Now that we’ve moved away from the “only up” market of the crypto cycle, things are quieting down. Bitcoin’s price has been relatively flat over the last 2-3 months. The NFT markets have slowed down. We’re no longer stressing over yield-platform meltdowns.

The industry is taking a breath.

But that doesn’t mean we’re entering a period of doom and gloom. It gives us an opportunity to take a step back and realize how much this exciting industry has grown over the last few years.

Crypto adoption is well above 2019 levels

We all witnessed Bitcoin and other cryptocurrencies reach and break new all-time highs over the last couple years. Since then, markets have fallen significantly. But global adoption is still well above 2019 pre-bull market levels, according to a Chainalysis report.

In North America specifically, we represent 19% of all DeFi usage, the second highest of all regions around the world, accounting for 37% of global transaction volume.

That’s massive.

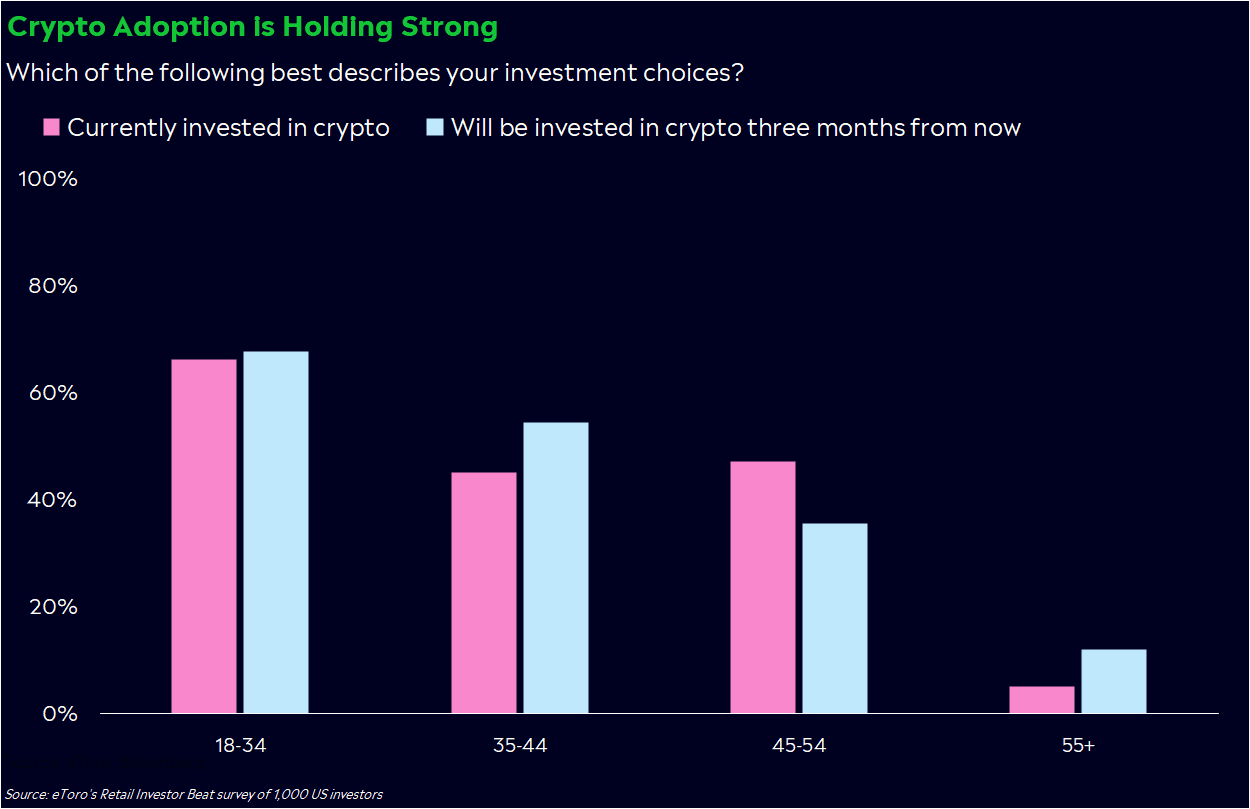

It’s also important to acknowledge that consumer adoption of crypto is holding strong. The percent of investors who own crypto has steadily increased this year and many are still thinking about investing, according to our quarterly global Retail Investor Beat survey, which included 1,000 US investors.

