On eToro, you can search for different kinds of ETFs and invest on the platform, as well as see what others are investing in. We’ll walk you through, step by step, in this article.

You’ve done your research, learned about

Log in to your account

To get started, you’ll need to make sure your eToro account is registered and verified. If you don’t have an account yet, register for one and complete the verification process. If you do, simply log in using your credentials.

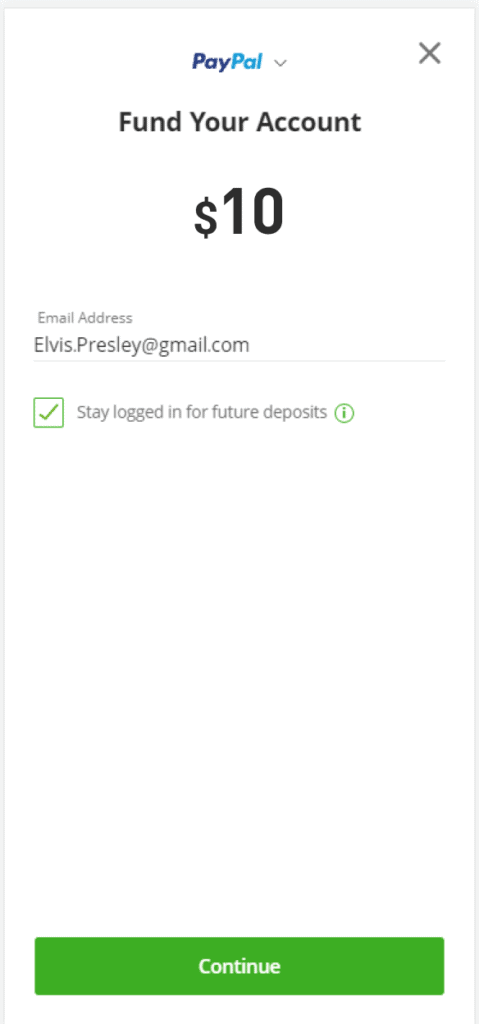

Fund your account

Once you’re registered and verified, the next step is to put funds into your account. You can do this by hitting the “Fund my account” button, then linking your bank account or PayPal and initiating a transfer. You can fund your account with as little as $10, as this is the minimum amount that you’ll need to invest in a

Search ETFs

Next, you’ll have to choose an ETF to invest in. You can do this by navigating to the Discover page and hitting the “ETF” button, or by searching a particular ETF

Once you browse your choices, you can click on an individual ETF to get more information on it, including charts that track previous performance, relevant statistics, and information on who manages it.

Tip: On eToro, you can find conversations about the ETF on its Discover page — from both news outlets and other users. This gives you additional information that may help you decide if you want to invest.

