Becoming an investor and finding a partner are two of the biggest life projects somebody can embark on.

Ironically, they can also be the most difficult, because they’re both inherently personal exercises. Being a good partner and a good investor both require you to know who you are and what you want out of life. And it can be tough to admit that you aren’t where you want to be.

But here’s the good news. You have higher aspirations for your future self, and that’s worth cheering about.

We’re here to help you figure out the rest. Here’s a step-by-step guide for love and money, straight from a survey we conducted of 2,000 adults.*

Step 1: Define your identity

Setting up your profile on a dating app can be rough. You’re forced to write two pithy sentences about yourself without sharing too much or too little. You may have to be honest with yourself about who you are and what you want. But in the end, that honestly could serve you well in finding a partner that’s best suited for you.

Knowing thyself is also at the heart of investing. Before you dump your money into that hot stock or cryptocurrency, you need to start with an honesty hour: why are you investing? There’s no wrong answer, but what you come up with can dictate the rest of your investing plan.

Your risk appetite can also be an important factor for both your relationship or your portfolio. In our survey, about 84% of respondents said it’s important that they find a partner that’s open to trying and experiencing new things. If you’re not the adventurous type, that’s OK! Knowing where you stand is key.

In markets, knowing your taste (and tolerance) for risk and adventure could help you decide which investments suit you and your goals best. Your friends may be investing in meme stocks, but if you can’t handle drastic ups and downs, that may not be the best option for you. Sure, the S&P 500 has climbed an average of 8% per year since 1950, but it’s also gone through 32 drops of 10% or more. Bitcoin has had an incredible run, but you’ve had to survive a 20% selloff every six months on average. That’s not easy.

If you’re investing for the long term — think several years or more — you may be able to stomach some swings. If you need your money soon, you may want to think more about what could best preserve your investment, while also earning some return.

Step 2: Determine your engagement

Now, the hard part: waiting for that answer back from the cutie you swiped right on. I’ve been there – creating the profile, swiping, then checking for a response incessantly. And if they do respond, you’re stuck overthinking about when you should respond. You’re excited, but you don’t want to seem desperate.Investing requires you to be purposeful about how often you’re checking your portfolio. In fact, it can be even more tempting than your dating app. About 55% of people said they check their banking and trading apps more than their dating apps.

While staying engaged with your money can be wise, it can also backfire on you. There are real risks to staying too engaged, like over-trading and panic-selling. Take the stock market’s COVID drop, for example. If you sold stocks on March 16 (the day the S&P 500 fell 12%, its worst drop since 1987), you would have missed some — or all — of the 100% rebound we’ve seen since then.

Your optimal amount of action might depend on your time horizon. Short timeframes may require you to keep a closer eye on your money. But as you look further out into the future, today’s headlines could make less of an impact on your investing goals. Plus, a long-term investor’s biggest superpower is compounding — the snowball effect that can happen when your money grows exponentially over long periods of time. But in the words of investing guru Charlie Munger, the key to compounding is to “never interrupt it unnecessarily.”

Don’t scare off your potential partner with too much, too soon. Don’t ruin your portfolio by overthinking it. Sometimes, the best strategy is to do nothing.

Step 3: Align your values

Congratulations! You’ve swiped right and hooked a good partner. A few dates later, you think you’ve found the one.

But before you commit, you need to have the talk about life’s biggest priorities — marriage, kids, religion, politics, parenting styles. It’s an uncomfortable, but necessary step. This person may be physically compatible with you, but their values may be the difference between a fling and forever.

Now, consider going through the same thought exercise with your money. For most of history, money and values were thought to be mutually exclusive. But today, we’ve learned that you can make a difference with where you invest. Do your companies follow environmental, social, and governmental standards? Do you feel comfortable investing in a stock that doesn’t totally align with your beliefs?

