Solana suffers 35% losses as smart chains take biggest hit

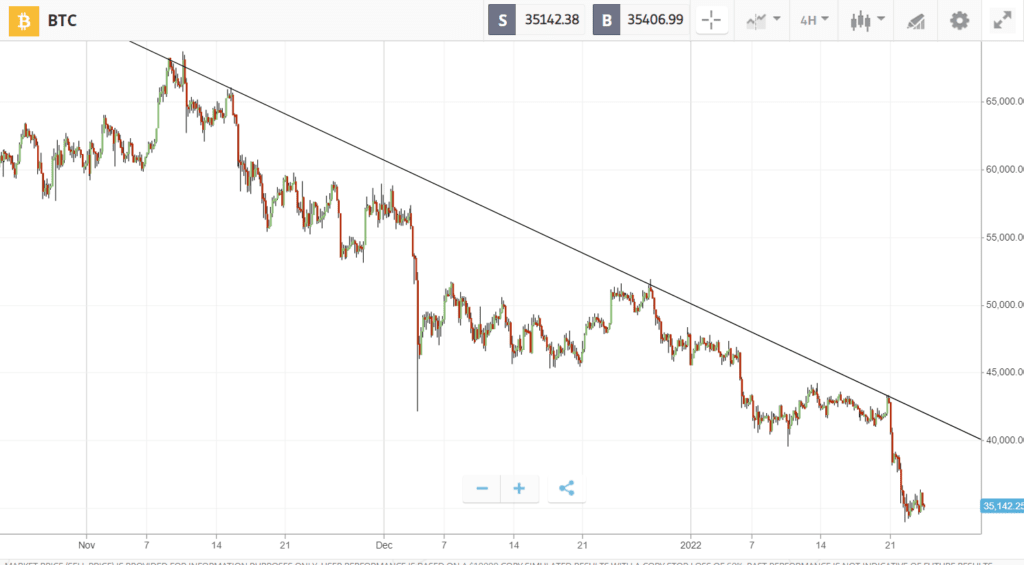

Losses on Wall Street bled into the crypto market last week, as Bitcoin sank to $35K under the weight of a global stock market sell-off.

Most of the downside came on Friday, when poor market sentiment turned to panic on disappointing earnings from Netflix. This uncertainty quickly spread to the crypto market, which was already reeling from a spot Bitcoin ETF rejection, a potential crypto ban in Russia, and caution over plans from the Biden administration for a new digital asset strategy. Nevertheless, the negativity was matched with multiple positive headlines as several Silicon Valley giants announced big future plans for crypto.

Amidst marketwide double-digit losses, Bitcoin emerged relatively unscathed at 16% down. Ethereum took a bigger hit with 25% losses, and rival smart contract platform Solana suffered a steep 35% drop on another network outage. Meanwhile ATOM, the token of Cosmos, showed relative resilience with only 14% losses.

This Week’s Highlights

– Silicon Valley giants make moves on crypto

– Macro fears spill over into crypto market

Silicon Valley giants make moves on crypto

As the market moved lower last week, some of the most powerful tech firms — including Microsoft, Intel, Google, and Facebook’s parent company Meta — were quietly adopting crypto.

Google is creating a new blockchain unit focused on distributed technologies, Intel is set to produce a Bitcoin mining chip, and Microsoft is thought to be maneuvering into the metaverse with the acquisition of game developer Activision Blizzard.

Meanwhile in the world of social media, Twitter integrated NFT profile pictures, and Meta was reported to be drawing up plans to bring special avatars to Instagram and Facebook.

Macro fears spill over into crypto market

During the last week, crypto has been caught in a wave of anxiety sweeping over global markets — triggered by inflation fears, a poor start to earnings season, and concerns about a new monetary regime.

Over the long-term, Bitcoin is often thought to act as a safe haven against such economic uncertainty, but more recently it has exhibited a strong correlation with traditional markets and tech stocks.

This has led many analysts to compare the recent downturn with the Black Thursday crash of March 2020, in which stocks and crypto plunged together as the coronavirus pandemic reached the shores of Italy.

Week ahead

Another big week lies ahead for Wall Street, and one that could be pivotal for Bitcoin and the broader crypto market.

Most significantly, Wednesday will bring the FOMC press conference, when Federal Reserve Chairman Jerome Powell is expected to give guidance on the central bank’s plans to raise interest rates.

Elsewhere, earnings for tech titans including Apple, Microsoft and Tesla could also help determine whether we see a broader global recovery or further downside.