Shiba Inu and Ethereum Classic inch higher

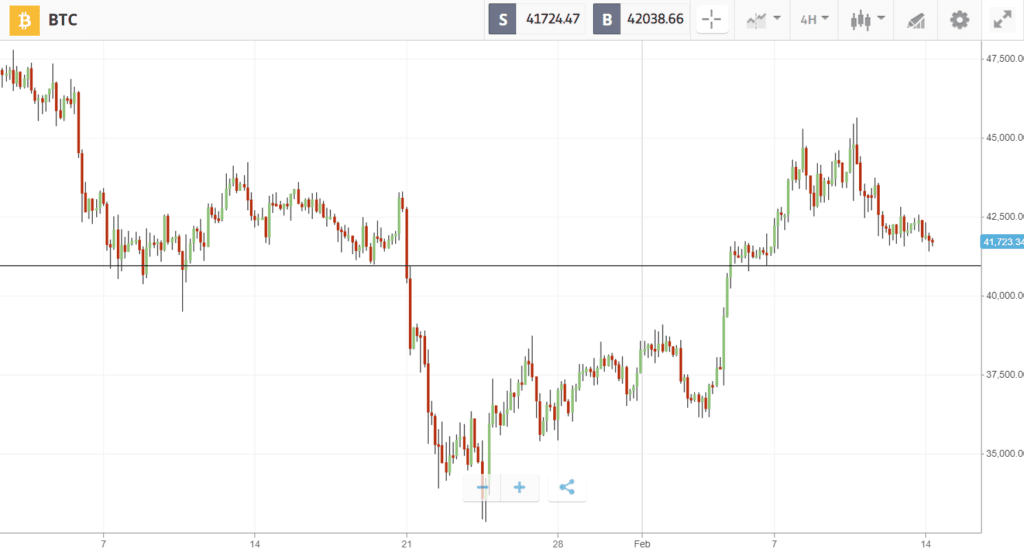

After roaring higher to $45K early last week, Bitcoin has retreated amidst fears of war and uncertainty around inflation.

Events in Russia have dominated market sentiment. Prices pushed higher on optimism over the official recognition of crypto in the country, before dropping back down on concerns about the Ukraine conflict. Elsewhere, yet more volatility was catalyzed by hot US inflation figures coming in at 7.5%, and the seizure of $3.6 billion in hacked Bitcoin by the US Justice Department.

Only a few altcoins managed to defy the market turmoil: Shiba Inu finished the week with 3% gains after the announcement of a mysterious new metaverse project, and Ethereum Classic rose 9% ahead of the Mystique upgrade on Sunday.

This Week’s Highlights

– Russia set to recognize cryptoassets as currency

– World’s largest asset manager to offer Bitcoin trading

Russia set to recognize cryptoassets as currency

Bitcoin rallied to a peak of almost $46K early last week, after local media reported that Russian authorities will create new legislation recognizing cryptoassets as a form of currency.

The move is a major change of direction for the Russian Central Bank, which previously proposed a blanket ban on crypto. In response to the news, some market analysts are now speculating that Russia could have even bigger future plans — such as accepting Bitcoin as payment for natural gas.

In related news, the US state of Tennessee has followed Arizona by drafting its own Bitcoin bill that would allow the state and other municipalities to invest in cryptoassets.

World’s largest asset manager to offer Bitcoin trading

The world’s largest asset manager, BlackRock, is wading into the crypto market.

BlackRock, which manages over $10 trillion in assets for pension schemes, endowments and sovereign wealth funds, is reported to be preparing a crypto trading service for its clients.

The news comes as big four accounting firm KPMG Canada announces the purchase of Bitcoin and Ethereum for its own corporate treasury, citing the belief that “institutional adoption of cryptoassets and blockchain technology will continue to grow and become a regular part of the asset mix.”

Week ahead

As global markets battle uncertainty over conflict in Ukraine and the prospect of rising interest rates, crypto is under pressure.

On Monday, the US Federal Reserve is set to hold an unscheduled meeting to discuss interest rates. Some analysts are expecting a hike, which could suck money out of stocks by making lower-risk assets such as bonds more attractive to investors.

Whatever the outcome, crypto traders will be watching closely to see If Bitcoin will keep trading in lockstep with stocks, or if it can decouple (even on Valentine’s Day) to forge its own independent path.