dYdX adds 20% on renewed enthusiasm for DeFi

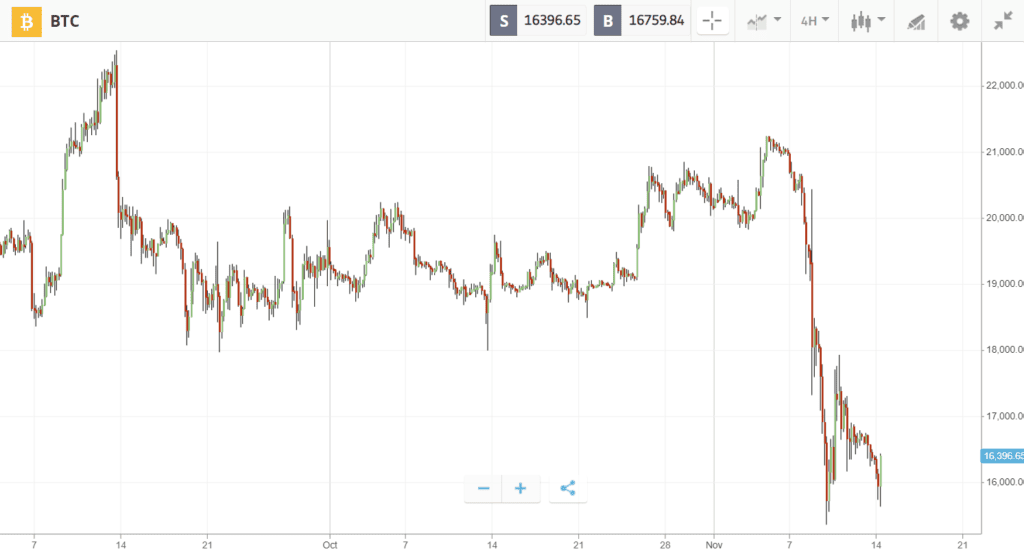

In a troubling week for the crypto market, Bitcoin plunged to $16K as almost the entire asset class suffered large losses.

The falling prices mirrored the trajectory of the 2018 bear market, with Bitcoin hitting new lows almost exactly a year since the date of the previous all-time high in November 2021. Following this downturn, prices saw a slight recovery on an unexpectedly positive inflation report. Yet crypto still lagged far behind the stock market, which registered its best daily performance since March of 2020.

Amidst the market turmoil, the token of decentralized derivatives exchange dYdX climbed 20% higher on renewed enthusiasm for DeFi. Most altcoins, however, saw double-digit losses with Solana and Serum both falling more than 60%.

This Week’s Highlights

– Major crypto exchange files for bankruptcy

– Ethereum turns deflationary amidst market volatility

– dYdX adds 20% on renewed enthusiasm for DeFi

Major crypto exchange files for bankruptcy

Crypto prices began to fall early last week as a major exchange halted withdrawals before filing for bankruptcy.

This prompted analysts to compare the moment with the crash of 2008, when the collapse of Lehman Brothers had a domino effect on the broader economy.

Nonetheless, while the collapse of the exchange is significant and may have an adverse impact on the broader crypto market, the events are not in the same order of magnitude as an entire banking crisis. Furthermore, crypto has historically recovered from such collapses to come back stronger than ever.

Ethereum turns deflationary amidst market volatility

Heightened trading activity over the last week has created heavy traffic on Ethereum, leading to a spike in gas fees.

In turn, Ethereum’s fee burning mechanism has ramped up, accelerating Ethereum’s deflationary trend and turned the cryptocurrency’s net issuance, or the annualized inflation rate, to 0.029%.

This means more Ethereum is now being burnt than is being created, reducing the circulating supply and potentially making the asset more attractive to investors.

dYdX adds 20% on renewed enthusiasm for DeFi

Uncertainty surrounding centralized trading platforms has put decentralized exchanges in focus, leading to 20% gains for the largest decentralized derivatives platform, dYdX.

As a decentralized exchange, dYdX promises to create a transparent and stable trading venue by processing transactions with code rather than a central intermediary.

Other decentralized exchanges, however, have not seen similar gains over the last week. Uniswap, for example, fell 20% to hit $5.5.

Week ahead

Looking ahead, investors are braced for more turbulence as the industry reckons with the aftermath of a major exchange bankruptcy.

Yet the spike in trading volumes seen across exchanges has led some analysts to suggest that we could have already seen a bottom. This would mirror the same bear market pattern of 2018, when Bitcoin formed a bottom one year after making a fresh all-time high, and then slowly drifted sideways before beginning to climb once again.

In the coming week, this thesis could be put to the test as recent volatility continues to put the crypto market under pressure.