What’s up with ETH?

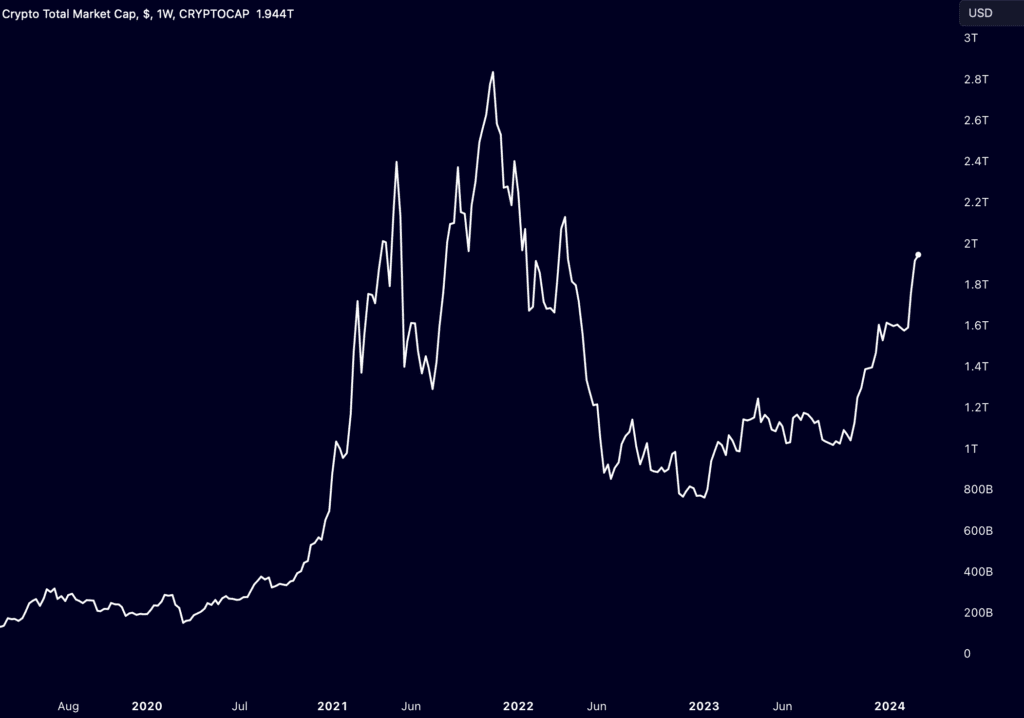

In the midst of a vibrant 2024, seasoned crypto investors and newcomers alike are diving into the fray. After enduring a bearish stretch for the past 18 months, investors are now actively implementing their strategies for the year. The market is buzzing with positive signals, making it an opportune moment to delve into the fundamentals of the Ethereum (ETH) ecosystem.