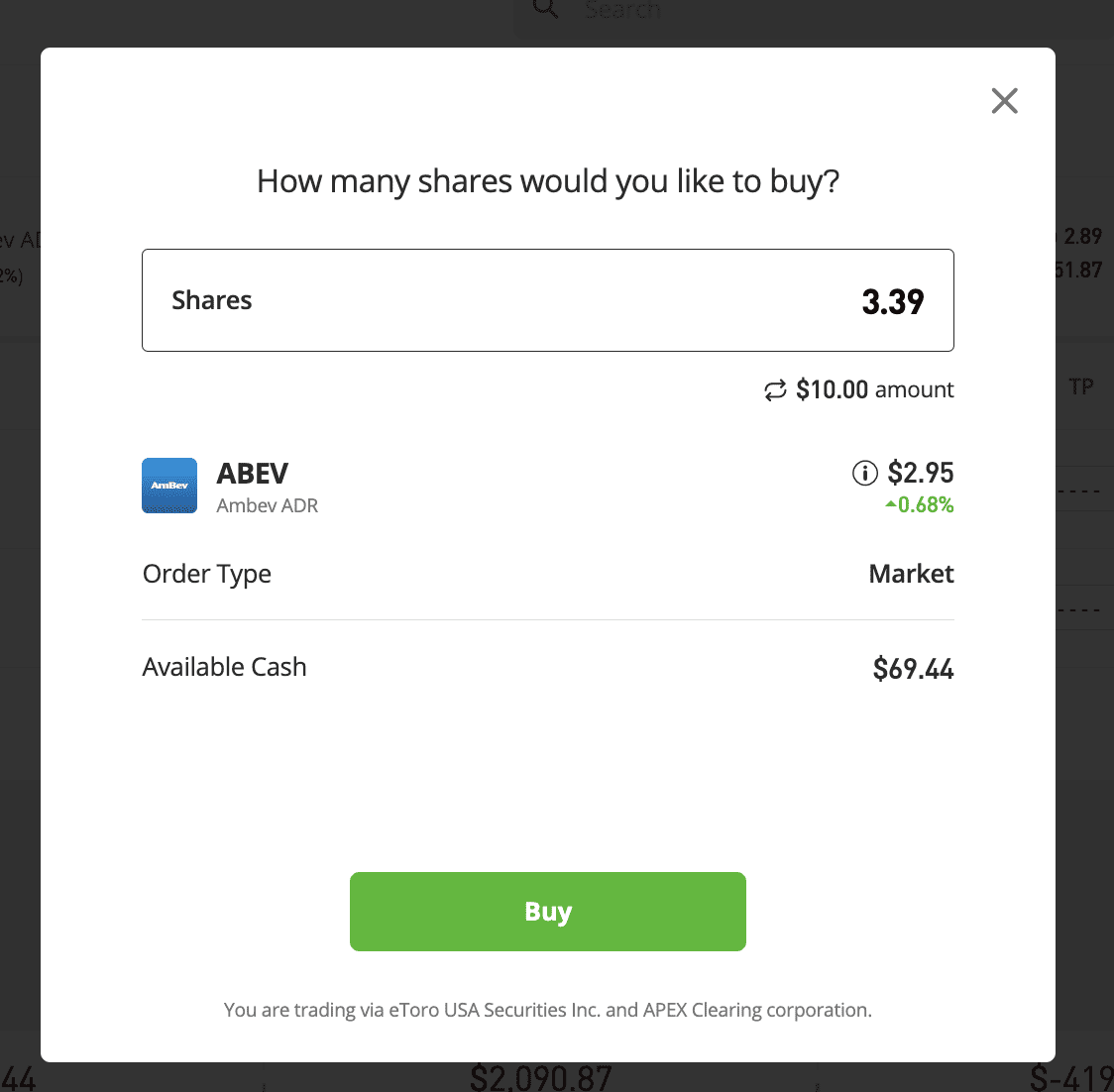

Purchase your ETF

Once you’ve found the right ETF for you, you can click the green button at the bottom of the screen (or top right, on desktop). There, you’ll be asked to enter the amount of money you’d like to invest in the ETF. Remember, you can invest in a fractional share for as little as $10 — that’s true for any ETF on eToro.

Once you’ve entered the amount, click “Buy.” It should only take a moment for your action to be completed.

Conclusion

ETFs can be a powerful tool to help diversify your portfolio. Whether you’re a beginner or a seasoned investor, you can get the investing tools you need on eToro. And if you’re still not ready to invest real money, try experimenting with the virtual portfolio, where you can practice investing in ETFs (and other assets) with $100k of fake money.

To get started investing in ETFs, head over eToro now.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation. Any references to past or future performance of a financial instrument, index or packaged investment product are not, and should not be taken as, a reliable indicator of future results.

Investing involves risk, including possible loss of principal. eToro encourages its customers to carefully consider the investment objectives, risks, charges and expenses carefully before investing in an ETF. Diversification and asset allocation may not protect against market risk or loss of principal. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained. Transactions in shares of ETFs may result in brokerage commissions and may generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders.

Securities trading is offered by eToro USA Securities Inc., member of FINRA and SIPC, a self-directed broker-dealer that does not provide recommendations or investment advice. Visit our Disclosure Library for additional important disclosures including our Customer Relationship Summary and order routing information and statistics. FINRA Brokercheck © 2023.