Deflationary shift drives Ethereum higher

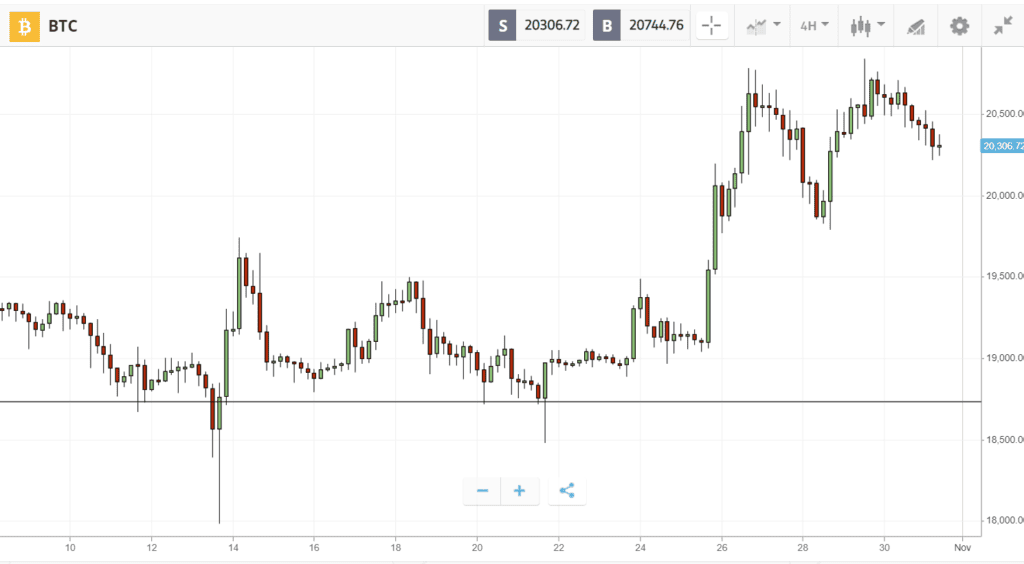

Crypto followed the stock market higher last week, as investors prepared for a potential slowdown in rate hikes.

Bitcoin, which has historically thrived on low interest rates, topped $20K on Tuesday. Yet it was outshined by Ethereum which surged nearly 15% to hit $1.6K, setting a new all-time high for liquidations as short traders were forced to close their positions. Since then, both of the major cryptoassets have remained at higher prices, even as big tech stocks Amazon and Meta suffered heavy losses, and the world’s largest Bitcoin miner warned of impending bankruptcy.

Stealing the spotlight, Dogecoin offered a dazzling performance. The canine-themed crypto jumped 100% on the week as its biggest fan Elon Musk took over Twitter, dwarfing the double-digit gains of other climbing smart contract platforms Solana and Cosmos.

This Week’s Highlights

– Dogecoin doubles as Elon completes Twitter takeover

– Ethereum rises 16% on deflationary tailwinds

Dogecoin doubles as Elon completes Twitter takeover

Elon Musk’s favorite meme coin has doubled in value after the chief executive of Tesla and SpaceX took the helm of Twitter.

Dogecoin’s rally could be driven by rumored plans to put the crypto at the center of the social media platform’s transformation. Messages alluding to this were made public in September during the discovery process of Musk’s court battle with Twitter.

Nevertheless, more evidence of Dogecoin-driven innovation may be required for the cryptoasset to make a complete comeback. The price of Dogecoin is still down roughly 80% from its all-time high set in May last year.

Ethereum rises 16% on deflationary tailwinds

Despite a disappointing performance after the Merge last month, Ethereum is making up for lost time and has jumped 16% to $1.6K.

The rising prices could be driven by reduced supply. Since the Merge, the Ethereum annual issuance rate has fallen from 4% to 0%, which could be reducing the amount of Ethereum in circulation and pushing prices higher.

In addition, the cryptoasset could also be riding tailwinds from Silicon Valley: Google has unveiled a new cloud-based blockchain node service and will offer support for Ethereum.

Week ahead

After a strong finish to a mostly sideways October, the crypto market could face headwinds from economic news in the week ahead.

Most significantly, Wednesday will bring the conclusion of the Federal Open Market Committee (FOMC) meeting, at which Jerome Powell is widely expected to announce a 0.75 percentage point rate hike.

At the meeting, investors will also be watching closely for any hints that Powell might give about slowing down the pace of future rate hikes.