Luna Classic attempts comeback with 80% gains

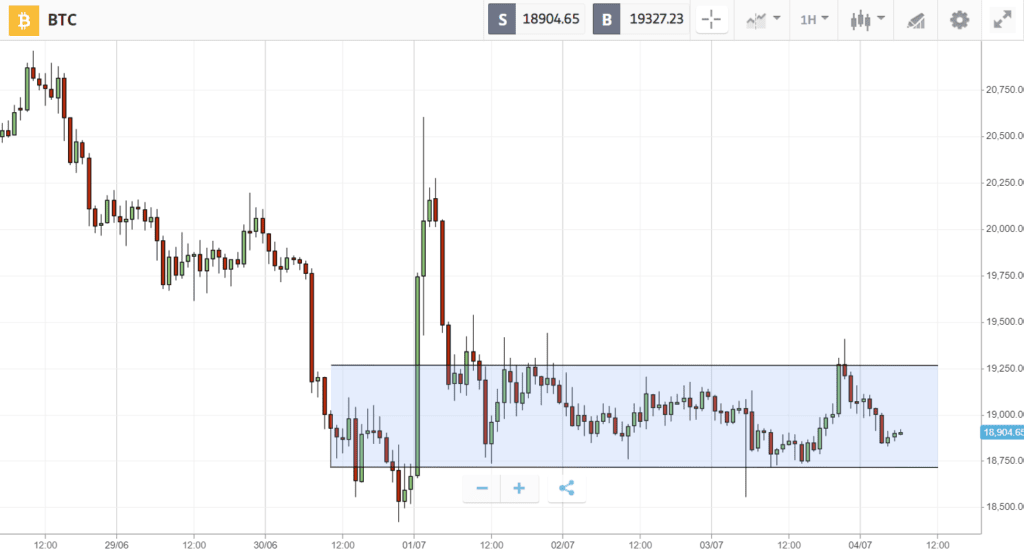

Beaten down by a relentless onslaught of negative news, Bitcoin fell 10% over the last week to rest at the $19K level.

The most significant factor weighing on the market is poor macroeconomic sentiment. As epitomized by the words of Federal Reserve Chairman Jerome Powell, who admitted on Wednesday that he has now learned “how little we understand inflation”. Meanwhile, the implications of the resulting economic turmoil are being made clear in crypto. Megafund Three Arrows Capital filed for bankruptcy on Friday, heightening fears of financial contagion as multiple crypto firms collapse amidst falling prices. Further darkening the mood, Wednesday saw the rejection of another Bitcoin ETF.

In a twist of fate, one of the only positive coins on the week was Luna Classic, which was left for dead in May but attempted to make a comeback last week with 80% gains. Ethereum was one of the biggest losers, dropping 12% as popular derivatives protocol dYdX announced a move to Cosmos, while Ethereum-based Layer 2 solution Polygon (MATIC) fell 5% despite Facebook quietly beginning to test NFTs on the network.

This Week’s Highlights

– Contagion fears intensify as 3AC ordered to liquidate

– Bukele and Saylor double down on Bitcoin

Contagion fears intensify as 3AC ordered to liquidate

The implosion of crypto megafund Three Arrows Capital (3AC) has blown a whale-sized hole in several crypto lending businesses.

Intoxicated by the heady brew of a bull market, the fund is thought to have borrowed extensively from lending platforms to finance ill-fated investments.

This came to fruition on Friday when the fund filed for bankruptcy, prompting widespread speculation about which crypto lending platforms will be dragged down with it.

Bukele and Saylor double down on Bitcoin

When prices fell below $20K, many speculated that megabull Michael Saylor would end up being forced to sell his enormous Bitcoin position.

Nevertheless, he appears to be doubling down. MicroStrategy disclosed on Wednesday that it had purchased 480 Bitcoin for about $10 million, taking its total holdings to approximately 129,699 Bitcoin.

Joining Saylor, El Salvador’s President Nayib Bukele has also been loading up on more Bitcoin. He tweeted on Thursday that “Bitcoin is the future”, showing his purchase of 80 Bitcoin at $19K each.

Week ahead

After closing its second-worst quarter ever with a total of 56% losses, Bitcoin sentiment is in the gutter.

Although the macro outlook is likely to remain challenging in the second half of the year, analysts from JP Morgan now see reasons for optimism. Last week the bank stepped in with a positive report, claiming that high levels of funding and strong acquisition activity could make for a relatively short crypto downturn.

More immediately, the week ahead will bring two key economic data points that could set the course of the market: Firstly, Wednesday’s release of minutes from the Federal Reserve’s last interest rate meeting, and then on Friday, the US jobs report.