American writer Mark Twain is thought to have said: “History doesn’t repeat itself, but it often rhymes.”

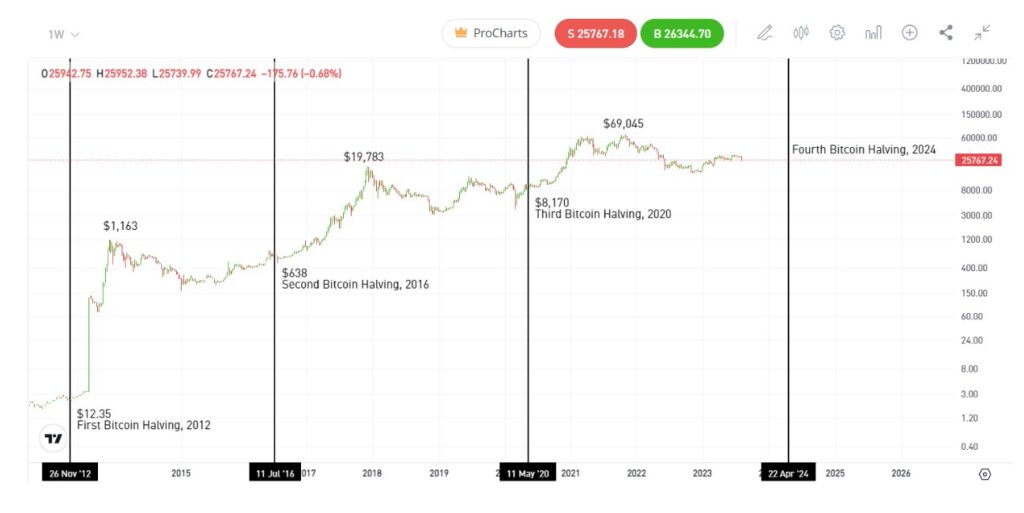

Each of Bitcoin’s biggest bull markets has kicked off within a year of one event: the halving.

These technical network events happen roughly every four years and halve the block reward given to Bitcoin miners, effectively reducing bitcoin’s inflation rate by 50%. Moreover, they are thought to be the critical catalyst behind the four-year cycle, which has played out repeatedly over bitcoin’s lifetime.

Is the four-year cycle a self-fulfilling prophecy?

Aside from historical similarities with previous cycles, there is another important market dynamic at play which suggests a recovery could be on the way.

As the halving approaches, analysts are now generally expecting that prices will rise as they have in previous cycles. According to market psychology, this can become a self-fulfilling prophecy as investors buy in anticipation of rising prices, thus causing prices to actually rise.

This psychology, along with the fundamental supply reduction of the halving and the unique dynamics of an ever-changing economic environment, means that although each of Bitcoin’s four-year cycles has been different, they have all followed roughly the same trajectory.

The patterns of the halving

As we now approach Bitcoin’s fourth halving, here are three familiar patterns that reveal exactly which phase of the four-year cycle we are in, and, most significantly, what we could expect to happen in the next few months.

