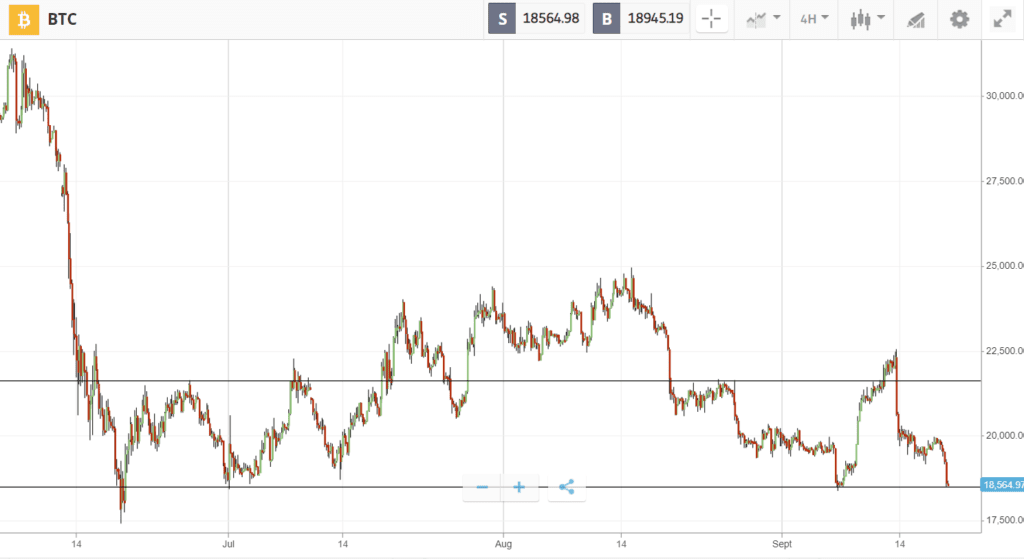

Bitcoin shows relative strength with only 10% losses

Despite mounting optimism over the successful Ethereum Merge, crypto was caught in economic turmoil last week as US inflation data sent global markets into a tailspin.

Both Bitcoin and Ethereum trended upwards earlier in the week, boosted by news that Fidelity might offer Bitcoin trading, and expectations that August’s inflation numbers would continue to trend lower. Then on Tuesday, hotter-than-expected inflation data wiped trillions off global markets. Cryptoassets plunged with stocks as the S&P500 had its worst day since June 2020, and then failed to bounce on Thursday as Ethereum successfully merged to proof-of-stake.

Compound and Cosmos briefly flashed green as they attempted to defy the downturn, but ended the week in the red like most other altcoins. Luna Classic was one of the biggest losers, shedding more than 30% after South Korea issued an arrest warrant for Terra CEO Do Kwon, and despite announcing a partnership with Starbucks, Polygon showed 15% losses.

This Week’s Highlights

– Crypto markets plunge on hot inflation

– Traders “sell the news” on successful Merge

Crypto markets plunge on hot inflation

Hotter-than-expected August inflation data sent crypto markets into a tailspin last Tuesday, with both Bitcoin and Ethereum plunging alongside stocks.

The data showed that consumer prices in the US declined from an annual rate of 8.5%, recorded in July, to 8.3%, which was higher than expected, thus indicating that high levels of inflation may be more stubborn than first believed.

As a result, investors are now preparing themselves for another major interest rate hike. Some even speculate that the Federal Reserve could raise rates by a full percentage point for the first time since the early 1990s.

Traders “sell the news” on successful Merge

Ethereum pulled off a seamless Merge to proof-of-stake on Thursday, prompting everyone from Vitalik Buterin to the CEO of Stripe to congratulate the community.

Nevertheless, the price of Ethereum and other major cryptoassets fell as traders “sold the news” amidst a flurry of negative headlines relating to the upgrade.

In a speech after the event, SEC chair Gary Gensler implied that Ethereum could be considered a security now that the move to proof-of-stake is complete, while the White House released a new crypto framework claiming that “digital assets pose meaningful risks“.

Week ahead

All eyes are now on the Federal Reserve meeting scheduled for September 20th -21st.

On Wednesday, the central bank is expected to announce a 75 basis points interest rate hike. Confirmation of this could help spark a rally for both crypto and stocks, while the other possibility of a 100 basis points hike is likely to trigger further downslide.

Then on Thursday, more volatility might be expected as the Bank of England announces its own interest rate decision.