Pass the stock market a mint, because it has some bad breadth.

Hygiene jokes aside, fewer stocks are pushing prices higher these days, even though the market itself seems to be drifting upwards. Market technicians call this a breakdown in breadth — the number of stocks going up versus those going down.

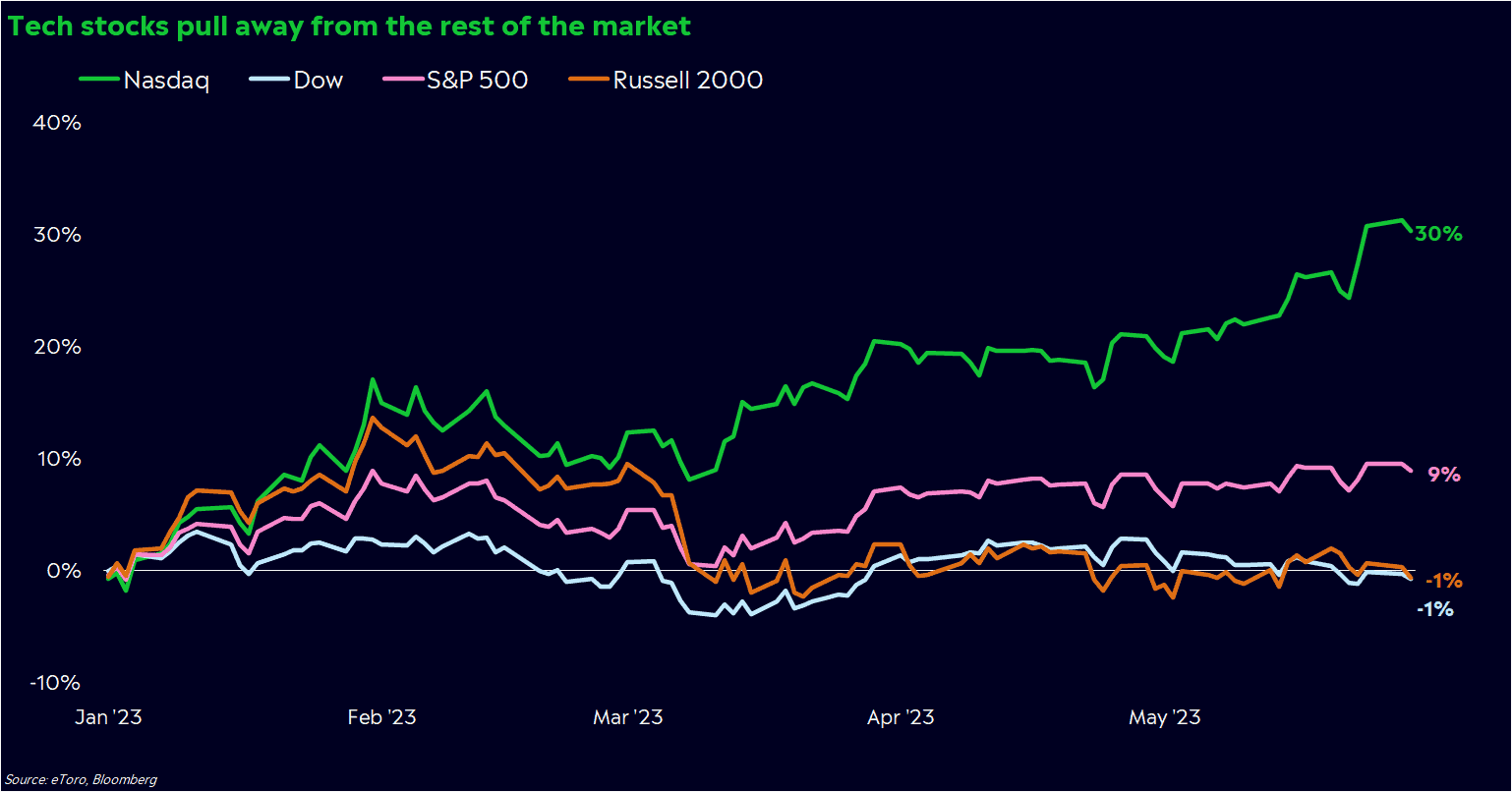

At first, it seems like an ominous sign. If fewer stocks are moving higher, then the market could be more vulnerable. In this instance, tech stocks seem to be the only group moving higher — reminding some of when tech became unmoored from the rest of the market in the dot-com bubble.