1. Price action reflects previous four-year cycles

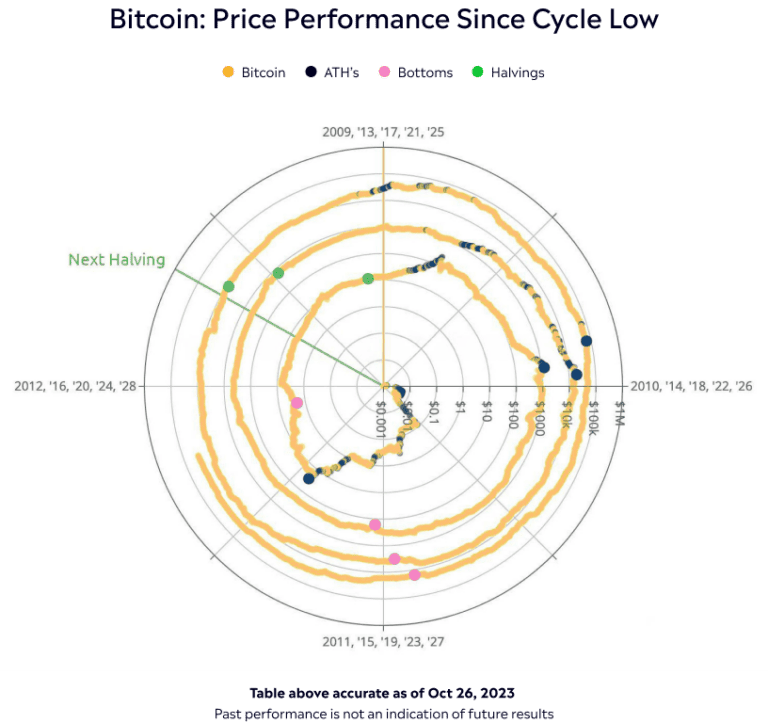

Historically, each year of Bitcoin’s four-year price cycle has been characterized by its own distinctive sentiment and price action:

- Bull market: Following the halving event, Bitcoin rallies on growing excitement and eventually sets a new all-time high.

- Capitulation by price: Bitcoin falls for a year, and many investors panic sell as prices move lower than their entry point.

- Capitulation by time: Bitcoin drifts sideways and creates a sense of boredom in the market, before eventually forming a new bottom.

- Recovery: Prices once again start to rise as Bitcoin embarks on a recovery.

As analysts including Rekt Capital have highlighted, variations of this four-year cycle have repeated since the first Bitcoin halving in 2013.

2. We are in the “boring phase”

Bitcoin is now trading in a similar way to previous four-year market cycles, as shown in the chart below.

This is shown by the black line on the chart, which indicates that we are now in the third year of the four-year cycle. During this period, prices drift sideways as short-term investors get bored and eventually leave the market.

However, if this cycle proceeds like others before it, then this period of boredom will eventually be followed by a recovery around the time of the Bitcoin halving.

3. Long-term holders are accumulating

In addition to patterns of price and time, holder metrics also suggest that we are in a period of the cycle that has historically preceded a recovery.

As Bitcoin rises during the heady thrill of a bull market, short-term investors buy and chase the price higher. Then, as prices drop in the following bear market (or during another major event, such as the collapse of the Mt. Gox exchange, the cold crypto winter of 2018, or the Covid crash of March 2020), they grow frustrated and sell their bitcoin.

Meanwhile, long-term holders tend to do the opposite: accumulate crypto when prices are lower in the bear market, and then carefully peel off profits as prices rise in the bull market. For example, those investors who held on through the Covid crash were rewarded with staggering 1,000% gains just over a year later.

Combined, these behavioral tendencies change the distribution of Bitcoin across wallets in each phase of the market cycle: During the bear market, long-term holders end up holding a greater proportion of the total supply while short-term “tourists” end up with less — and vice versa in the bull market.

As data from Glassnode shows, this is exactly what has happened in recent months, with the amount of Bitcoin held by long-term holders surging to hit all-time highs at 14.6 million, while the amount of bitcoin held by short-term “tourists” sinks to a low of only 2.56 million.

In the context of historical patterns, this distribution suggests that we are now at the point of the cycle when the pendulum will begin to swing the other way, as prices rise and short-term investors start buying again.

Looking forward

This pattern is being cited in thought leadership circles, as well. Many of the most seasoned and accurate analysts credit Bitcoin’s halving events with triggering enormous rallies, and are now setting sights on price targets above $100K.

Crypto at $100K in 2024?

One of the most renowned price forecasters is crypto analyst Michael Van de Poppe. He predicted with almost laser-like accuracy that bitcoin would hit between $65 to $85K at the end of 2021, and has since said that he expects highs of around $40 – $50K at the 2024 halving, before the price eventually pushes beyond $100K.

