Ethereum, Polkadot, and Solana hit all-time highs

As Bitcoin rapidly approaches all-time highs above $67K, Ethereum, Solana, and Polkadot are already celebrating new records.

Rivalry between the smart contact platforms sparked a frantic race higher last week. Ethereum shot towards $5K, and Polkadot surpassed $50 as the highly anticipated parachain auctions launched on Thursday. Elsewhere, Bitcoin Cash briefly spiked 5% on a fake press release, and Shiba Inu slumped 28% from the recent high.

Meanwhile, Bitcoin continues to win favor at the highest levels of society. Prices rose 7% last week as several American mayors committed to converting their paycheck to Bitcoin, and global investment bank Jefferies endorsed the cryptoasset as an alternative to gold.

This Week’s Highlights

- Solana overtakes Cardano in record-breaking rally

- Top banking analyst chooses Bitcoin over gold

Solana overtakes Cardano in record-breaking rally

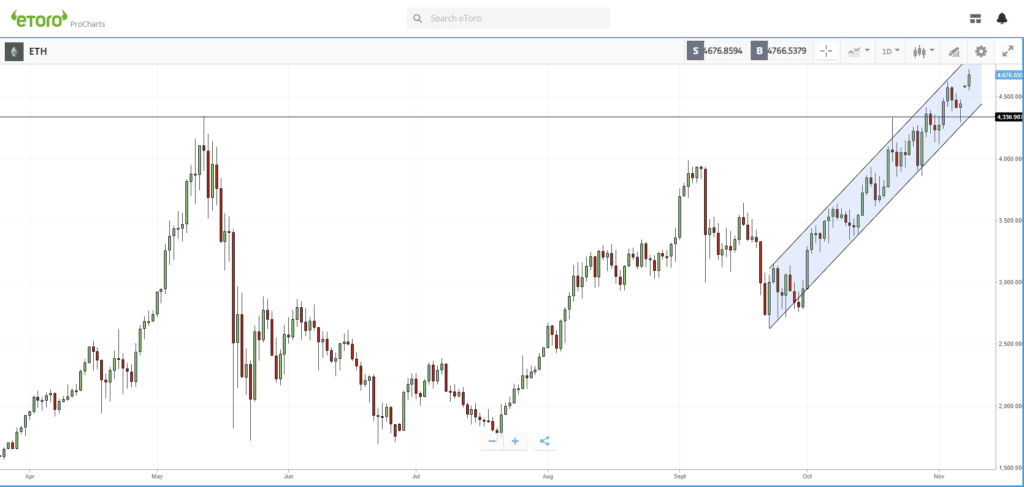

Ethereum’s all-time high on Wednesday sparked an altcoin explosion as rival smart contract platforms raced to break their own records.

Amidst the excitement, Solana shot up the charts to overtake Cardano and claim its place as the fourth-largest cryptoasset. The up-and-coming smart contract blockchain, which has risen 17,000% this year, is widely expected to become one of the strongest rivals to Ethereum.

Close behind, Polkadot added 5% last week on the launch of parachains, beaten by Polkadot-based token platform Enjin which rose 20%.

Top banking analyst chooses Bitcoin over gold

Gold is losing its shine to Bitcoin, according to a top analyst at global investment banking firm Jefferies.

Global Head of Equity Strategy Christopher Wood has cut his allocation to the gold in favor of Bitcoin, and warned banks that blockchain could reduce the need for intermediaries and potentially trigger the end of the “dollar paper standard.”

Wood joins a growing chorus of voices from the highest echelons of global finance — including SkyBridge Capital’s Anthony Scaramucci — that are bullish on the prospects of Bitcoin to rival gold as the go-to store of value for the 21st century.

Week Ahead

After a wild week in which soaring altcoins have sent the crypto market value to almost $3 trillion, we could now see funds flowing back into Bitcoin.

This could push the asset as high as $67K, to match the previous all-time high that was set in late October.

Such bullish price action would be supported by the long-awaited Taproot upgrade. This is set to go live in the coming week and will bring greater privacy and efficiency to the Bitcoin network.