Fantom boosted 13% as projects look to move from Terra

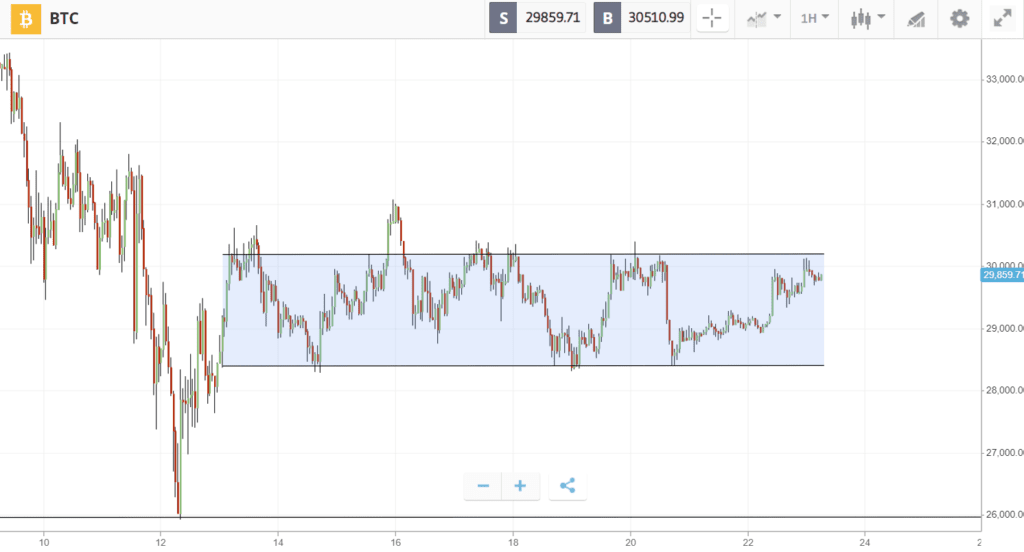

Bitcoin has spent much of the last week trading around $30K, as it slowly attempts to recover from the market free-fall induced by the collapse of Luna.

Despite the sideways price action, the ecosystem has seen growing mainstream recognition. G-7 finance ministers called for the acceleration of crypto regulations on Monday, just as El Salvador president Nayib Bukele kicked off a meeting discussing Bitcoin with dozens of central bank representatives, and the UK affirmed plans to recognize stablecoins as a form of payment. Meanwhile, a big technical development appeared on the horizon as Vitalik Buterin said that the Ethereum Merge could happen as early as August. The price, however, showed little reaction.

Elsewhere, most cryptoassets are mirroring the sideways action of Bitcoin and Ethereum. With the exception of Fantom and Build and Build, which have risen 13% and 3% respectively as they attract projects migrating away from the Terra ecosystem.

This Week’s Highlights

– Vitalik confirms timing of Ethereum’s biggest milestone yet

– El Salvador president meets with 32 central bank representatives

Vitalik confirms timing of Ethereum’s biggest milestone yet

At the ETH Shanghai Web 3.0 Developer Summit on Thursday, Ethereum co-founder Vitalik Buterin let slip that one of the biggest technical milestones in Ethereum history is almost upon us.

“If there are no problems, then the merge will happen in August,” said Buterin, referring to the final stage of Ethereum’s long-awaited transition to Proof of Stake. This technical milestone won’t solve scalability challenges immediately, but will set the foundation for solutions to help mainstream Ethereum-based dApps.

Nevertheless, the price of Ethereum continued to move sideways around $2K on poor sentiment.

El Salvador president meets with 32 central bank representatives

Early last week, El Salvador’s President Nayib Bukele hosted representatives from more than 32 central banks to discuss financial inclusion.

Topics discussed included the digital economy, financing for small and medium-sized businesses, and how El Salvador has been impacted by becoming the first country in the world to adopt Bitcoin.

Pictures of the event showed central bankers lining up to get help downloading and using a Bitcoin Wallet, raising hopes that other countries could be set to follow in El Salvador’s footsteps and experiment with crypto.

Week ahead

As Bitcoin extends its losing streak to a record eight weeks, analysts are continuing to search for signs of a bottom before starting to deploy funds.

Nevertheless, some big players are already taking advantage of lower prices. Last week’s CoinShares report identified record weekly inflows, suggesting that investors might have seen

the Luna collapse and associated the sell-off with a timely buying opportunity.

In the week ahead, macro events are likely to continue dominating market focus. These will center around the release of minutes from the Federal Open Market Committee (FOMC) meeting on Wednesday, and more US inflation data in the form of the The Personal Consumption Expenditures price index on Friday.