Economies and financial markets undergo natural cycles that involve periods of expansion and contraction. Learn what economic and market cycles are, how they work and the different stages of each.

Regardless of the asset class you are investing in, understanding how underlying economic cycles can influence market prices is critical when trying to achieve your long-term financial objectives.

Fortunately, there are indicators that provide hints when change is about to occur, and guidelines on which stocks and other assets could be good acquisitions during different stages of the market cycle.

What are economic cycles and how do they work?

“Economic cycles” refers to the fluctuations in an economy, usually between positive and negative periods of growth. Gross domestic product (GDP) is the main tool used to measure economic growth. It is regularly updated by most major economies at the end of every financial quarter, and GDP statistics calculate the total amount of goods and services produced within an economy.

Analysts therefore have a useful tool with which to compare current GDP growth with that of the previous quarter, or growth rates from prior years.

Tip: The conditions typically associated with different GDP growth rates favor distinct types of asset groups.

What are the stages of the economic cycle?

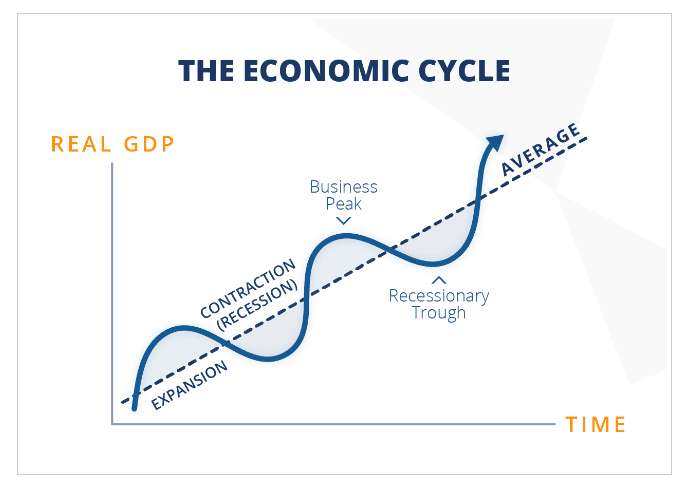

Historical data suggests that economies tend to adhere to a predictable pattern, characterized by fluctuating growth rates and occasional contractions. This economic cycle encompasses four distinct stages – expansion, peak, recession and trough.

Expansion

The expansion stage is marked by increased output by most sectors of the economy. This includes increased employment, consumer spending and business investment. These factors contribute to an uptick in the rate of inflation, and GDP tends to experience growth with each passing quarter.

Peak

During the peak stage, spending, investment and employment rates start to decelerate but remain in positive territory. Inflation may accelerate, while GDP remains positive but decreases every quarter.

Recession

During this stage, GDP experiences a decline each quarter as spending, investment, inflation and employment levels fall.

Trough

The trough stage is the moment when GDP finally stops decreasing and starts increasing. This leads to the restoration of consumer and business confidence, which causes an increase in aggregate spending, helping to avoid a substantial rise in inflation.

Source: Financial Edge

It is a widely held belief that two consecutive quarters of GDP growth tend to signal the onset of the expansion phase, while two successive quarters of declining GDP indicate the start of a recession.

What are market cycles and how do they work?

Market cycles are similar to economic cycles in that they involve recurring periods of growth and decline. However, these cycles differ in two main ways.

Firstly, peaks and troughs in market cycles are measured in terms of asset prices, rather than overall economic activity or GDP, as is the case with economic cycles. Secondly, the expansion and contraction periods of each of these cycles do not necessarily occur at the same time.

Tip: Stock markets tend to recover before the underlying economy because investors try to buy assets early.

What are the stages of market cycles?

Market cycles are subject to careful examination by investors and analysts due to their adherence to predictable patterns. Investors can identify when one trend is ending and another is starting, which allows them to open positions that are designed to capitalize on the transition.

Accumulation

The accumulation stage is characterized by big institutional investors acquiring riskier assets, such as stocks. These firms have considerable cash to invest, which means they need to carefully establish a balance between buying into positions before the price rises, and avoiding excessive buying that could unintentionally drive up prices.

Mark-up

As substantial cash flows into the markets, asset prices break out of their existing price ranges and initiate an upward trend. This often attracts additional cash into the market, including investments from retail investors seeking to capitalize on the upward movement.

Distribution

During the distribution phase, certain investors will sell their positions to lock in some, or all, of their profits. Similar to the accumulation phase, institutional investors may exercise caution by selling gradually, to avoid potentially causing a price crash. On price charts, this would be reflected by the formation of a new sideways price range.

Decline

The decline, also known as the “mark-down” phase, is the last of the four market cycles. During this phase, selling pressure results in the price of assets breaking out of the sideways trading pattern and forming a new downward trend.

Tip: It is almost impossible to identify the exact top and bottom of a market.

Final thoughts

Short-term price fluctuations in asset prices may appear to be random, but they are influenced by long-term trends based on the underlying conditions of an economy. Economic and market cycles follow somewhat predictable patterns, and determining the current stage is a crucial step in building a portfolio tailored to prevailing market conditions.

Visit the eToro Academy to learn more about stocks and market cycles.

Quiz

FAQs

- Why is there sometimes a time-lag between economic and market cycles?

-

The stock market tends to recover before the broader economy does, as investors base their decisions on what they expect to happen, rather than what is actually happening. Many investors aim to buy at the bottom of the market, before the price of stocks and other assets rise.

- What is the definition of a bull market and a bear market?

-

Generally speaking, a bull market occurs when the price of assets increase in value, while the opposite is true of bear markets. More specifically, a market is truly considered a bull or bear market if it rises or falls by more than 20% respectively. Some investors will label a market as “bullish” or “bearish” if the price moves in a particular direction, even if it does not reach the 20% threshold.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments.

This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.