-

To be a good trader, you must put in the work

-

Technical and fundamental analysis are powerful tools

-

Employ orders to automate your trading

-

Social features can help you grow

It is no secret that there’s no quick way to become a good trader. When it comes to the world of online finance, knowledge and practice are two of the most important factors that make or break a successful trader. Growing your capital using online trading may seem alluring, but aspiring traders should bear in mind that it involves a lot of hard work, responsibility and dedication. However, if you know where to start and which tools to use, you can get off on the right foot and gradually become a better trader. Here are some tools used by both amateur and professional traders:

Technical analysis

Perhaps the most popular tool used by traders worldwide, technical analysis focuses on extracting information from charts and graphs relating to the asset in which you wish to trade. Analysts who use this method try to locate recurring patterns and apply different models to financial instrument charts, in an effort to determine where they will go next.

While a rule of thumb in trading is that past performance is not an indication of future results, it is hard to deny the popularity of this method and the fact that many professional analysts swear by it. On eToro, there are several tools that can be used for technical analysis. One of the most advanced tools eToro offers is ProCharts, which enables users to compare charts from different assets and timeframes.

Fundamental analysis

Another popular method is fundamental analysis. As opposed to its technical counterpart, fundamental analysis focuses on identifying market opportunities by looking at other forms of information, such as:

- News stories: Media discussion can often impact the crypto market. For example, Facebook’s announcement that it is launching its own crypto, or a new blockchain platform developed by Microsoft can influence the crypto market. News regarding events of financial importance, such as a Bitcoin ETF being debated by the SEC could also have an effect on the crypto market.

- Financial events: Global financial summits in which crypto is part of the discussion, government officials addressing crypto, and similar events could have an impact on cryptocurrencies.

- Market events: The majority of cryptocurrencies have a blockchain-based infrastructure. Blockchain networks periodically undergo upgrades, known as “forks,” that could have far-reaching consequences, such as the creation of Bitcoin Cash in 2017.

- Government action: There are still no unified regulations for the crypto market around the world. Therefore, when an influential government takes action regarding the market, such as the China crypto crackdown of 2018, markets could be heavily impacted.

Of course, the two methods do not contradict one another and many traders opt to use a combination of the two. On eToro, there are a variety of ways to stay updated with information relevant to fundamental analysis. For example, by reading daily market insights, or the eToro blog.