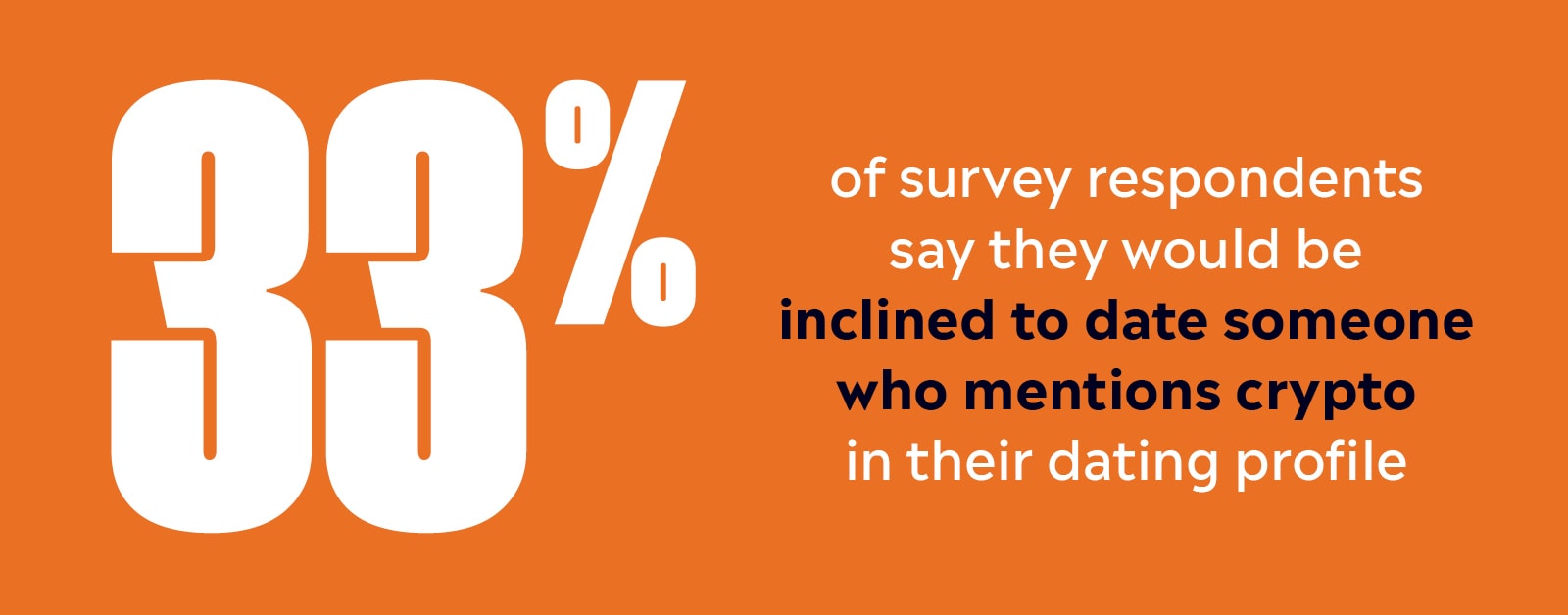

Identity, beliefs, and money are more intertwined than ever, which is why we’ve seen the crypto community explode in popularity. Crypto is the market embodiment of identity and values. Crypto investors buy in for many different reasons, but many believe in a new global economy — one that is more open, transparent, fair, and equitable. And others see their crypto involvement as part of their identity. It makes sense that 33% of survey respondents say they would be inclined to date someone who mentions crypto in their dating profile (versus the 20% who said they would view it as a turn off).

When you’re examining your portfolio, think about how your beliefs align with your investments. It’ll help you stick to your goals and rest easy knowing your money could be making a difference. And in the end, a company’s commitment to making the world a better place could benefit its bottom line (and in turn, its stock price).

*Survey research was conducted by Appinio from 3 January – 4 January 2022. Sample size included 2,000 adult U.S. residents between the ages of 18 and 99. They did not need to be eToro platform users.

By the way, all investments involve risk, including the loss of principal, and there is no guarantee that your investment objectives will be met.