But in reality, bad breadth has popped up in all kinds of markets — up, down and sideways.

And right now, it could be more of a distraction than a reason to sell out.

Market of stocks ≠ stock market

The stock market had a weird month.

The S&P 500 coasted higher while debt ceiling tensions flared, and that was weird enough. Even weirder — it wasn’t the whole market moving higher, just an unusually small subset of stocks.

Just a quarter of S&P 500 stocks actually beat the index during May, and two-thirds of S&P 500 stocks actually fell. By one measure — the S&P 500’s cumulative advance-decline line — the balance of rising to falling stocks during May was the worst for a monthly gain in at least the past two decades.

It wasn’t just the number of stocks bucking the trend, either. Tech stocks led during the month, with the Nasdaq 100 posting a 7.6% gain. AI darlings like Nvidia and AMD soared more than 40%, a striking difference from the median S&P 500 stock’s 4% fall.

The market of stocks seems to be acting differently than the stock market. And it’s hard to feel confident about the durability of a house when a large part of the foundation looks shaky.

Stinky breadth isn’t unusual

Or perhaps there’s more to the story.

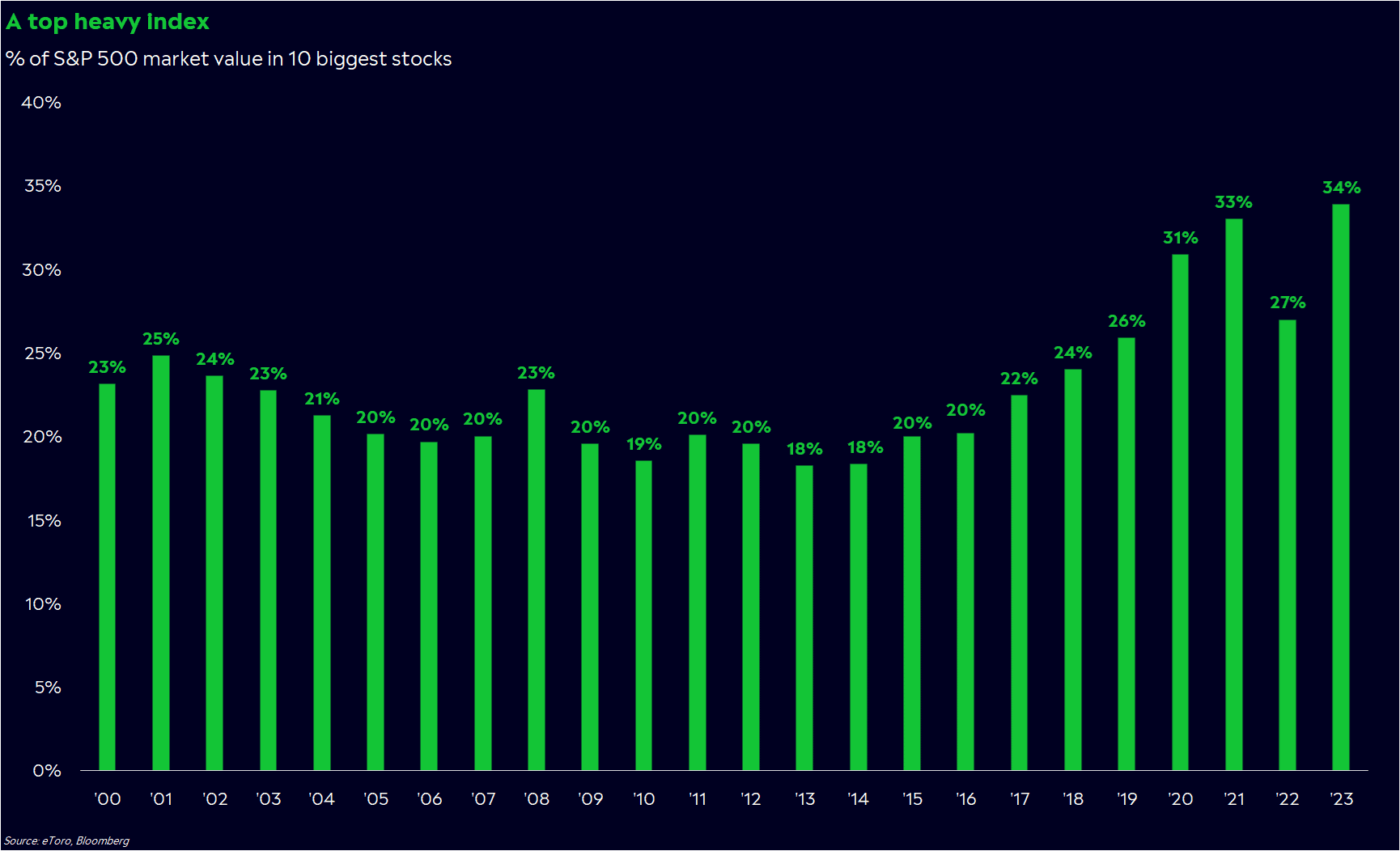

Breadth stinks, but it’s also more of a feature than a bug. Look at history, and you’ll notice long stretches of bigger stocks driving market returns.

Part of this is by design. The S&P 500 — along with many other indexes we watch — are market cap-weighted. Bigger companies get a higher weighting in index calculations, so naturally, they tend to drive returns.

There’s actually a version of the S&P 500 that gives every stock an equal weighting, and its history can give you some clues to when bigger stocks have broken away from the rest of the market. The S&P 500 rose faster than its equal-weight counterpart for a six-year period from 1994 to 1999, and again from 2017 to 2020. Those periods were marked by higher rates and slowing growth, similar to the environment we’re contending with today.

Big tech is often a culprit of bad breadth, too. This year, the MANAA stocks — Microsoft, Apple, Amazon, Alphabet, Netflix and Meta — have accounted for 85% of the S&P 500’s gain in market value. But this concentration in tech isn’t anything new, even if it’s a little extreme. Over the past five years, the MANAA stocks have been responsible for at least 20% of the change in the S&P 500’s market cap each year.

Tech’s meteoric rise over the past 10 years has led to a bunch of warnings about bad breadth, even though stocks have gone up for the bulk of the past decade. In 2017 — one of the calmest years for the stock market — big tech led in eight out of 12 months. And back then, there were the same cries about how thin leadership could tank the stock market.