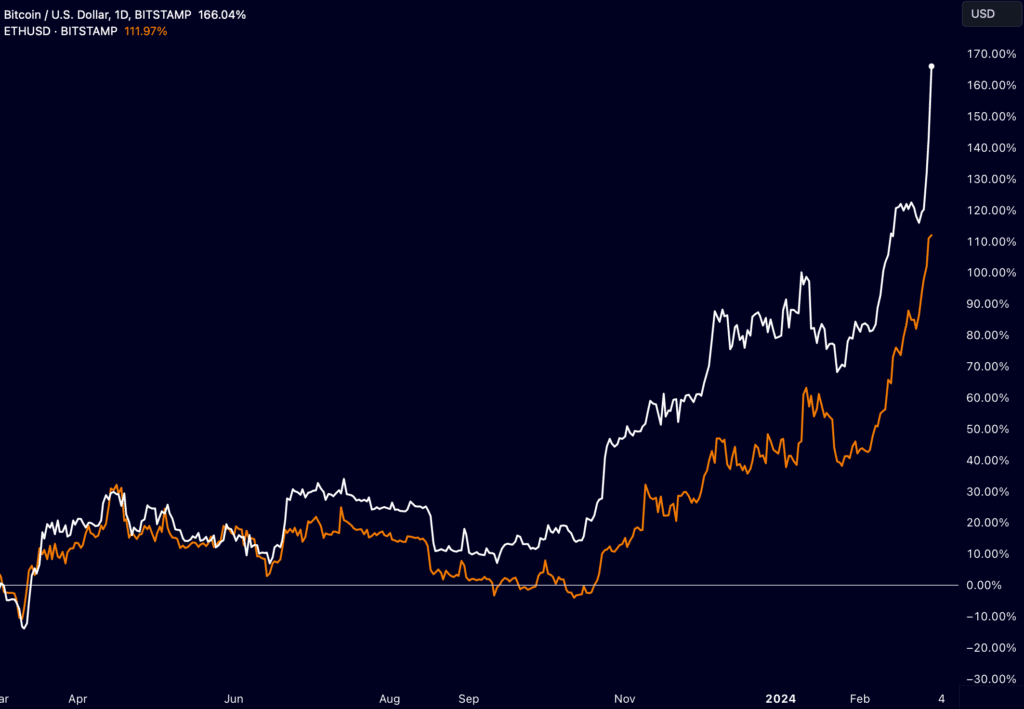

While Bitcoin (BTC) has been commanding attention with significant events in its ecosystem, Ethereum is also making waves. BTC’s surge has been fueled by both institutional and retail acceptance, along with its fixed monetary policy. Recent milestones such as the approval of spot Bitcoin ETFs and the anticipation surrounding Bitcoin’s halving in April have propelled its value above the elusive $60,000 mark.

However, the spotlight isn’t solely on Bitcoin and Ethereum. Solana (SOL) has emerged as a breakout star in the past six months, securing its position as the fourth-largest crypto token by market capitalization, hovering near $50 billion. This meteoric rise places Solana just behind BTC, ETH, and USDT in terms of market cap. According to Google Trends, searches for “Solana” surpassed those for “Ethereum” for the first time in mid-December. Additionally, Solana has witnessed a surge in stablecoin trading volume, surpassing other chains and over $100B in week-over-week activity. Initially touted as an Ethereum competitor due to its scalability for high-volume, low-cost transactions, Solana’s rise begs the question: is it poised to dethrone Ethereum?

Unlike any other blockchain project, Ethereum’s core values revolve around decentralization, security, and fostering a vibrant developer culture centered on innovation. Much of the excitement surrounding Ethereum stems from ongoing technological upgrades and a commitment to continuous improvement.

Looking ahead to 2024, Ethereum’s growth trajectory will continue to be propelled by significant technological advancements. In just 2 weeks, Ethereum is meant to undergo the Dencun upgrade, a key set of EIP upgrades (“Ethereum Improvement Proposal”) focused on scalability, security and efficiency that are being referred to as “the Surge”. But the core upgrades on the Ethereum L1 blockchain are just the start. Ethereum’s journey in 2024 will be shaped by builders operating across the ecosystem and the market’s perception of its significance.

ETH Staking and Liquid Re-Staking

Ethereum’s successful transition to a proof-of-stake consensus mechanism has paved the way for a groundbreaking innovation: liquid staking and re-staking. In September 2022, Ethereum completed its “Merge,” transitioning from Proof of Work to Proof of Stake consensus. This upgrade, heralded for its role in lowering barriers to entry for network participation and significantly reducing Ethereum’s energy consumption, allowed anyone staking 32 ETH to become a validator. Another pivotal update was the Shanghai update in April 2023, which enabled validators to unstake and withdraw ETH. Currently, approximately 25% of all ETH is staked to the network, totaling around 30 million ETH, equivalent to nearly $83 billion based on a valuation of $2,768 per ETH.

While stakers earn yields on their assets, a drawback of this model was the locking up of billions of dollars of ETH on-chain. This has led to the emergence of liquid staking protocols such as Lido and Rocket Pool, enabling users to “wrap” their staked ETH and utilize representative tokens in other financial applications. This innovation not only transforms staked ETH into a liquid asset but also fosters the development of new security solutions, extending the utility of ETH. For instance, the Eigen Layer provides a security infrastructure that allows developers to access network validation capabilities without deploying their own validator. While these advancements carry inherent risks, they exemplify technological innovation addressing real-world challenges, driving market sentiment and investor enthusiasm.

