In collaboration with

iShares by BlackRock, a global leader in ETFs

Investing in ETFs can be a smart way to generate income, as they can offer diversification, low costs, and high liquidity compared to other traditional investments.

Want to generate income by investing in ETFs? This video explains different types of ETFs you can explore.

Investing in ETFs can be a great way to generate passive income, with features such as diversification, low expenses, and easy trading. ETFs may give investors exposure to broad market trends, industry sectors, and asset classes.

Not only do they offer a wide range of investment options, but ETFs can be tax-efficient and can offer greater trading flexibility compared to actively managed funds.

By investing in ETFs, investors can earn both dividends and capital gains, which can compound over time and provide a steady stream of income.

In this guide, we’ll cover how you can pursue consistent income through ETFs.

Investing in bond ETFs

Bond ETFs are one type of ETF that can offer consistent income, offering investors a diversified portfolio of bonds — including government bonds, corporate bonds, and more — all bundled together in a single fund.

As a quick refresher: When you buy a bond, you are essentially lending money to the bond issuer, such as a business or government. The issuer promises to pay back the money you invested, plus interest, on a specific date.

Generally, investing in bonds can generate income in two ways: through regular interest payments and through the potential for capital appreciation if the bond’s market value increases over time.

The amount of interest payments on bonds can vary, depending on a number of factors:

- Issuer creditworthiness: This is the bond issuer’s likelihood of paying you back. The lower the creditworthiness of the issuer, typically the higher the interest rate of its bonds, which means more potential risk for you as the bondholder, but more potential income.

- Bond’s maturity: The date when the bond issuer promises to pay you back. Typically, the longer a bond’s maturity, the higher its interest rate. That means higher potential income for you, but also higher risk.

Bonds issued by less creditworthy issuers are called high-yield bonds and have typically higher interest rates than bonds issued by lenders of higher creditworthiness. Bonds with a longer-term maturity date typically carry higher interest rates.

This means high-yield bonds and bonds with longer maturities may offer relatively higher potential income than bonds issued by relatively creditworthy entities and bonds with shorter maturities. In short, higher risk equals higher potential reward.

You could go out and buy individual bonds that match your income goals, but this takes a lot of research and can be costly. Additionally, bonds are not as easily accessible as other asset classes such as stocks and may require a relatively higher initial investment.

Bond ETFs though can simplify the investing process of capturing the income potential of individual bonds.

| Pursuing income through bond ETFs |

- Accessibility: Bonds are traditionally difficult and expensive for most investors to access on their own. Bond ETFs can offer lower costs than actively managed funds and can be traded like stocks, giving investors the option to buy and sellwhen it is most convenient for them. .

- Consistent income: Bonds ETFs offer the potential for investors to earn monthly income.

- Diversification: Because bond ETFs may contain hundreds, sometimes thousands of bonds, they allow investors to spread their risk across a broad range of bonds.

- Liquidity risk: When an individual invests in an individual bond, they typically receive back the amount they invested once the bond matures. When an individual invests in a bond ETF, they are not guaranteed to receive their initial investment back.

As Karen Veraa, Head of iShares US Fixed Income Strategy, explains, “Bond ETFs may offer convenient exposure to the bonds that may meet your income needs.”

“Bond ETFs may offer convenient exposure to the bonds that may meet your income needs.”

Karen Veraa — Head of iShares US Fixed Income Strategy

Income earned from bonds in a bond ETF is distributed to you proportionate to your investment in the ETF.

For instance, if you want to pursue the potential enhanced levels of income offered by high-yield bonds, you can purchase a high-yield bond ETF. These ETFs offer targeted exposure to high-yield bonds.

On the other hand, if you are more risk-averse and want consistent income in the short term, you can invest in a Short Treasury ETF, which includes bonds issued by the US government that mature in a relatively short time.

If you want to pursue consistent income from all kinds of bonds, you could purchase a broad-based bond ETF, which offers exposure to various kinds of bonds, including high-yield, longer-dated bonds, shorter-dated bonds, and international bonds.

Tip: You can search for all these kinds of different ETFs on eToro.

Investing in dividend ETFs

Dividend ETFs are another option for investors to seek consistent income.

A dividend stock aims to pay a portion of the company’s earnings to its shareholders on a regular basis, typically quarterly. Dividends are usually distributed as cash or additional shares of stock.

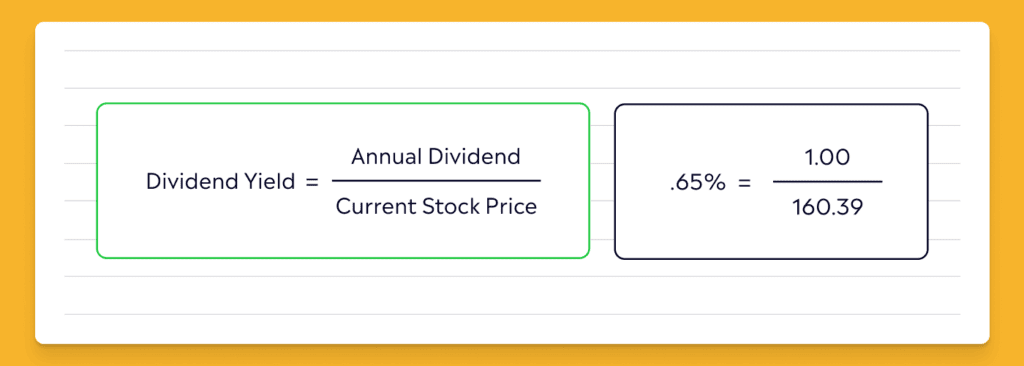

A stock’s dividend yield can provide an estimation of a stock’s dividend potential. The dividend yield is calculated by dividing the annual dividend per share by the current share price (don’t worry, this is typically calculated and made available for you as an investor).

