Tron and Tezos jump 7% as Avalanche and Solana fall

Analysts calling for a decoupling of stocks and Bitcoin got what they wished for last week, but not quite as they imagined.

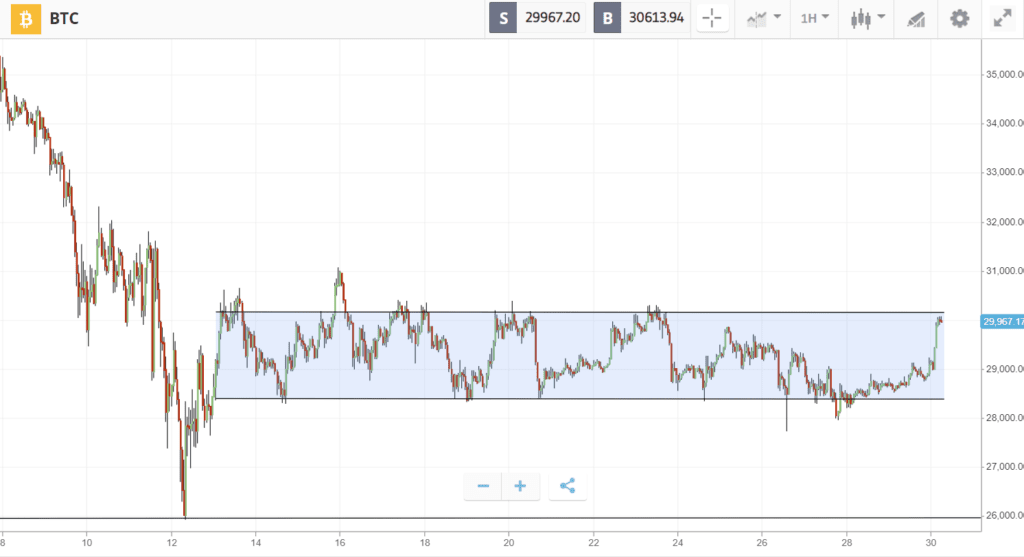

Stocks surged on Friday as the S&P 500 snapped out of a seven-week losing streak, while Bitcoin fell to $28K before making a recovery. This lackluster price action could be explained by the lingering aftereffects of the Luna collapse, which has cast a long shadow over the market. Darkening the mood further, Ethereum faced technical hitches in Merge preparations, and Guggenheim Chief Investment Officer Scott Minerd pinned $8K as his next Bitcoin price target. Though critics were quick to point out that he previously forecast prices of $400K.

The latest Layer 1 chains, which outperformed in 2021, were hit hardest by the continued downturn. Avalanche, Fantom, and Solana all posted double-digit losses, while older competitors got a boost: TRON surged 7% to become the third-largest blockchain, matched by similar gains from Tezos.

This Week’s Highlights

– Ethereum falls 8% on technical hitch

– Venture funding shows no sign of slowdown

Ethereum falls 8% on technical hitch

Preparations for Ethereum’s Merge hit technical challenges last week, as The Beacon chain, which is critical to the upgrade, experienced a blockchain “reorganization.”

This potential security risk, combined with issues on the Ropsten testnet, spread concerns among investors — resulting in Ethereum leading the market down with around 8% weekly losses.

Nevertheless, as Ethereum developer Terence Tsao explained in a Twitter thread, these technical problems are likely to be just minor hiccups ahead of the big upgrade.

Venture funding shows no sign of slowdown

Despite the recent turbulence, venture capitalists continue to plow more funds into the crypto ecosystem.

Just last week, Andreessen Horowitz closed on a massive new $4.5 billion crypto fund. This was accompanied by multiple smaller fund launches, including a $100M blockchain investment fund from Old Fashion Research, and an Africa-focused startup fund from Swiss firm Crypto Valley Venture Capital.

Such high levels of venture funding make it unlikely that crypto will experience a long winter, according to a JP Morgan research note released on Wednesday.

Week ahead

Analysts including Fundstrat’s Sean Farrell are expecting low liquidity, increased leverage, and tightening monetary conditions to precipitate a spike in volatility over the US Memorial Day weekend.

Then as we move into June, investors will be watching to see how the market will react to the beginning of quantitative tightening. Under this new monetary policy, The Federal Reserve will be shrinking its $9 trillion balance sheet.

However, despite the uncertain conditions, bullish investors are looking for a “recoupling” event in which Bitcoin could benefit from a bouncing stock market.