Could artificial intelligence drive the next bull market?

Developments in artificial intelligence have driven a powerful rally for some altcoins over the past week, keeping the total crypto market cap above $1 trillion.

This contrasts with the lackluster performance of the broader crypto market, which remains weighed down by geopolitical tensions over mysterious spy balloons, regulatory enforcement actions, and uncertainty around this week’s release of US inflation data.

At the top of the charts, Hedera Hashgraph and The Graph are this week’s biggest gainers, while Bitcoin has dipped in what could be a short-lived buying opportunity.

Read more after the jump.

This week’s focus

– Bitcoin wavers at $22K ahead of inflation data — will the rally continue?

– Will AI-powered altcoins lead the next bull market?

– Hedera Hashgraph adds 25% as it heads for top 10

Bitcoin wavers at $22K ahead of inflation data — will the rally continue?

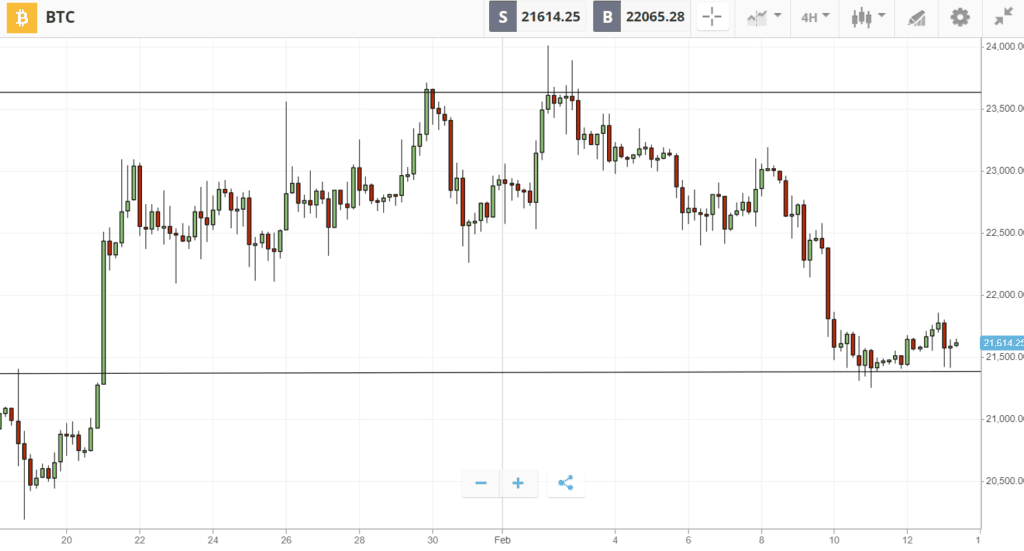

After touching resistance at $24K, Bitcoin has retreated to find its support at $22K.

After a strong start to the year, Bitcoin hit a stumbling block at $24K last week, and has now retreated to $22K in what could be a “buy the dip” moment.

The downside is thought to have been driven by fresh macro uncertainty, with surprisingly strong US economic data invoking fears that the Federal Reserve will once again start raising interest rates.

In the week ahead, Tuesday’s inflation data could give a clearer indication of whether this will be the case.

If the Valentine’s Day inflation report comes in hot, showing that inflation is slowing less than expected, then investors could be left disappointed as prices fall on the prospect of higher interest rates.

Yet if it turns out that inflation is still cooling, then Bitcoin is likely to continue rallying.

Will AI-powered altcoins lead the next bull market?

$GRT is up 180% since the start of the year

Altcoins powered by big data and artificial intelligence made big gains last week on speculation that this sector will drive the next crypto bull market.

The Graph is leading the AI-themed takeover with 17% gains, notching total returns of around 180% for those who bought the asset on New Year’s Day. This reflects similarly spectacular performances from other AI-linked cryptoassets such as Fetch.AI.

After such a strong rally, some investors are wondering if the AI trend could have already peaked.

According to institutional investors, however, the AI-powered transformation has just begun. A recent report by JP Morgan found that more than half of institutional traders believe artificial intelligence and machine learning will be the biggest driver of change for financial markets in the years to come. Big tech firms appear to think the same, with the likes of Microsoft investing billions in the technology over the past few weeks.

Hedera Hashgraph adds 25% as it heads for top 10

$HBAR has broken higher after climbing in an ascending channel

Riding higher on a barrage of non-stop positive news, Hedera Hashgraph has added 25% in the last week.

The project was initially boosted by news that Dell is joining the likes of Google and Nomura on the Hedera governing council. Dell will now run a Hedera node, helping support a network which also plans to be at the forefront of AI. Just last week, The project announced plans to host innovative AI-powered NFTS on the blockchain.

As these deals are being made, network activity is skyrocketing: total value locked (TVL) hit all-time highs of $137 million earlier in February, and the project now has the fifth highest number of contributors of all crypto projects, according to data from Santiment.

Nevertheless, Hedera Hashgraph is still not in the top ten largest cryptoassets, and ranks 26th in terms of its total market cap. This could change in the coming months, with recent tweets from CEO Shayne Higdon suggesting that around 80 projects are set to go live on the network before April.