Many crypto investors haven’t been fazed by the selloff, either. In June, 92% of investors told us they held onto their crypto or bought more in the first half of the year. And those who own crypto said it comprises 44% of their portfolio on average, up from 32% at the beginning of the year.

Crypto prices have been remarkably stable lately

Now, thanks in part to growing adoption, crypto prices have been surprisingly resilient. While the UK budget panic pushed stocks to new lows, crypto held up surprisingly well. In fact, Bitcoin hasn’t closed within 5% of its year-to-date low at any point in the last three months, and it was one of just two major markets that rose in the third quarter.

Crypto’s resilience could be telling a bullish story. Investors aren’t panic selling. Instead, they’re HODLing – a sign of a maturing market. When markets are in panic mode, investors tend to be more discerning about the risk in their portfolio. Crypto has been a victim of that trend in the past, but over the past month, Bitcoin has been less volatile than the S&P 500 — yes, even in the face of a surging US dollar and rising interest rates.

It’s possible we’re seeing a new foundation being built in crypto.

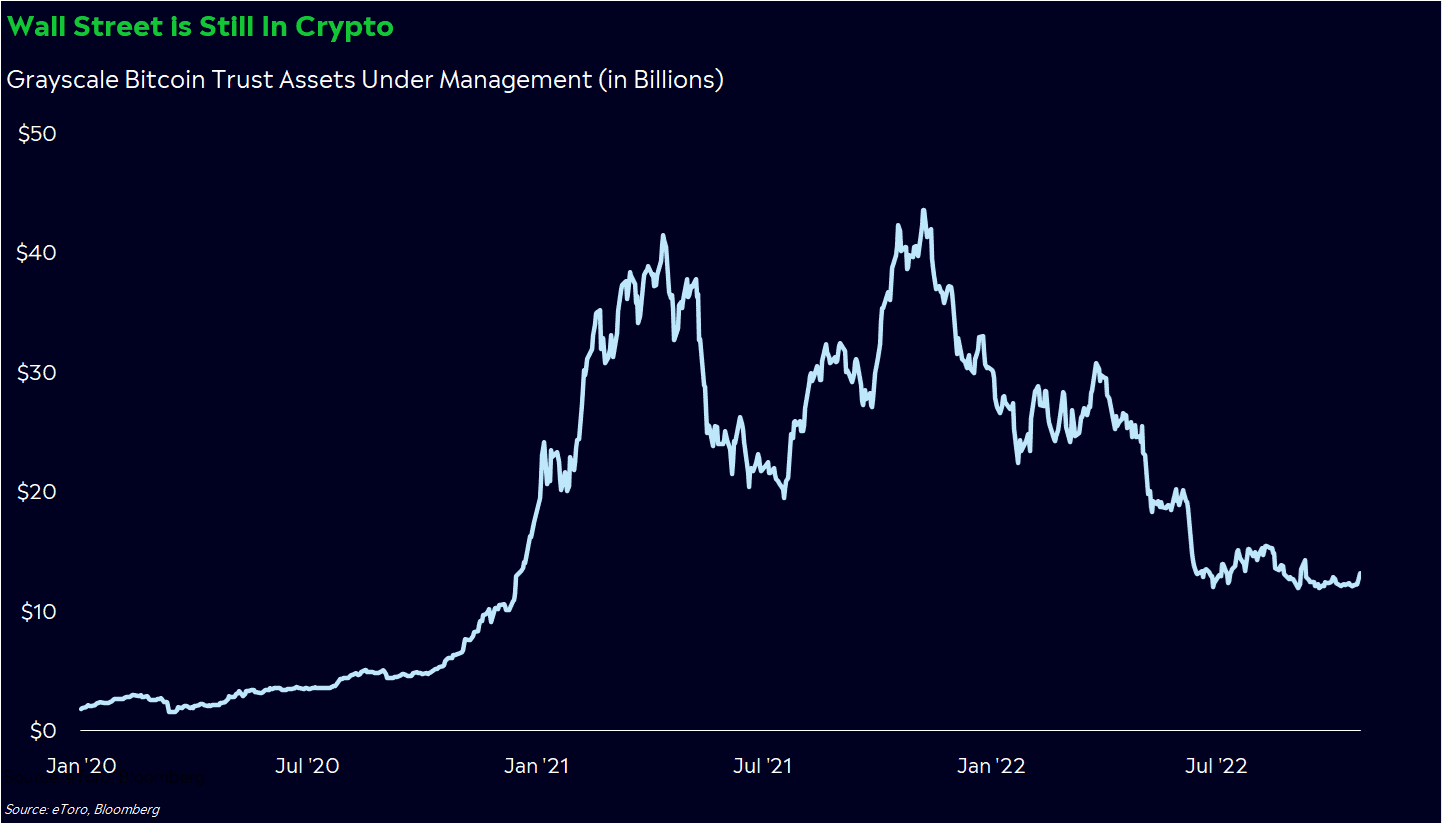

Wall Street is still in

The meme still holds: institutions came and they’re sticking around. In 2020, $15 billion of institutional AUM had been allocated to the crypto asset class. Not only that, but 58% of institutions are invested in digital assets, according to Fidelity estimates.

That represents a massive level of adoption in capital allocations. But maybe even more importantly, it also brings a new level of legitimacy to the asset class. As this trend continues, regulators are seeing more demand for investment vehicles for this category.

We already have exchange-traded products that track Bitcoin, and we could eventually see ETFs that hold actual crypto. The assets of the Grayscale Bitcoin Trust, a primary investment vehicle for institutional investors, has been flat over the last three months.

