger age.

Just to put this in perspective, the standard percentage of annual income to save typically recommended by financial planners is 10–15%. At a savings rate of 10%, it would take nine years of work to save for one year of living expenses. But with a savings rate of 50%, it takes only one year of work to save for one year of living expenses. The short-term implementation obviously requires no small sacrifice — but the accumulated long-term benefits are obvious as well.

The FIRE movement’s recent rise in popularity indicates that many young people are tired of financial uncertainty and the conventional “rat race” of working just to pay the bills — enough to make those short-term sacrifices. It also, for some time, coincided with a sustained bull run on the stock market, boosting the FIRE devotees’ investments even further.

FIRE investing types

As with any popular movement, variations will inevitably arise as people adapt the methodology to their own needs and lifestyle. Beyond the “traditional” FIRE method, there are several variations whose adherents have named them:

LeanFIRE: By planning to minimize living expenses to below average for the long term, you can retire earlier than if you were planning for an average lifestyle.

FatFIRE: In contrast to the LeanFIRE variation, with FatFIRE you are planning on having higher-than-average expenses once you reach early retirement.

BaristaFIRE: For those to whom extreme savings seem, well, extreme, consider this variation as part-time FIRE. You are saving enough now so that, later on, you won’t need as much income each year from work. While you won’t necessarily retire early, you will have the flexibility to choose not to work full time, or perhaps at a job that pays less but that you enjoy more.

CoastFIRE: Here the concept is that by investing aggressively from an early age, you plan on not needing to continue investing — eventually using the power of compounding to cover your expenses, aka “coasting.” This variation can also be used similarly to BaristaFIRE, for job flexibility rather than early retirement.

Invest wisely for financial independence

The freedom to choose not to work is not an impossible dream — nor is FIRE the only way to achieve it. But it does require consistent discipline and dedication. It also usually requires a smart investment strategy that includes a variety of assets, such as stocks and ETFs, that can stand the test of time and pay healthy long-term dividends. No matter what your goals are, it’s always important to always make these investment decisions wisely.