NEO adds 10% on integration with China’s blockchain division

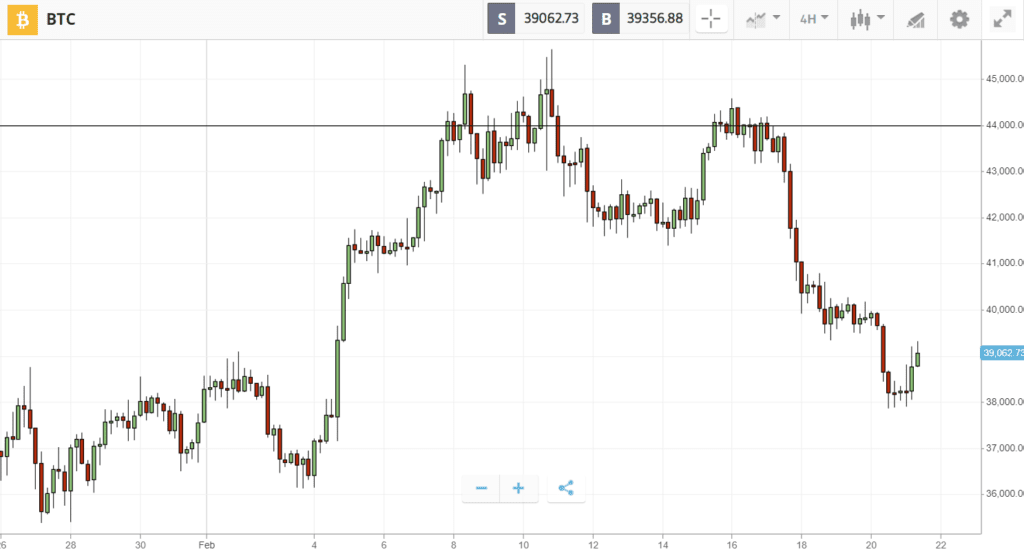

Bitcoin has fallen under $40K, turning almost the entire crypto market red as fears of a Russian invasion of Ukraine rattle investors.

Aside from the geopolitical headwinds blowing in from Eastern Europe, Bitcoin is being rocked by impending rate hikes and the prospect of regulatory action from the White House. Nevertheless, adoption is marching ever onwards. Ukraine is legalizing crypto, the US states of Georgia and Illinois are weighing mining tax incentives, and major oil and gas firm ConocoPhillips has started to work with miners. Even famed investor Warren Buffet, who once referred to crypto as “rat poison squared”, has invested $1 billion in a Bitcoin-friendly neobank.

In the altcoin universe, NEO has risen almost 10% on an integration with China’s state blockchain arm. Avalanche*, the smart contract platform newly listed on eToro*, is following closely behind. Meanwhile, metaverse token MANA has finished the week flat despite America’s largest bank JPMorgan opening a virtual lounge in Decentraland,

* This cryptoasset is not currently listed on eToro US.

This Week’s Highlights

– Ukraine legalizes crypto

– Canadian truckers put crypto in spotlight

Ukraine legalizes crypto

As Russia negotiates new crypto laws, Ukraine is passing its own legalization bill.

The new law does not recognize cryptoassets as legal tender, but it does put crypto under the oversight of the same regulatory agency as stocks — removing any doubts about the legality of the asset class.

Elsewhere, the UAE has joined Turkey in preparing its own local crypto regulations.

Canadian truckers put crypto in spotlight

Canada has captured the attention of the crypto world by invoking emergency powers to freeze the bank accounts of “Freedom Convoy” protestors.

The action is thought to have impacted hundreds of businesses and individuals protesting vaccine mandates in downtown Ottawa, and has prompted widespread condemnation among crypto enthusiasts.

In the US, for example, Congressman Warren Davidson referenced Canada’s actions in proposed legislation that affirms the right of citizens to self-custody their digital assets.

Week ahead

Although US traditional markets are closed on Monday for Presidents’ Day, crypto could still react to developments on the Russia–Ukraine border.

If Russia announces a de-escalation, we may see a spirited recovery, but an invasion would likely lead to more downside.

In addition, the market could also react to an executive order on crypto from President Biden, which is widely expected to be released this week.