L2, L3, Roll-ups – Ethereum Scalability

As Ethereum tackles scalability, it has embraced a rollup-centric roadmap in recent years. Scaling solutions such as Layer 2s (L2s) have emerged as crucial extensions of the network, offering fast and cost-effective transactions. L2s operate as external execution layers that interact with Ethereum L1, while roll-up technology enables numerous off-chain transactions to be settled on-chain with a single transaction. The market size of Ethereum scaling solutions is projected to exceed 25 billion, with popular solutions like Arbitrum, Optimism, and Celo witnessing rapid growth in both developers and users.

There are also whispers of “Layer 3s” – application-specific scaling solutions designed to enhance compute power for specific applications, such as those leveraging large data sets and machine learning. These scaling solutions aim to support developers in building decentralized applications (dApps) capable of accommodating mass adoption use cases. Farcaster, for instance, is a decentralized social media protocol built on the Optimism roll-up, which gained attention for its significant increase in daily active users over the past month. Unlike competitors like Solana and Polygon, Ethereum’s scaling solutions offer a “best of both worlds” scenario, providing developers with scalable infrastructure while offering users a more efficient experience, thereby accruing value and usage to Ethereum. Once again, Ethereum’s market proposition hinges on technological innovation.

ETH & AI

The crypto industry’s multi-year slog towards mass adoption and “billions” of users is well documented, but what if those billions of users come in the forms of bots, and not people? AI and crypto have emerged as the two breakthrough technologies of our era – and much attention has been paid to the interface and overlay, and how the convergence of these technologies drive wholly new companies, economies, business models, and understanding of usage. Of course, AI agents operating on ETH is nothing new – automated on-chain arbitrage bots are fundamental building blocks of the DeFi ecosystem, supporting important market-making functions to support the price stability, while also seeking alpha for their operators. And crypto’s leaders are leaning into this potential (with healthy skepticism), with Ethereum’s founder Vitalik Buterin writing recently on the convergence of AI and Ethereum.

As Buterin suggests, as AI agents become more advanced, AI agents may become the primary users of many dApps, games, and other applications that require engagement. For example, they could be trained for play-to-earn mobile apps. Recently, Buterin praised AI advances for their ability to accelerate and refine the software development process and identify code risks. This tooling could propel the Ethereum roadmap itself as well as development across the Ethereum ecosystem – speeding and improving the development of infrastructure solutions, protocols, and dApps. At multiple levels of the technology stack, the combination of AI and Web3 is an innovation-first growth driver to watch closely.

ETH & TradFi

But…what about the ETH ETF? 😉 Despite the focus on technological advancements, the buzz surrounding an ETH ETF set to debut in May 2024 is hard to ignore. Following the approval of the BTC ETF in January 2024, ETH is poised to follow suit. The introduction of an ETH ETF promises regulatory legitimacy and provides a straightforward avenue for both retail and institutional investors to gain exposure to ETH assets, potentially unlocking significant capital inflows. Crypto-native ETFs not only broaden market interest and legitimacy but also expand the investor base without requiring crypto investors to be crypto users.

However, for many, this is beside the point. The allure of crypto lies in its ownership structure, which allows individuals to hold actual assets rather than mere representations. No culture has embraced the “ownership” aspect of crypto more than Ethereum ecosystem participants – and Ethereum’s future roadmap continues to be focused on supporting developers’ ease of use while remaining true to Ethereum’s core tenants of decentralization and security. The ecosystem remains committed to respecting the tenants of Web3 ownership while creating conditions that support a more seamless user experience (low transaction costs, speed, etc.). What has always differentiated ETH has been the culture of its ecosystem anchored by developers, and 2024 promises to be another landmark year.

BIO

Anna Stone is a pioneering Web3 leader, educator and advocate on a mission to use emergent technologies such as blockchain and artificial intelligence to build a more open, free and just world. Stone is the Executive Director and one of the founding team members behind GoodDollar, the world’s largest crypto universal basic income project that is used by over 700,000 people around the globe, and one of the industry’s strongest examples of blockchain making a positive impact. Stone is also a Web3 specialist at eToro, where she contributes to business and product strategy. She has over 13 years of experience in bringing to market complex pioneer products across the fields of Web3, blockchain, big data, machine learning and analytics.