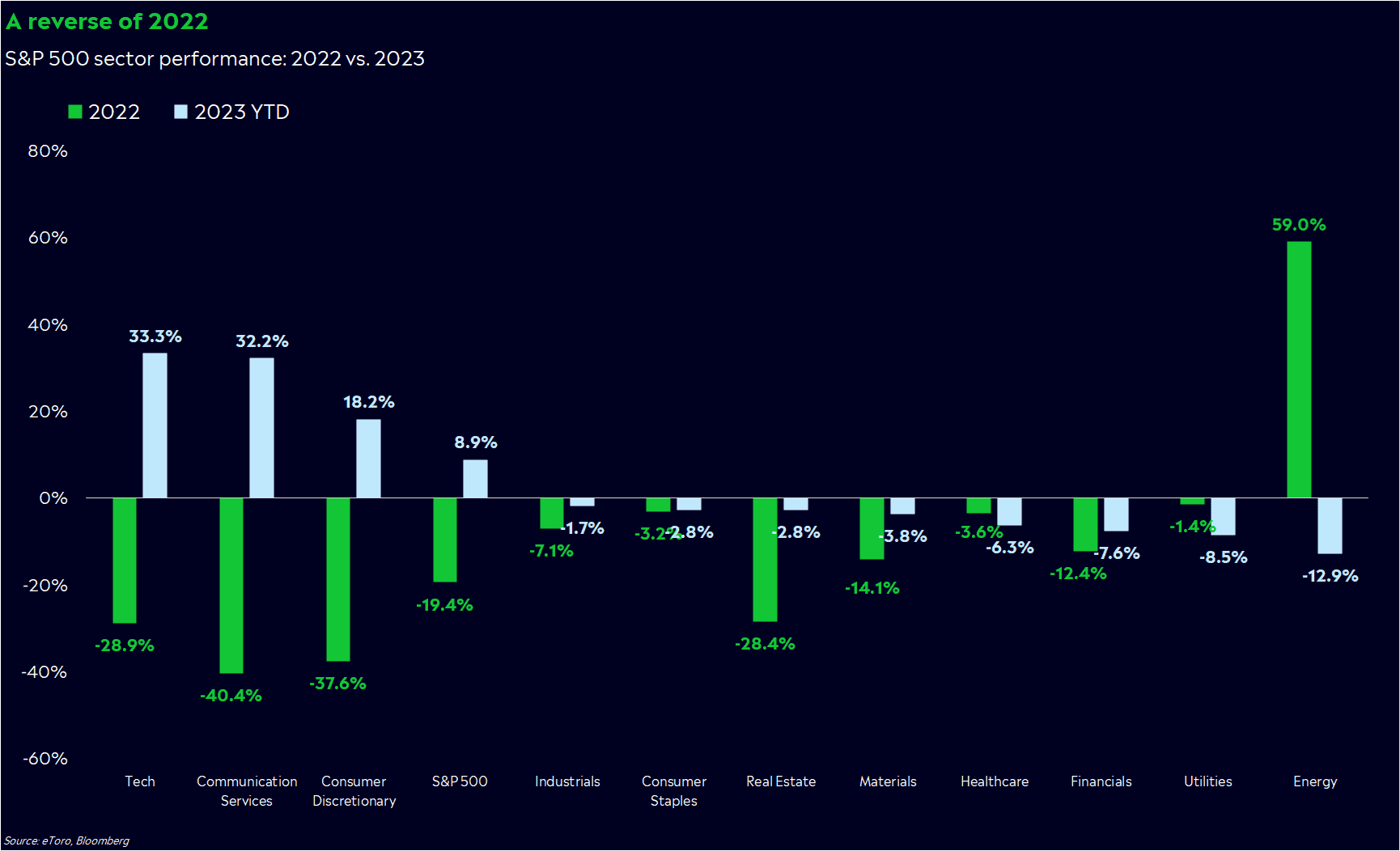

A reverse of 2022

Bad breadth could also be a reflection of the uneven waves moving through the economy.

Here’s what I mean. In 2022, rate-sensitive sectors like tech and real estate were hammered as the Fed aggressively raised rates. Now, a rate hike pause is in sight, and investors seem to be shifting into bigger companies within those same rate-sensitive industries. It’s possible we’re just seeing the reverse of last year’s selloff.

Earnings expectations confirm this view. If you look at 2024 earnings estimates, you’ll see that tech, communication services, and consumer discretionary profits are expected to rebound at an unusually quick pace. Coincidentally, those three groups were the only S&P 500 sectors to rise in May.

Of course, AI hype has helped boost tech. And while I think AI has a bright future ahead, it may be a tough time to invest in a largely unproven technology. Some of this tech fervor feels a little over-the-top, considering we’re in a high-rate environment with scarce funding.

So what does this mean for you?

Remember the context. Bad breadth isn’t a good sign. But basing a strategy solely on breadth may leave you on the wrong side of a move. History shows us as much. Stay cautious, but think about tweaks you can make to your portfolio instead of bailing out entirely.

Consider how you’re investing. If you’re worried about bad breadth, maybe it’s time to look at a basket of stocks instead of picking a few and crossing your fingers. When stocks are moving in different directions, investing in single stocks can be especially risky.

Choose carefully. If you’re excited about AI, remember that there’s more than one way to invest in a theme. Think about the suppliers that could power the AI boom and the industries that could embrace AI the most. Keep in mind that technological trends often take years to play out, and they typically have their own ups and downs.

*Data sourced through Bloomberg. Can be made available upon request.