In collaboration with

iShares by BlackRock, a global leader in ETFs

Thematic investing has emerged as a strategy that may allow you to invest in emerging trends and industries. ETFs offer a low-cost, diversified way to get exposure to specific themes such as disruptive technologies, renewable energy, healthcare innovation, and more.

Looking to get in on the latest trends? Learn how to invest in thematic areas like AI or renewable energy with ETFs.

Investing is all about finding the right opportunities that can help you. And with the rapid changes happening in the world today, investors may be looking for ways to capitalize on emerging themes and trends.

Thematic ETFs, or exchange-traded funds, can help you do just that.

These funds offer investors a way to tap into specific themes and industries, allowing you to capture

In this guide, we will discuss the potential benefits of thematic ETFs and the different themes you can invest in.

What is thematic investing?

Thematic investing is a strategy that focuses on investing in companies that are part of a specific theme or trend. It’s a way to align your investment portfolio with your personal values, beliefs, and interests.

This type of investing allows investors to align their portfolio with their values and beliefs, while potentially benefiting from the growth of the trend.

Common themes include renewable energy, healthcare innovation, or disruptive technologies like artificial intelligence. Thematic investing may also involve looking at macroeconomic trends, global events, and demographics to identify themes that may shape the future.

Thematic investing can also help investors diversify their portfolios and reduce risk by investing in different industries and sectors.

Thematic investing is sometimes confused with sector investing, which focuses on investing in companies in a specific industry, like healthcare or finance. Thematic investing focuses on broader, cross-industry themes, like sustainability or innovation.

Why invest thematically?

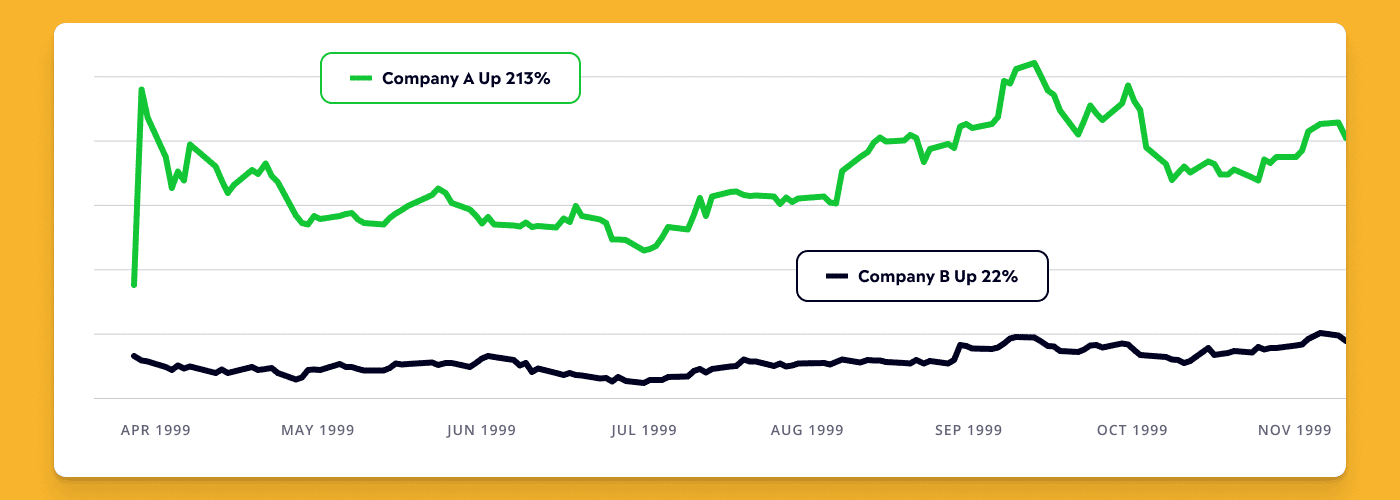

Let’s use the example of company A and company B (see the charts below)1, both e-commerce companies.

During an approximate six month period in the late 1990s, A, an online seller of toys, was up 213% while B, an online seller of books, was up only 22%.

