The Daily Breakdown takes a look at Netflix stock as shares hover near record highs and are up more than 40% so far in 2024.

Tuesday’s TDLR

- Will the S&P 500 break out or break down?

- Netflix sits near key resistance.

- Microsoft raises its dividend and boosts buyback.

What’s happening?

The Federal Reserve is this week’s big focus, as they are preparing to lower interest rates on Wednesday afternoon for the first time in four years.

Notably, we’ve had a lot of volatility over the last few months.

The S&P 500 rallied to all-time highs in mid-July, then tumbled lower into early August, falling 9.7% from peak to trough. Then the index rallied more than 10% to come within spitting distance of all-time highs again, before falling almost 4% in a few days and rebounding with what is now a six-session win streak.

Back near the highs again, fatigue is setting in for traders who are unsure of whether to sell this rally (again) or hold on tight for a potential move higher. Longer term investors may not be as focused on the day-to-day action and this is a good reminder to remember which camp you fall into.

Active traders may want to be mindful of their position sizing and exposure going into what’s potentially going to be a volatile event and a bumpy couple of days or weeks. Long-term investors will want to remind themselves of their investing goals and plans.

Want to receive these insights straight to your inbox?

The setup — NFLX

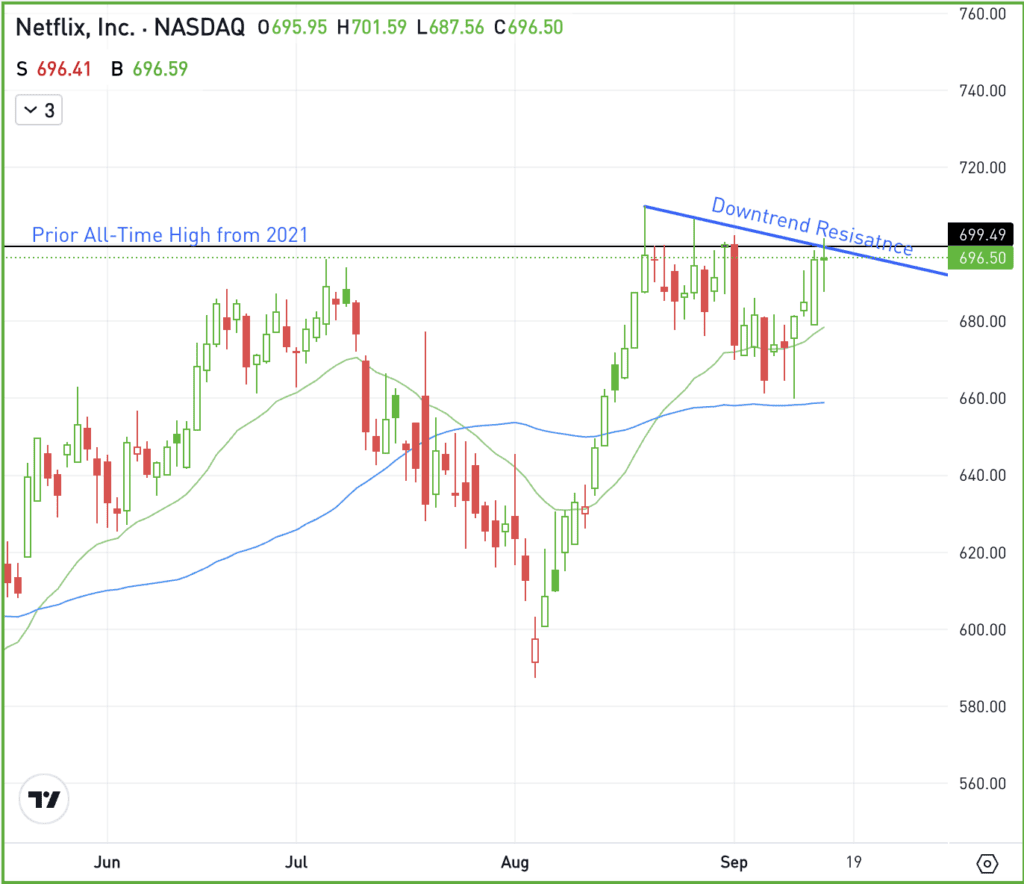

Netflix stock has quietly climbed higher throughout 2024, up about 43% on the year. Shares have climbed in 9 of the last 11 months as bulls continue to bid NFLX higher.

Shares are sitting just below the prior all-time high from November 2021 near $700 and continue to consolidate. For what it’s worth, earnings are still about a month away.

Now, bulls are looking to see if NFLX can break out over resistance and gain steam above $700.

This week’s events have the potential to make-or-break this setup in the short term, so keep that in mind for those who are watching NFLX.

If shares clear $700 and close above this level, the rally could continue higher. On a pullback, keep an eye on recent support near $660. Below that mark and more selling pressure could ensue.

Options

One downside to NFLX is its share price. Because the stock price is so high, the options prices are incredibly high, too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

INTC – Intel stock is surging after announcing plans to create custom AI chips for Amazon’s AWS. The company has also received $3 billion in federal grants to produce advanced chips for the Pentagon’s Secure Enclave program — focused on military and intelligence use — under the CHIPS Act.

MSFT – Shares of Microsoft are trading higher this morning after the firm announced a fresh $60 billion buyback program and hiked its quarterly dividend more than 10% to 83 cents a share.

SMH – Chip stocks fell as investors locked in profits after last week’s rally. Nvidia, the AI leader, dropped nearly 2% on Monday. Broadcom slipped 2.2%, while KLA Corp and Marvell Technology saw declines of 2% and 1.5%, respectively. Overall though, the SMH ETF slipped just 1.3%.

SPY – The all-time high for the SPDR S&P 500 ETF Trust is at $565.16, a level that the ETF is hovering near in pre-market trading this morning. The S&P 500 index would have to hit ~5,670 this morning to make new highs. Bulls may want to keep an eye on this index today.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.