The Daily Breakdown looks at the four-day selloff in the S&P 500, as well as the recent weakness in Apple.

Thursday’s TLDR

- Semiconductor bulls want stocks to find support.

- Apple stock threatens to break lower…again.

- Shares of United Airlines rip higher on earnings.

What’s happening?

Stocks gyrated between positive and negative territory on Wednesday, and while the S&P 500 closed lower on the day, it found its footing — at least for now — at the key 5,000 level, while the Nasdaq 100 stumbled 1.2%.

We’re going into Thursday with a peak-to-trough decline of almost 5% from the all-time high. Remember, going back to 1974, two to three pullbacks of 5% or more are common every year.

Now I want to see if stocks can find their footing, even if it’s only good for a short-term bounce. Specifically though, I am keeping my eye on three things:

- I want to see how semiconductors trade from here. The SMH ETF — which is often used as a proxy for semi stocks — fell hard on Wednesday, down 3.1% and vastly underperformed the broader market.

Given what a big role semiconductor stocks played in Q1, can they find their footing and rebound in Q2? It may need the behemoth of the group — Nvidia — to lead the charge. - Energy was the best-performing sector in the S&P 500 last quarter. Despite a nasty dip in crude oil on Wednesday, energy stocks held up okay. Let’s see if this prior leadership group can find some momentum.

- Netflix reports earnings after the close. It’s the first of the FAANG group and the first notable US tech company to report this quarter. Let’s see how the market reacts.

Want to receive these insights straight to your inbox?

The setup — AAPL

Apple has struggled. It’s the second-worst performer in the Magnificent Seven so far this year, down 12.7%. Tesla is the only component that’s done worse — and they are the only two components currently lower year to date.

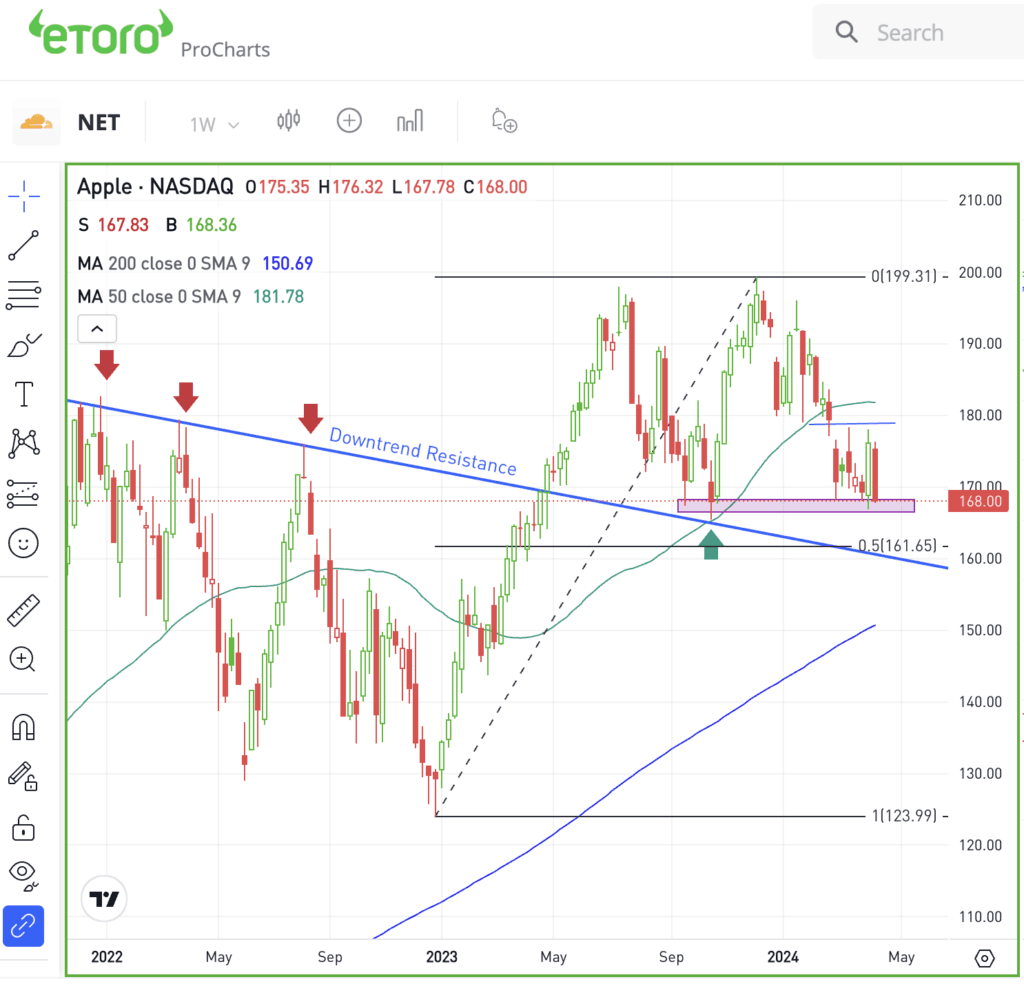

Apple enjoyed a big rally last week, but has come back under pressure. Notice how the stock is clinging to the $168 level, which has been recent support.

Let’s see if this level continues to hold. This level was support in Q4 and has been support so far in 2024. If it fails, it could open the door to lower prices.

In late February, I highlighted that Apple was teetering on key support near $180 and that if it were to fail, puts or put spreads could be one way to capitalize on a decline.

While active traders could profit from another decline with a bearish position, a further dip may pique the interest of longer-term bulls.

If we zoom out to the weekly chart like we have above, the low-$160s could be an interesting area for dip-buyers.

That’s where we have the prior downtrend resistance line. Notice how this level acted as support in Q4, triggering a run to all-time highs. In the low-$160s, there’s also the 50% retracement, which is simply the halfway mark between a range — in this case, that range is the 2023 low and the recent all-time high.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

TSM — Taiwan Semiconductor may be overlooked for stocks like AMD and Nvidia. However, it’s a big company, commanding a $625 billion market cap. The firm reported earnings this morning, beating analysts’ expectations and issuing solid guidance for Q2. Will it be enough to generate a rally?

UAL — Shares of United Airlines ripped higher on Wednesday, bucking the trend in the overall market. The post-earnings rally sent shares to their highest level since early September and came after the firm’s Q1 report. While United Airlines lost 15 cents a share, this result still beat expectations, as did revenue.

GOOGL — Earlier this week, Tesla stock sank on news of more layoffs. Now, Alphabet is rumored to be doing another round of layoffs too. The cuts are reported to be “pretty large-scale,” but we’ll have to wait for any sort of confirmation from the firm.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.