Quant makes quick 40% as DeFi sector surges

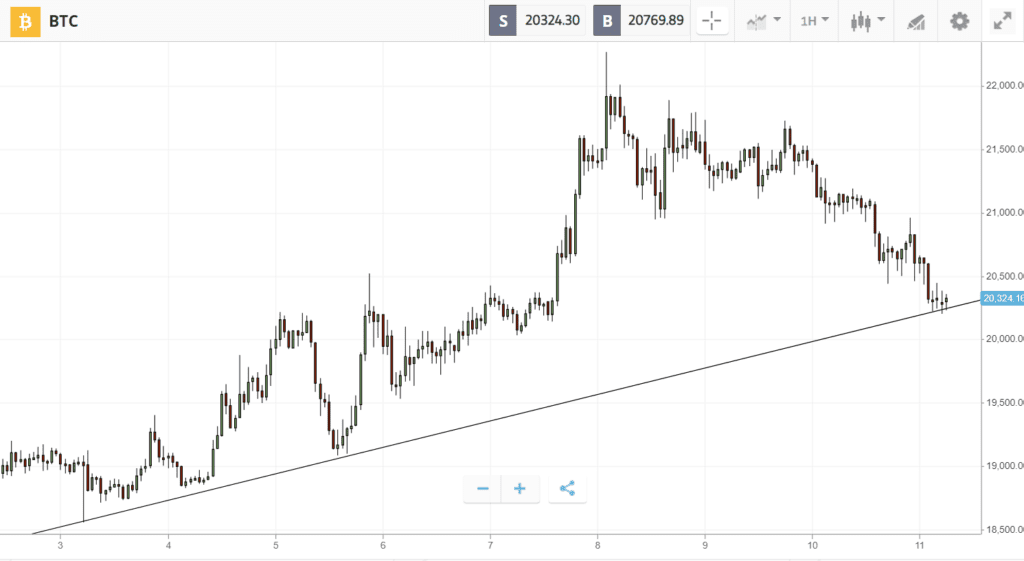

Optimism is creeping back into the crypto market, with Bitcoin bouncing 7% higher as the second half of 2022 begins.

The renewed confidence comes on signs that the economy could be approaching a turning point. US Federal Reserve officials claimed on Thursday that recessionary concerns were “overblown”, and strong jobs data on Friday countered any opposing claims. Fears were similarly relieved in the crypto market, with embattled lender Celsius paying off its biggest loan, and another lender bankruptcy adding a note of finality to the crypto contagion.

Altcoins felt the changing sentiment most acutely, with Quant rallying almost 40%, Aave adding 35% on the announcement of an algorithmic stablecoin, and Shiba Inu surging 10% after teasing plans for another stablecoin. Other top performers include DeFi favorite Uniswap with 25% wins.

This Week’s Highlights

– Bankruptcies bring finality to crypto contagion

– Aave and Uniswap lead double-digit DeFi rally

Bankruptcies bring finality to crypto contagion

Last week’s market resurgence was overshadowed by another bankruptcy, with crypto lender Voyager filing for Chapter 11 bankruptcy protection late Tuesday, following the downfall of high-flying fund Three Arrows Capital.

Nevertheless, surging crypto prices suggest that investors believe most of the drama has passed, and that the worst of the panic selling is over.

This sentiment has been reinforced by a number of industry figures — including Justin Sun, Changpeng Zhao, and Sam Bankman-Fried — who have recently stepped in with financial offers to rescue struggling firms.

Aave and Uniswap leads double-digit DeFi rally

The resurgence of Ethereum last week supercharged the DeFi sector, with dozens of tokens making double-digit gains.

Aave added 35% on the announcement of a new stablecoin, while Uniswap soared 25%, and SushiSwap 21%. Close behind, Curve is up 17% over the week.

Meanwhile, mother blockchain Ethereum has added 9% as it takes another step closer to “The Merge” — its long-awaited transition to a proof-of-stake blockchain.

Week ahead

Economic events in the week ahead include June’s US inflation report on Wednesday. This data could move global markets as it will indicate how much the Federal Reserve is likely to tighten monetary policy to battle inflation.

In the crypto market, some analysts are expecting increased selling pressure in the coming weeks as victims of the Mt. Gox hack receive payouts.

Nevertheless, discounted prices across the market are now generating significant excitement: Bloomberg senior analyst Mike McGlone tweeted last week that “Bitcoin could soon kickstart the greatest bull market in history.”