Institutions do not appear to be leaving any time soon. Providing this investor class with more opportunities can only be a positive catalyst for the wider industry.

Market cycles aren’t a bad thing

The economy is in a much different position than it was just a year ago. Markets have naturally changed as well. Inflation is up and so are costs in nearly every sector.

Change isn’t a bad thing, even though it can feel painful in the moment. In down times, capital becomes more selective and concentrated in proven projects, which strengthens the ecosystem for everyone. The cream naturally rises to the top.

Just like after the previous crypto bull run, projects and trends will die and new use cases will emerge. The last run was kicked off with the emergence of the ICO boom, leading to a new way for projects to fund their development. This past bull market was initially fueled by the boom in yield products, and later boosted by the viral adoption of NFTs.

In an emerging technology space, boom and bust cycles are to be expected. These down markets provide an opportunity for investors and builders to re-evaluate their investing thesis and find new opportunities for the future.

Zooming out

Look. It’s been a rough year for all of us, no matter how exciting it’s been for the industry. These days, the easiest thing to do is tune the world out.

The reality is that crypto assets are now a legitimate asset class worthy of portfolio allocation. There was a time where this category was a fringe dream. Now you can have exposure to Bitcoin on all major investing platforms.

It’s easy to get lost in the current state of the markets, but if you zoom out, the future has never looked better.

*Data sourced through Bloomberg. Can be made available upon request.

**The Q3 2022 Retail Investor Beat was based on a survey of 10,000 retail investors across 13 countries and 3 continents. The following countries had 1,000 respondents: UK, US, Germany, France, Australia, Italy and Spain. The following countries had 500 respondents: Netherlands, Denmark, Norway, Poland, Romania and the Czech Republic.