Solana and Zcash join the rally with over 20% weekly gains each

Driven by an explosive ETF launch, Bitcoin hit new all-time highs above $67K last week before settling back down around the $60K mark.

The newly launched exchange-traded funds dominated headlines, overshadowing a flurry of adoption news elsewhere: $2.21 trillion investment giant PIMCO announced it was dabbling in cryptoassets, and a U.S. pension plan became the first to publicly announce an investment in the market. Meanwhile, Walmart announced the arrival of Bitcoin ATMs in 200 stores.

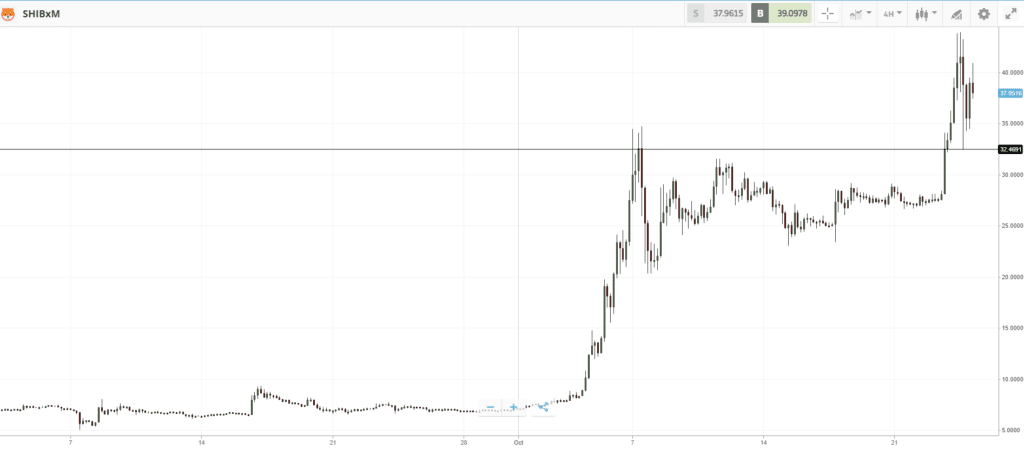

Although Ethereum narrowly missed out on record prices, Shiba Inu celebrated new highs with almost 500% monthly gains, and high-performance blockchain Solana added 29%. The all-time high party even awakened sleeping giant Zcash, which reared its head after months of trading sideways and jumped 23%.

This Week’s Highlights

- Bitcoin ETF debuts to hot demand

- Institutional adoption intensifies on inflation fears

- eToro adds four more assets to its crypto offering

Bitcoin ETF debuts to hot demand

The hype leading up to Tuesday’s ETF launch was matched by reality, as blistering demand from investors made it one of the hottest financial product launches ever.

In the first two days of trading, assets in ProShares Bitcoin futures ETF reached over $1 billion. This made it the second-busiest ever ETF launch, setting a high bar for Thursday’s debut of the Valkyrie ETF which saw $80 million in first-day trading volume.

Although these future-backed ETFs fall short of spot ETFs, they represent affirmation that U.S. regulators want to work with the crypto industry, and could open the floodgates to liquidity from institutional and retail investors who couldn’t previously find their way into Bitcoin.

Institutional adoption intensifies on inflation fears

As the long-awaited Bitcoin ETF launched amidst widespread inflation worries, institutional investors affirmed their support for cryptoassets.

Hedge fund legend Paul Tudor Jones told CNBC last week that inflation was probably the most significant threat to financial markets today, and that he believes crypto offers better protection than gold.

Elsewhere, 2.2 trillion investment giant PIMCO announced its foray into crypto, Digital Currency Group tripled the company’s current position of Grayscale Bitcoin Trust investments from $750 million to $1 billion, and a pension fund for Houston firefighters purchased Bitcoin and Ethereum — marking the first time a public pension fund has publicly invested in crypto.

eToro adds four more cryptoassets

eToro has listed four new tokens on its investment platform, bringing the total number of assets in its crypto offering to 36. ATOM is the token of Cosmos, which aims to create / prompt blockchain interoperability by creating an “Internet of Blockchains.” Curve DAO Token is the governance token of decentralized exchange protocol Curve, 1Inch Token powers the 1INCH Network, a DEX aggregator that brings together liquidity from multiple decentralized exchanges, and The Graph (GRT) Token powers The Graph, a decentralized protocol for indexing blockchain data.

Week ahead

As Bitcoin rings in the long-awaited ETF with fresh all-time highs, we could be entering a new era of institutional involvement in cryptoassets.

In the coming week, another fund will join the gang in the form of VanEck’s Bitcoin Strategy ETF, which is expected to offer investors lower fees for getting exposure to Bitcoin.

Yet with adoption comes regulatory pressure, and uncertainty could hit the market in coming days as The Financial Action Task Force (FATF) publishes its revised guidance for cryptoasset firms.