Graphic is for illustrative purposes only.

But overreliance on this metric alone can be risky. For instance, a company whose share price is falling and pays a dividend could have a higher dividend yield than one whose stock is rising and also pays a dividend.

Dividend ETFs are composed of a basket of stocks that have historically paid regular dividends.

Dividend ETFs offer the benefit of diversification, which can help to reduce risk and increase stability in your portfolio.

An additional benefit of dividend stocks beyond their potential of offering consistent income is that they have outperformed non-dividend-paying stocks over the long-term.1

Many dividend-stock ETFs include filters that ensure only financially-healthy companies, that is companies that have some characteristics that may help them fend off their competition, so the company may continue generating strong earnings and paying dividends, are included.

With dividend stock ETFs, you may be able to earn consistent dividend income from financially healthy companies.

1Source: BlackRock. Past performance does not guarantee future results. Data from 12/31/1978 through 12/31/2021. Yardeni, Refinitiv, with data from Compustat and IDC. The investment universe is the 500 largest U.S. stocks by market cap. Dividend policy constituents are calculated on a rolling 12-month basis and are rebalanced monthly. Category returns are calculated on a monthly basis. Provided for illustrative purposes only.

| Pursuing income through dividend-stock ETFs |

- Low barrier to entry: You typically only need the price of one share to invest in a dividend ETF. In some cases, you may be able to purchase a fraction of one share.

- Diversification: Dividend ETFs may offer exposure to hundreds of dividend stocks in a single purchase.

- Consistent income: Dividend ETFs offer the potential for investors to earn stable and predictable returns compared to other investments.

- Income is typically distributed quarterly: Dividend ETFs typically distribute income on a quarterly basis, which may not be ideal for investors who need monthly income.

- Lack of control: A dividend ETF may include stocks of a company that does not align with your values.

International stock ETFs: A primer

International stock ETFs may also offer investors the opportunity to pursue consistent income.

These funds hold a basket of stocks from various countries, allowing you to spread your investment across multiple regions and sectors.

International ETFs may offer the potential for attractive returns due to growth opportunities available abroad and especially those within emerging markets.

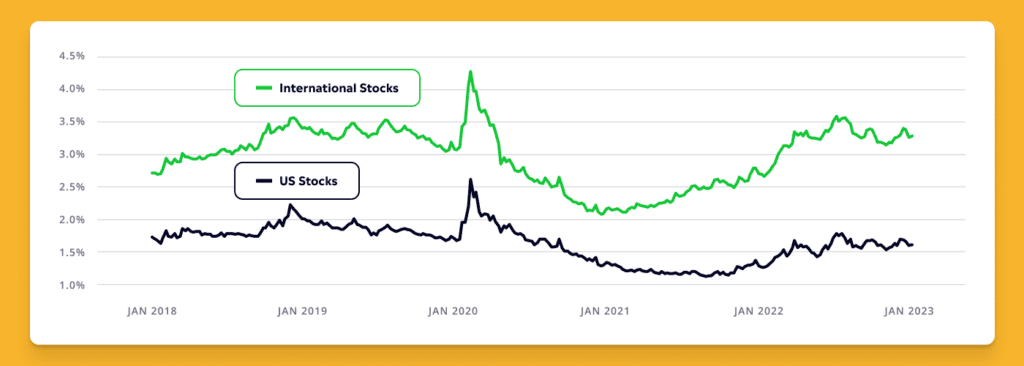

Additionally, they provide exposure to currencies other than the US dollar, which can hedge against domestic volatility. Historically, international stocks have provided higher dividend yields than their US counterparts (see the chart below). 2

However, it’s worth noting that international ETFs can also carry higher risks than domestic funds, given regulatory and political risks in certain markets, so it’s important to do your research and invest wisely.

2 For illustrative purposes only. Source: BlackRock as of 04/11/2023. US Stocks are represented by the S&P Total Market Index and International Stocks are represented by the MSCI ACWI Excluding US Index. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Conclusion

As you can see, ETFs can simplify the process of pursuing consistent income that can fit your goals.

About iShares by BlackRock

iShares unlocks opportunity across markets to meet the evolving needs of investors. With more than twenty years of experience, a global line-up of 1300+ exchange traded funds (ETFs) and $3.12 trillion in assets under management as of September 30, 2023, iShares continues to drive progress for the financial industry. iShares funds are powered by the expert portfolio and risk management of BlackRock.

This communication is in collaboration with iShares by BlackRock. BlackRock and iShares are trademarks of BlackRock, Inc. or its affiliates (together “BlackRock”). BlackRock does not sponsor or endorse any content outside the ETF Academy and is not affiliated with eToro or any of its affiliates.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation. Any references to past or future performance of a financial instrument, index or packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro encourages its customers to carefully consider the funds’ investment objectives, risks, and charges and expenses carefully before investing. This and other information can be found in the funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting each fund company’s website or www.sec.gov/edgar/search. For iShares Funds, please visit www.iShares.com/prospectus. Read the prospectuses carefully before investing.

Investing involves risk, including possible loss of principal. Diversification and asset allocation may not protect against market risk or loss of principal. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained. Transactions in shares of ETFs may result in brokerage commissions and may generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders.

Securities trading is offered by eToro USA Securities Inc., member of FINRA and SIPC, a self-directed broker-dealer that does not provide recommendations or investment advice. Visit our Disclosure Library for additional important disclosures including our Customer Relationship Summary and order routing information and statistics. FINRA Brokercheck © 2023.