Early crypto pioneer Adam Back puts Bitcoin at $100K even earlier. He thinks the crypto asset will hit six figures around the date of the halving itself. Known for his foresight, Back said in 2019 that Bitcoin would hit $50K — a prediction that came true in early 2021.

Kevin Kelly, the founder of crypto research firm Delphi Digital, has drawn similar conclusions. His analysis concludes that the halving event will put Bitcoin en route to fresh all-time highs above $69K in late 2024. Kelly also has a solid track record, noting at the beginning of 2022 “that a sustained downtrend in global liquidity” was set to disrupt crypto prices.

Calls for $100K Bitcoin around the time of the halving have also been echoed by a chorus of voices from the traditional financial world. These include big names like Geoff Kendrick, the head of crypto research at Standard Chartered Bank, 25-year macro analyst Dan Tapiero, and Fundstrat’s prolific predictor Thomas Lee.

Cathie Wood: Bitcoin will hit $1M

Famed investor Cathie Wood maintains her view that Bitcoin will hit $1M by 2030. Her firm, ARK Invest, is known for making big bold predictions that are rooted in solid mathematical models. The Bitcoin halving is fundamental to her vision, creating steadily increasing scarcity that supports higher prices. As she said earlier this year: “Bitcoin is a store of value and an investment. Limited to 21 million units, so right now the inflation rate is 1.8% per year, that’s what is being mined. In a couple of years that will halve to less than 1% and keep halving until you get to that 21 million…”

Wood’s $1 million dollar Bitcoin vision is matched by countless other analysts, including mega bull Michael Saylor and ex-chief manager at Goldman Sachs Raoul Pal. Time frames vary, but all are expecting bitcoin to move in this direction over the next five to ten years.

| Expert | Prediction |

| Michael Van de Poppe, renowned crypto analyst | Expects BTC highs of $40-$50K at the 2024 Halving, will eventually hit $100K and beyond |

| Adam Beck, early crypto pioneer, known for his foresight | BTC likely to hit $100K by the 2024 halving |

| Cathie Wood, CEO ARK Invest | Bitcoin will hit $1M by 2030 |

| Kevin Kelly, founder of crypto research firm Delphi Digital | Halving will send BTC to fresh ATH of $69K in late 2024 |

| Geoff Kendrick, head of crypto research at Standard Chartered Bank | Bitcoin will hit $100K around the time of the halving |

| Dan Tapiero, macro analyst | Bitcoin will hit $100K around the time of the halving |

| Thomas Lee, Fundstrat, prolific predictor | Bitcoin will hit $100K around the time of the halving |

| George Tung, analyst, TheStreetCrypto | “Once we break $69,000, that’s when all bets are off” |

| CoinCodex | BTC price will peak above $170,000 in August 2025 before a retracement to levels near $95,000 – $100,000. |

| CoinTelegraph (BitQuant) | There will be a new all-time high sometime during the pre-halving rally, with the post-halving peak seeing prices over $250,000. |

| CryptoCon | There will be a new high of around $130,000 about 4 years after the previous high, or sometime around November 2025. |

| Marshall Beard, Gemini | If BTC reaches its previous high of $69,000, it will get to the “$100,000 price figure” |

Be smart when investing in Bitcoin

It should be acknowledged that while many enthusiasts and analysts paint an optimistic picture of Bitcoin’s future, it is essential to acknowledge potential drawbacks. Bitcoin’s meteoric rise in price has been characterized by extreme volatility and speculation, which has left some investors wary. The cryptocurrency market is known to be volatile, is constantly subject to regulatory scrutiny, and its price can be influenced by a variety of factors. It is crucial for investors to conduct thorough research and consider the risks involved before making investment decisions in the cryptocurrency space.

However, for investors, the halving means another chance to climb aboard an asset class that has repeatedly outperformed every other financial market on earth.