Cardano rises 30% on mixed altcoin market

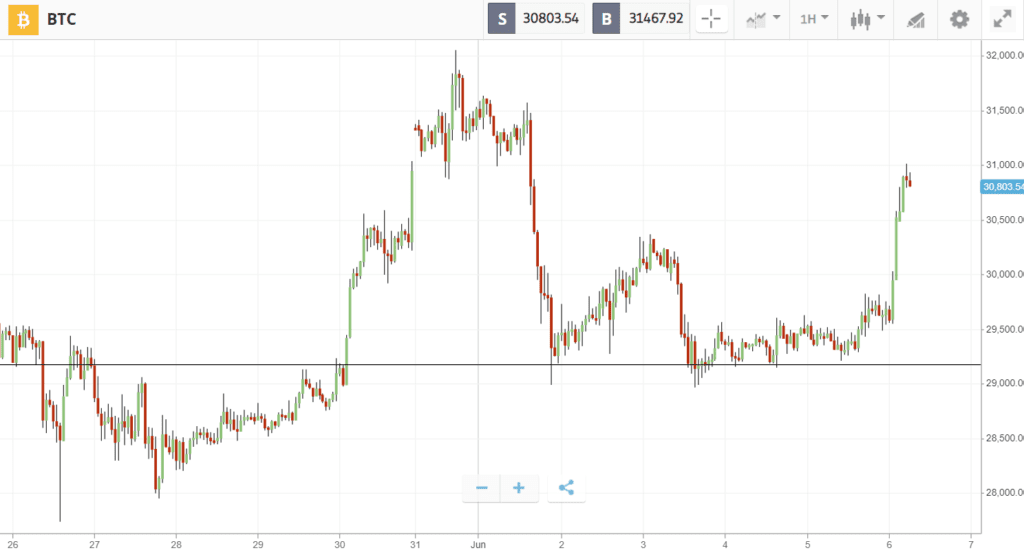

After a week of largely sideways price movement, Bitcoin rallied to $31K after breaking a nine-week losing streak with the first green weekly candle since March.

The leading crypto has made 6% weekly gains, which come as regulators around the world look to tighten their grip on the market, including the Biden administration, which is preparing recommendations to reduce the energy consumption of Bitcoin. Yet last week also saw Bitcoin prove its worth as a valuable tool for energy producers. Kenya’s largest electricity producer announced that it will offer surplus power to Bitcoin miners, and oil companies in the Middle East moved to power mining with otherwise wasted natural gas.

Elsewhere, Ethereum has risen 3% as developers continue testing ahead of the Merge, and the altcoin market is a mixed bag: Cardano has swung almost 30% higher ahead of a major upgrade, while Solana has suffered a 7% weekly loss on a blockchain bug. Stellar’s XLM is up 13% on an integration with MoneyGram, while Ripple’s XRP is only 3% higher. Aave is another top weekly performer with 15% gains.

This Week’s Highlights

– Cardano climbs 30% as Solana falls

– Crypto market stalls as regulators consider next move

Cardano climbs 30% as Solana falls

As the race for smart contract dominance wears on, Cardano is pulling ahead with almost 30% gains, while Solana falls behind.

Cardano’s climb has made native asset ADA the sixth-largest cryptoasset on the market, overtaking Ripple’s XRP. The ascent is likely to be driven by the upcoming Vasil hard fork, a network upgrade expected in June that is set to increase scaling capabilities.

Solana, on the other hand, suffered a loss of confidence last week after the network was halted for more than four hours, leading to 7% weekly losses for native asset SOL.

Crypto market stalls as regulators consider next move

As major cryptoassets slowly inch higher, the regulatory landscape continues to become clearer — setting a strong foundation for developers to build the next wave of innovative protocols.

In the US, the White House is drafting policy recommendations to address environmental issues around crypto, and in Switzerland, the Basel Committee on Banking Supervision has announced it will release crypto guidelines for banks by the end of this year.

Meanwhile, Japan has passed a legal framework for stablecoins, the United Kingdom has proposed its own stablecoin regulations, and South Korea is establishing a crypto oversight committee to protect investors.

Week ahead

The next big turning point for the crypto market could come on Friday, when consumer price data will indicate how likely the Federal Reserve is to intensify the battle against inflation.

Lower numbers would confirm that we have likely already seen an inflation peak, which could lead to a relief rally for risk assets such as crypto and stocks.

Higher numbers, however, could have the opposite effect. Market strategist Art Hogan suggests rising inflation could “tip over the apple cart for markets”, significantly damaging recent efforts to recover.