Author’s note: Hi there! I’m Callie Cox, the US-based Investment Analyst/market nerd at eToro. I’m constantly thinking about how market moves and headlines impact your finances.

Starting today, I’ll be publishing a weekly blog called The Bottom Line, which will dig into what’s happening in markets, culture, and the retail investing world. I’m also fascinated by behavioral finance — the study of how emotions impact investing — so we’ll talk about feels, too.

I can’t wait to take this investing journey with you. Give me a shout on Twitter @callieabost if you ever want to chat markets, college basketball, celebrity news or cute dogs.

____

The first week sets the tone for the rest of the year.

We make our resolutions, tell our friends, and take those first few steps to becoming a new human.

Wall Street does the same thing. The big banks release their outlooks for the year, proclaiming what they expect from earnings, the economy, and markets.

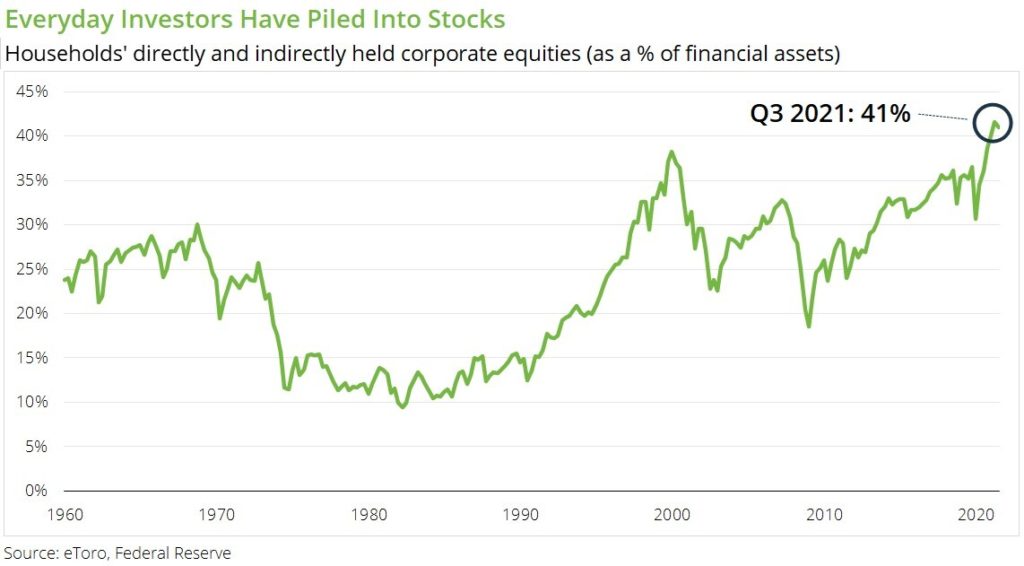

But we all know the market isn’t just Wall Street any more. Individual investors are a powerful force in finance. U.S. households have more money in stocks than ever before, and they’ve started to move markets through social-fueled cooperation.

So how are everyday investors priming their portfolios for the year ahead? We surveyed 2,000 adults, ages 18 to 65, to find out.

Turns out they’re feeling more confident in their financial plans and ready to add to their portfolios, especially in crypto.

32% of respondents said they typically keep financial resolutions for the entire year, compared to 18% who said they keep other resolutions for the full year.

First, let’s talk about resolutions. According to our survey, people seem to be better at keeping their financial resolutions than non-financial resolutions, such as going to the gym and eating better. To us, that’s a testament to how important finances have become to everyday Americans. Talking about money keeps the world informed, empowered, and intentional.

That could be extra important in the year ahead. Based on history, we could be overdue for a quick reset in stocks. Since 1950, the S&P 500 has gone through a selloff of 10% or more every two years, on average. We may even be in the midst of that now, as high-growth stocks slide.

We’re all for keeping your resolutions, but remember: it’s smart to plan for your plan to fail. This isn’t a comment on your willpower, but more a statement on life’s ups and downs. Wise investors stay calm and look for opportunity in times of trouble.

Almost half of respondents said they’re more likely to invest this year compared to last year.

Retail investors largely aren’t feeling discouraged by record prices, the Fed, or the yield tantrum 2.0. They’re keeping calm and investing.