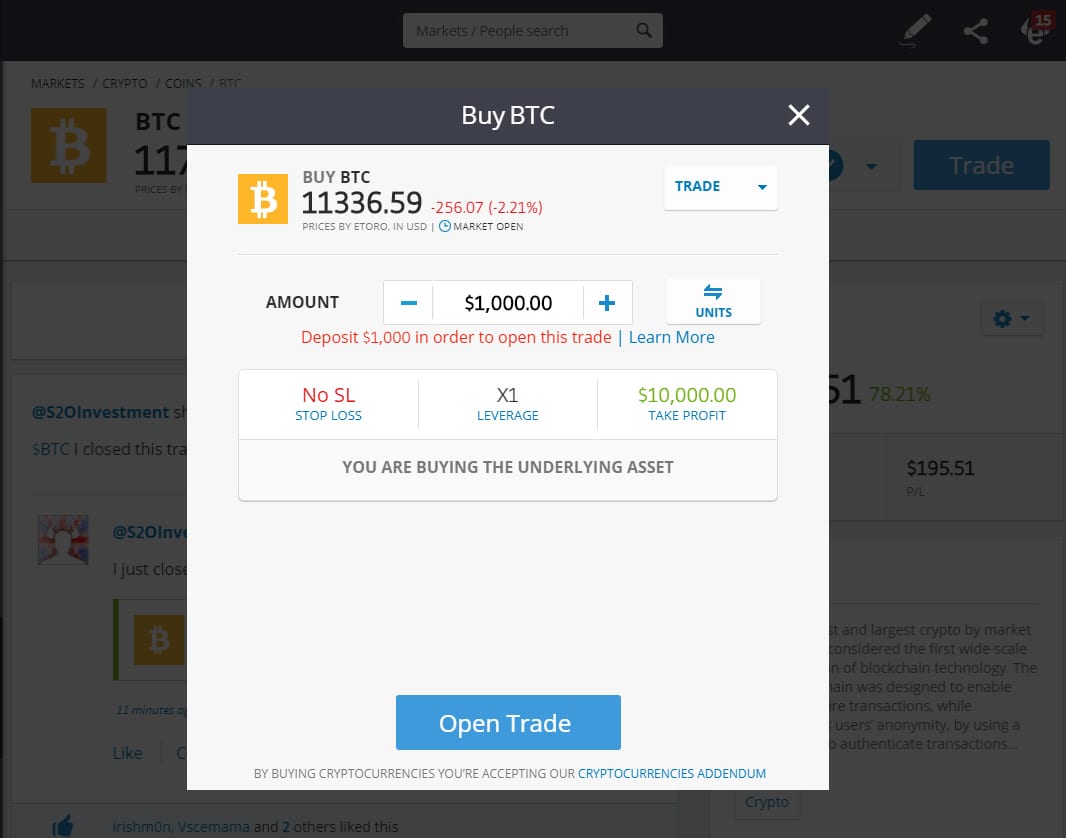

Automated orders

To save time and execute some financial decisions automatically, many traders use specific orders. There are quite a few ways to do this. An order can be set for an asset to be executed automatically only at a specific price. Other types of orders include Stop Loss, which automatically close a trade if it reaches a certain amount of loss, and Take Profit, which does the same when a certain profit point is reached.

Social interaction

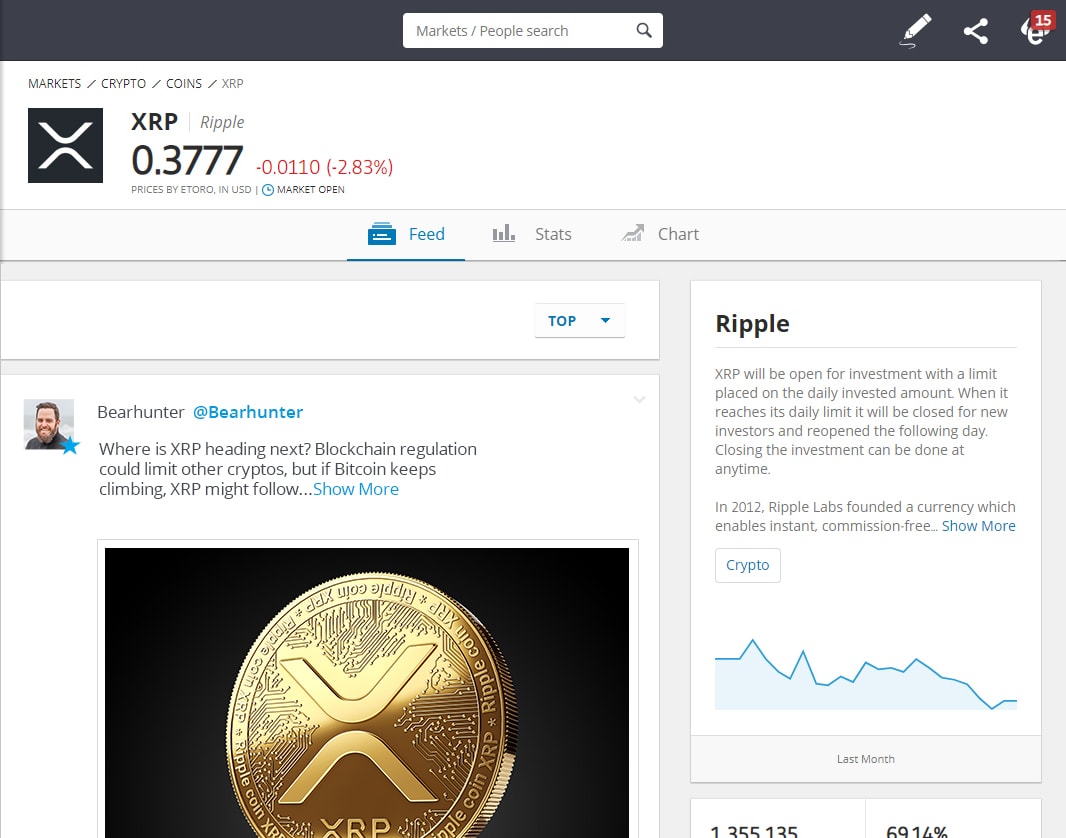

Despite what some might say, trading does not have to be a lonely practice. After the Internet enabled anyone to trade from home, the Web 2.0 revolution opened the door to a new form of conversation and interaction, which has also impacted financial services. Chat rooms and message boards discussing trading and investing became commonplace, and later, dedicated platforms emerged, culminating in the eToro social trading network, which is the world’s leading social platform for traders.

Each eToro user gains access to a personalized News Feed that shows the most recent and relevant discussions on the topics they wish to follow. Moreover, the transparency of the platform enables users to look at each other’s stats and even allocate some of their funds to copy other users. The social aspect is such a main part of the eToro platform, that some users can gain the status of Popular Investor and receive payments for allowing others to copy them and benefit from their experience. While not a “tool” per-se, social trading adds an aspect to online trading that is both informative and enjoyable.

eToro USA LLC; Virtual currencies are highly volatile. Your capital is at risk.