ApeCoin and Aave lead altcoin market higher

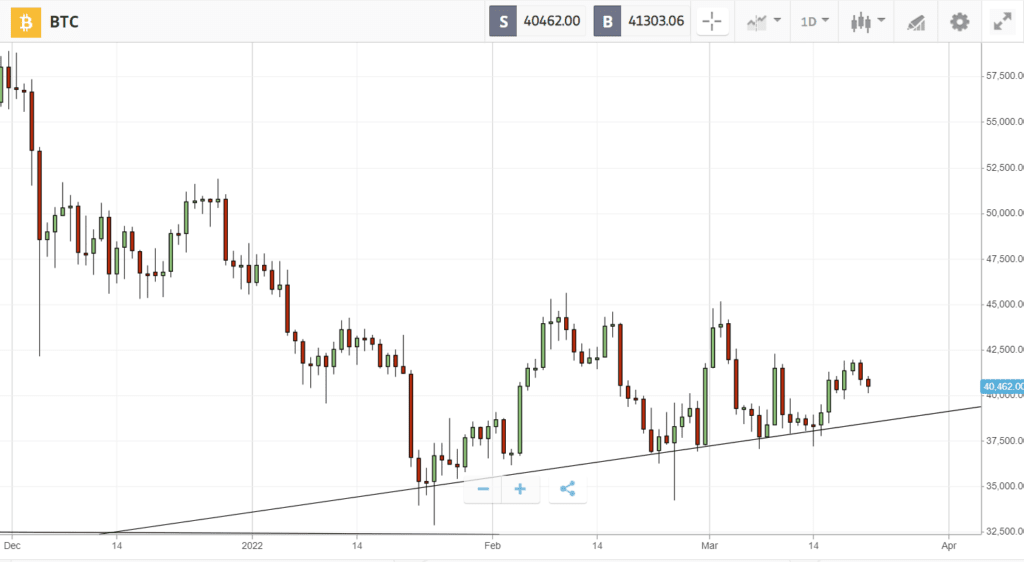

Boosted by clarity on interest rates from the Federal Reserve, Bitcoin pushed 8% higher over the last week to battle the $42K level.

Outpacing its bigger brother, Ethereum rose 13% to $3K on successful testing of ‘the merge‘ and a range of other bullish news: The European Parliament rejected the prohibition of Proof of Work blockchains, Ukrainian President Volodymyr Zelenskyy officially legalized crypto, and eBay showcased a new cryptoasset wallet. In addition, Mark Zuckerberg revealed plans to release NFTs on Instagram.

ApeCoin was one of the week’s top performers after surging more than 50% on listing. Meanwhile, Aave led the DeFi sector higher with 30% gains, rival protocol MakerDAO added 18%, and The Sandbox rose 12% on a new partnership with British multinational bank HSBC.

This Week’s Highlights

– Bitcoin rises to $42K on Fed rate hike

– Aave ascends on V3 launch

Bitcoin rises to $42K on Fed rate hike

Last Wednesday, the Federal Reserve responded to inflationary pressure by raising rates for the first time since 2018, and noted that it expects to raise rates six more times in 2022.

Bitcoin climbed around 4% following the announcement, benefiting from increased clarity as uncertainty around future monetary policy was lifted.

Helping Bitcoin’s cause as an inflation hedge, Elon Musk and MicroStrategy CEO Michael Saylor reiterated their commitment to the cryptoasset. In a brief Twitter exchange, Saylor claimed that as weaker currencies collapse, “the flight of capital from cash, debt, and value stocks to scarce property like #Bitcoin will intensify.”

Aave ascends on V3 launch

AAVE, the token of one of the largest DeFi lending platforms, was one of last week’s top performing altcoins.

The gains were driven by the release of the latest version of the protocol, Aave v3, which is being launched across six different blockchains to reflect Aave’s pioneering vision of a multichain future.

MakerDAO, another DeFi protocol which enables lending functionality, is following closely behind. Native token MKR rose almost 20% to tag $2K on news of several governance proposals including a tokenomics shakeup.

Week ahead

After the rate hike sparked a rally across stocks and crypto, investors are watching closely to see if positive momentum can persist amidst the uncertain macro environment created by the war in Ukraine, rising inflation fears, and new Covid shutdowns in China.

In the coming week, El Salvador’s ‘Volcano Bond’ could be launched. This innovative new financial product was due last week, and may help invigorate buyers by creating more demand for Bitcoin.