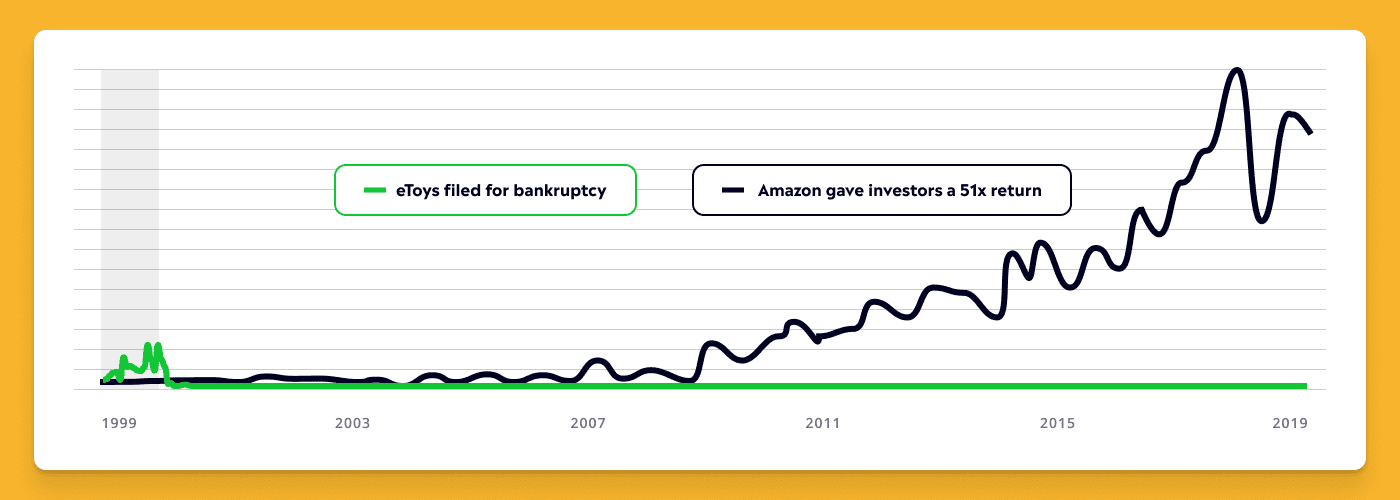

But, in the 20 years that followed, one company delivered a 51x return to its investors, while the other filed for bankruptcy. As you may have guessed, Company B was Amazon, and Company A was eToys, a company you probably have never heard of.

Case study part 1: Picking the theme can be easier than picking the company1

Case study part 2: Picking the theme can be easier than picking the company1

As the example shows, picking the right theme can be easier than picking the right companies.

1Past performance does not guarantee future results. Bloomberg, December 2021. Amazon’s total return gross dividends was 4,678% between 5/19/99 and 12/31/21. eToys filed for bankruptcy in February 2021. This is not meant as a guarantee of any future result or experience. This information should not be relied upon as research, investment advice or a recommendation regarding any security in particular. Specific companies or issuers are mentioned for educational purposes only and should not be deemed as a recommendation to buy or sell any securities. Any companies mentioned do not necessarily represent current or future holdings of any investor.

Thematic investing: individual stocks vs. ETFs

When it comes to thematic investing, there are a few different approaches to consider.

One option is to buy individual stocks that fit the theme you’re interested in. Another option is to invest in thematic ETFs, which offer exposure to a basket of stocks that align with your chosen theme.

A challenge of thematic investing via individual stocks is that it sometimes requires a deep understanding of the theme or trend you’re investing in. This means conducting research on the companies operating in that space, and the economic, social, and technological factors driving the trend.

Thematic ETFs, on the other hand, offer the potential for more

“A thematic ETF seeks to offer convenient, low-cost exposure to a particular theme,” explains Jay Jacobs, US Head of Thematics and Active Equity ETFs at iShares.

“A thematic ETF seeks to offer convenient, low-cost exposure to a particular theme.”

Jay Jacobs, US Head of Thematics and Active Equity ETFs, iShares

| Thematic investing with individual stocks |

- Greater flexibility: You have the ability to pick and choose exactly which companies to invest in based on your interest, and have greater control over how your money is invested.

- Riskier: It’s harder to achieve diversification when investing in individual stocks. If one of your chosen companies performs poorly, it could have a significant impact on your portfolio.

- Time consuming: Building a portfolio of individual stocks takes time and effort. You have to research companies, monitor their performance, and make decisions about when to buy and sell.

- More expensive: Buying and selling individual stocks may cost you more over time

| Thematic investing with thematic ETFs |

- Instant diversification: When you invest in an ETF, you’re buying a basket of stocks that all align with your chosen theme. This means you’re less exposed to the risks of any one company.

- Less control: Because you’re investing in a basket of stocks, you have less control over which individual companies you’re investing in.

How to get started investing with thematic ETFs

As we explained above, thematic ETFs can be a useful tool for investors looking to increase their exposure to particular industries or themes while possibly minimizing risk and investment costs.

To get started, it’s important to do some research and find the right ETFs that align with your investment goals and

With thousands of ETFs out there, there’s typically an ETF option for any type of theme.

For example, if you’re interested in electric vehicles (EV), you could consider an EV ETF that seeks to replicate the performance of a group of companies involved in the production and sales of electric vehicles.

