Unprecedented macro headwinds lead to 25% losses for BTC and ETH

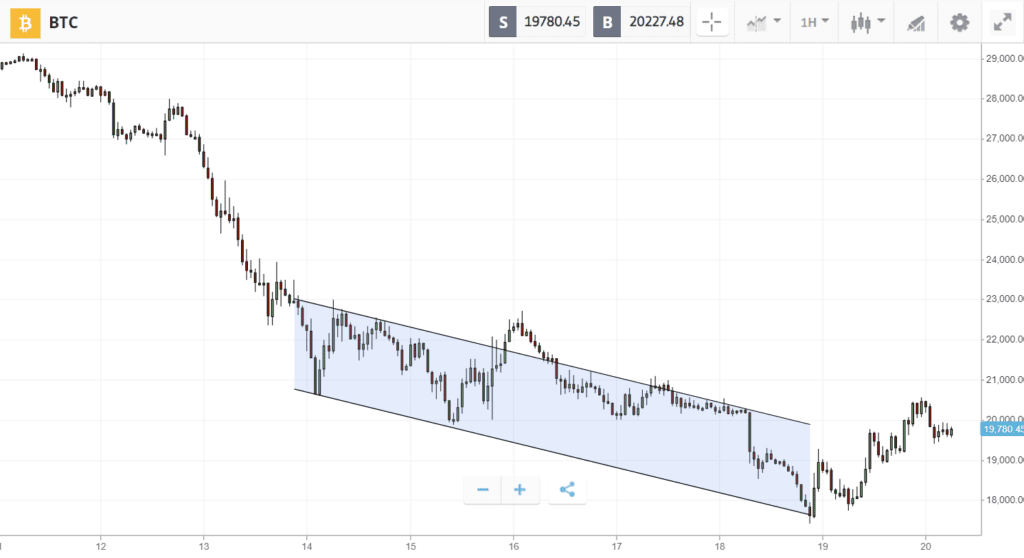

In one of the worst weeks ever for crypto, Bitcoin plunged 25% to test the previous all-time high of $20K.

Markets began falling ahead of the Fed’s 0.75 bps rate hike on Wednesday, which represents the biggest rate increase since 1994 and is widely expected to trigger an economic slowdown. At the same time, the after effects of the Luna collapse continue to squeeze prices lower. Last week saw two more firms buckle under the pressure, with fintech lender Celsius and investment fund Three Arrows Capital both facing potential insolvency.

As Bitcoin tumbled, Ethereum entered freefall — shedding almost 30% to briefly dip below the critical psychological level of $1K. Meanwhile, the altcoin market held up relatively well, with Theta and Basic Attention Token even managing to show low double-digit gains.

This Week’s Highlights

– Fed rolls out biggest rate hike since 1994

– Financial contagion spreads as crypto firms collapse

Fed rolls out biggest rate hike since 1994

In an effort to combat higher inflation, the Federal Reserve announced last Wednesday that it is raising interest rates by 0.75% — the largest increase in almost three decades.

“Clearly, today’s 75 basis point increase is an unusually large one, and I do not expect moves of this size to be common,” said Federal Reserve Chairman Jerome Powell, adding that he expects to announce an additional hike of between 50 and 75 basis points following the next Fed meeting in July.

His words prompted a brief relief rally for the ailing stocks and crypto markets. Yet it couldn’t last. The upswing ran out of steam as the Swiss central bank surprised markets with its first rate hike in 15 years, which was matched by a similar move from the The Bank of England.

Financial contagion spreads as crypto firms collapse

The ripple effects of Luna’s $60 billion collapse are spreading across the ecosystem, with two major crypto firms now facing potentially fatal financial stress.

Celsius Network, an interest-earning yield platform, froze withdrawals last week in what some say could be crypto’s Lehman brothers moment. Then just a few days later, famously bullish crypto investing firm Three Arrows Capital defaulted on its obligations.

The liquidations of these firm’s assets are thought to have contributed to plummeting prices, and also sparked fears of financial contagion — where market disturbance spreads between firms with close financial relationships.

Week ahead

As the Fear and Greed Index shows, crypto market sentiment is now at all-time lows.

The intensity of downswing has fazed many investors, but industry titans including Digital Currency Group’s Barry Silbert and macro investor Raoul Pal are now turning bullish.

In the week ahead, investors will be looking for more clues about future monetary policy when Federal Reserve Chair Jerome Powell addresses the US Congress on Wednesday and Thursday.