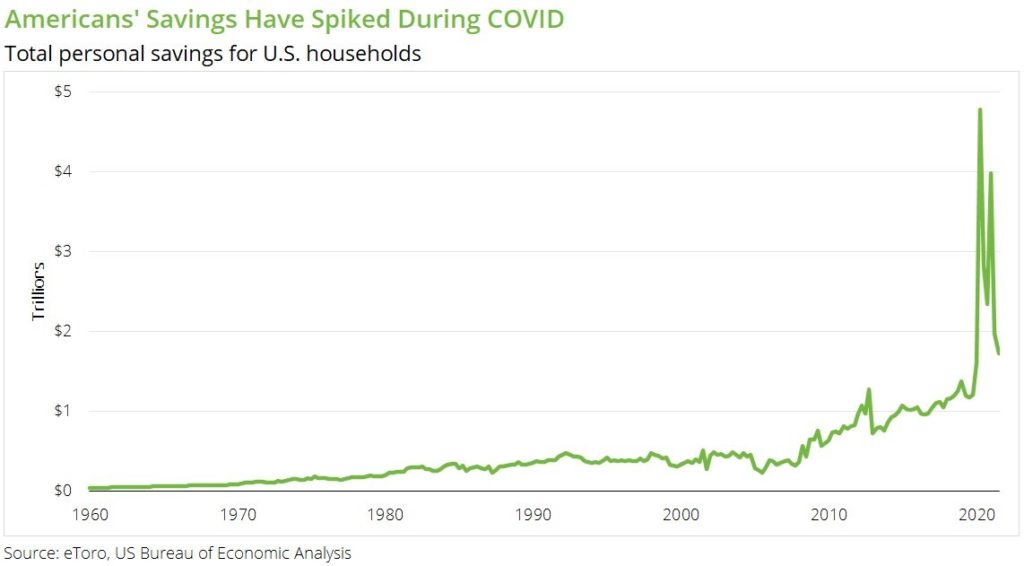

It makes sense, if you think about it. The world tends to frame investing as this daily game of trading the ups and downs. But in reality, many people invest for long periods with the hopes of building wealth or preparing for retirement — the “set it and forget it” method. They periodically toss extra cash into the market based on the calendar, not the headlines. And right now, Americans (in general) are sitting on a lot of extra cash.

If 2021 taught us anything, it’s that stock prices rise when people want to buy stocks, even when the environment feels uneasy. Cash on the sidelines could still be a powerful engine for the market, especially with low bond yields and expensive prices in other markets. There’s a wave of new-age investors armed with memories of an 11-year bull market. Plus, with inflation raging at a 40-year high, it’s especially important to think about putting money to work.

About 36% said they’re planning to invest in crypto.

Crypto had its coming-of-age moment last year, as it evolved from a niche concept to an everyday conversation. Tesla bought billions in Bitcoin for its balance sheet. Big merchants like PayPal and Visa started accepting crypto as payment. And even Wall Street entered the crypto chat with their own investments.

Today, while crypto is a part of everyday conversation, there are still plenty of people learning about the space. Adoption is happening rapidly, and there’s a chance that crypto has an even bigger year in the spotlight.

This maturation may not prevent big swings in crypto prices. There’s still a lot of risk. It’s a relatively new market that’s difficult to value. But new money could see dips as a chance to buy in.

Crypto is worth paying attention to even if you’re not investing in it just yet. After all, thinking of crypto and stocks as separate markets is so 2021. Everything is connected in one big financial ecosystem. We need to start thinking critically about how crypto markets interact with other assets to better understand our own portfolios.

More than 70% of respondents cited family, friends, and social media as their biggest inspirations to invest.

COVID’s lockdowns and quarantines have shined a light on the importance of community. Humans crave social interaction and approval. That’s why you can’t stop refreshing that like count on Instagram.

That need for community has grown into a stock market movement. Just ask GameStop investors who found themselves in the middle of a historic short squeeze last year. Social media isn’t going away, either — the WallStreetBets subreddit now boasts 11.4 million subscribers. It’s the network effect, capital markets style.

Even if you’re not a meme stock investor, you may find yourself caught up in a social movement. “Buy the dip” was one of retail’s biggest mantras last year, and that helped the S&P 500 cruise through a historically calm year in the midst of rocky news and COVID outbreaks.

Information travels fast these days in the markets, too. We’re more plugged in than ever, and niche events like Fed meetings and Congress hearings have become main events on social media. That could lead to more herd-mentality moves. These days, it’s worth keeping your goals in mind and your emotions in check.