Let’s take a deeper dive into other themes and their associated ETFs.

Technological innovation

With the rapid pace of technology, there may be opportunities for investors to benefit from companies at the forefront of innovation.

This might mean identifying trends like the increasing importance of cybersecurity or the growth of e-commerce, and then investing in companies that are well-positioned to benefit from these trends.

Take the smartphone, which has become an incredibly important part of our lives, thanks to our desire for connectivity. At the start of 2021, there were about 35 billion internet-connected devices in the world. By 2025, that number is expected to more than double, to 75 billion.2

This rapid acceleration in connectivity is leading to opportunities in areas like artificial intelligence (AI). An AI ETF can offer investors exposure to companies in robotics and artificial intelligence innovation.

2Statista, Internet of Things (IoT) Connected Devices Installed Base Worldwide from 2015 to 2025. Data beyond 2021 are projections. Forward looking estimates may not come to pass.

Changing demographics

Demographic shifts in the global population can also create opportunities for investing.

One of the most significant changes that’s currently happening is the aging population. According to the United Nations, the number of people over 65 years old is expected to double to 1.5 billion by 2050. 3

The elderly population has specific needs and preferences, such as healthcare and retirement living. Companies that cater to these needs may perform well in the long run.

Another way to invest in changing demographics is in the healthcare sector. As the population ages, the demand for health services is increasing. Biotech companies that focus on developing drugs and therapies for diseases, such as Alzheimer’s and cancer, may have growth potential.

3United Nations, World Population Ageing. 2019.

Infrastructure

There is a growing need for infrastructure investment in many countries, particularly in developing economies. This includes investments in areas such as transportation, energy, and water.

The World Bank estimates there will be $100 trillion of infrastructure spending over the next 15 years.4

Investors can access exposure to domestic and international infrastructure companies involved in these developments with an infrastructure ETF.

4United Nations Department of Economic and Social Affairs, The World’s Cities in 2018.

Climate change

With climate change becoming an increasingly pressing concern, investment opportunities are emerging in areas such as clean energy, which refers to forms of energy that are derived from sources with little to no carbon emissions.

This includes companies involved in solar and wind energy, as well as battery storage and electric vehicle companies.

With advances in technology, costs associated with renewable energy production have decreased significantly, leading to increased competitiveness in the market.

For example, between 2010 and 2020, renewable energy’s share of US electricity generation doubled from 10% to 20%.5

Investors interested in capturing these opportunities could consider a clean energy ETF that offers exposure to global companies involved in the clean energy sector.

5Source: Deloitte Insights. “Renewable transition separating perception from reality”. September 21, 2021. See Investing in the next generation of environmental tech breakthroughs for more information. https://www.ishares.com/us/insights/environmental-technologies-investing-etf.

Conclusion

The world is constantly changing — thematic ETFs can be a smart move for those who want to diversify their portfolio and capitalize on long-term trends.

From ESG investing to the rise of innovative industries like robotics and AI, there are plenty of options to choose from.

Plus, with lower fees and the ability to buy and sell like a stock, ETFs offer flexibility and accessibility that individual stocks may lack.

Want to give thematic ETFs a test drive? Get started with eToro’s virtual portfolio.

About iShares by BlackRock

iShares unlocks opportunity across markets to meet the evolving needs of investors. With more than twenty years of experience, a global line-up of 1300+ exchange traded funds (ETFs) and $3.12 trillion in assets under management as of September 30, 2023, iShares continues to drive progress for the financial industry. iShares funds are powered by the expert portfolio and risk management of BlackRock.

This communication is in collaboration with iShares by BlackRock. BlackRock and iShares are trademarks of BlackRock, Inc. or its affiliates (together “BlackRock”). BlackRock does not sponsor or endorse any content outside the ETF Academy and is not affiliated with eToro or any of its affiliates.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation. Any references to past or future performance of a financial instrument, index or packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro encourages its customers to carefully consider the funds’ investment objectives, risks, and charges and expenses carefully before investing. This and other information can be found in the funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting each fund company’s website or www.sec.gov/edgar/search. For iShares Funds, please visit www.iShares.com/prospectus. Read the prospectuses carefully before investing.

Investing involves risk, including possible loss of principal. Diversification and asset allocation may not protect against market risk or loss of principal. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained. Transactions in shares of ETFs may result in brokerage commissions and may generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders.

Securities trading is offered by eToro USA Securities Inc., member of FINRA and SIPC, a self-directed broker-dealer that does not provide recommendations or investment advice. Visit our Disclosure Library for additional important disclosures including our Customer Relationship Summary and order routing information and statistics. FINRA Brokercheck © 2023.