Crypto market wavers as Wall St. and sovereign states embrace Bitcoin

April proved to be a cruel month for Bitcoin, which finished with 16% losses on Saturday after continuing to track stock market turbulence.

Much of the downside was attributed to weak earnings from big tech firms, including Amazon and Google’s parent company Alphabet. Nevertheless, Bitcoin is holding up well compared to the Nasdaq tech index, which has now fallen 22% since the start of the year, while Bitcoin has dropped only 17%. One of the reasons for this relative strength could be huge strides in crypto adoption. In the last week alone, Goldman Sachs issued its first Bitcoin-backed loan, while Fidelity announced it will offer Bitcoin in 401k accounts, and several Latin American countries rolled out supportive crypto regulation.

Few altcoins managed to avoid the falling prices. ApeCoin briefly defied the stagnating market to hit all-time highs at $27 before gravity kicked in, and TRON added 8% ahead of the launch of its algorithmic stablecoin on Thursday. Most cryptoassets, however, are showing double-digit losses — including Zcash which fell 20% as Edward Snowden was revealed to have helped create the coin.

This Week’s Highlights

– Latin America embraces crypto

– Fidelity to allow Bitcoin in 401(k) plans

Latin America embraces crypto

Despite stagnating prices, Bitcoin’s fundamental appeal continues to improve as Latin American countries make big leaps towards adoption.

Only last week, Panama moved forward with comprehensive legislation promoting the use of crypto; The Central Bank of Cuba announced that it will issue licenses for virtual asset service providers; and Brazil passed a law to create a crypto regulatory framework.

This flurry of activity comes after the Central African Republic followed El Salvador to become the second country to adopt Bitcoin as legal tender.

Fidelity to allow Bitcoin in 401(k) plans

In another historic moment for crypto, the largest US retirement plan provider, Fidelity Investments, has announced it will allow investors to put Bitcoin into their 401(k) retirement savings accounts later this year.

The announcement represents another big move into the mainstream for Bitcoin, as it will enable first-time investors to easily gain exposure to the cryptoasset, without having to actually buy it on an exchange.

Elsewhere, the world’s largest asset manager, BlackRock, launched a Blockchain ETF that will also make it easier for investors to get exposure to crypto and blockchain innovation.

Week ahead

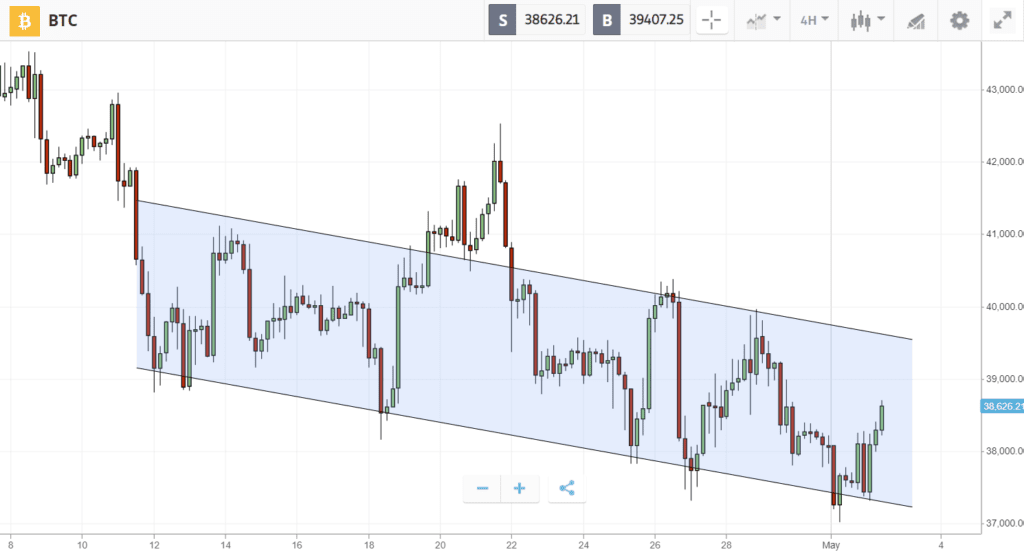

After five weeks of consecutive losses, Bitcoin is now in its longest losing streak since 2018.

Yet this week, the market could be approaching a turning point: On Wednesday, the Federal Reserve is expected to hike rates by 50 basis points. If this occurs, it could lead to a bounce in a classic “sell the rumor, buy the news” style. Otherwise, a more aggressive hike could trigger downsides for both stocks and crypto.

As we move into early summer, seasonal factors could also come into play. Bitcoin has historically made high returns in May, which suggests that as per the old adage, April showers could bring May flowers.