Algorand and Avalanche follow with more than 15% gains

Ethereum stole the show last week, exploding 20% as developers set a date for the blockchain’s long-awaited transition to proof-of-stake.

Meanwhile, macroeconomic events drove the broader crypto market. Bitcoin dipped to $19K on Tuesday, as hot inflation data prompted speculation that the Fed could raise interest rates by a full percentage point in July. Yet before the end of the week, the price had rebounded to almost $22K after Fed officials hinted at an interest rate hike of only 75 basis points. Finally, Friday’s news that Vladimir Putin has banned digital asset payments in Russia failed to impact prices.

In the altcoin market, smart contract platforms dominated the action. Quant Network continued its winning streak, adding 30% to create total gains of 100% over the last month, while Solana, Avalanche and Algorand all added more than 15% over the week.

This Week’s Highlights

– Ethereum surges 20% as Merge date set

– Bitcoin’s correlation with stocks weakens

Ethereum surges 20% as Merge date set

A date has now been set for Ethereum’s most anticipated upgrade in history: The Merge to proof-of-stake.

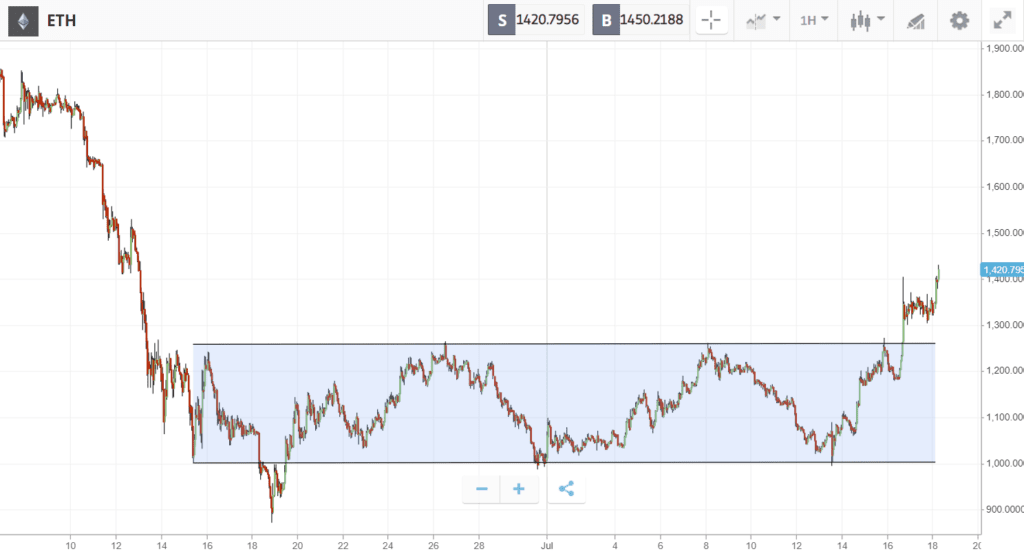

On Thursday, Ethereum Foundation developers penciled in a September 19th launch for the big event, prompting Ethereum to explode 20% and touch highs above $1,400.

The tokens of other projects in the Ethereum ecosystem were also caught up in the excitement. Ethereum-based decentralized exchange Uniswap rose almost 10%, while Ethereum scaling solution MATIC spiked 50% — boosted further by news that Polygon has been selected to participate in Disney’s 2022 Accelerator Program.

Bitcoin’s correlation with stocks weakens

Bitcoin’s correlation with stocks is close to its lowest point this year, with Bloomberg data showing that the 40-day correlation between the largest cryptoasset and the Nasdaq 100 Index has fallen below 0.5.

The correlation between the two markets hit record highs back in April, as Bitcoin became almost as correlated to the stock market as it is correlated to Ethereum.

Since then, however, the two markets have drifted apart and no longer move so closely together. This could indicate that crypto is beginning to establish its own rhythm, independent of the stock market and is potentially closer to hitting a bottom.

Week ahead

In the coming week, the crypto market could be steered by corporate earnings.

Several big tech names are set to share their revenues, which will offer a glimpse into the health of the US economy, and could impact all markets including crypto.

If prices move down and Bitcoin’s bullish momentum fades, then analysts may have their eyes set on $13K as a potential bottom. In a report last week, JP Morgan identified this figure as the cost of producing one Bitcoin, which “is perceived by some market participants as the lower bound of Bitcoin’s price range in a bear market.”