Fixed-income investments provide a fixed return over a period of time, like bonds or bond ETFs. These investments are generally considered less risky than stocks and can be a reliable source of income for investors seeking stability and predictable returns.

Fixed-income investing is a low-risk strategy that aims to generate regular payments from your investments.

Although fixed-income assets are generally safer than growth-oriented investments like stocks, they still carry some level of risk. Here’s what you should know about fixed-income investing.

What is fixed-income investing?

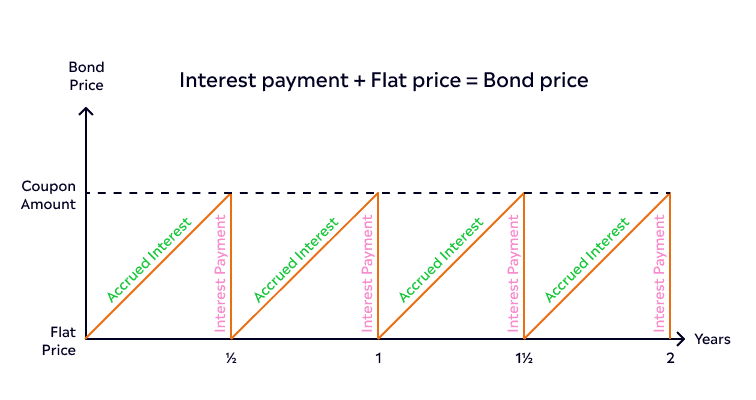

When you invest in fixed-income investments, you are essentially lending money to a corporation or government. They pay you interest, or coupons, at regular intervals, like monthly or quarterly, and return your initial investment when the bond matures.

This type of investing is called “fixed-income” because the returns on these investments are typically fixed or predictable.

Let’s say you buy a 10-year bond worth $10,000 with an annual interest rate of 5%. This means that the bond will pay you $500 in interest per year.

Typically, bonds make interest payments in fixed intervals, such as semiannually or annually. If this bond pays you interest semiannually, every six months, you would receive an interest payment of $250.

At the end of the bond’s term, you would also receive the initial investment amount of $10,000.

While bonds can be bought and sold for a profit, most investors focus on the steady payments rather than capital gains . Fixed-income investments also include preferred stocks and bank certificates of deposits. But for many, bonds are the go-to choice.

The most common types of fixed-income securities include bonds, certificates of deposit (CDs), and Treasury bills.

The main benefit of fixed-income investing is the relative stability it offers compared to other investment options. Since the income generated from these investments is predictable, it can provide a steady cash flow and can act as a cushion during uncertain economic times.

Fixed-income investing can also balance out riskier investments in your portfolio, like stocks and real estate.

Fixed-income investments are a smart addition to your investment mix, especially when paired with riskier assets like stocks. They offer stability, protect your capital, and deliver predictable returns. At eToro, you can easily tap into this asset class through ETFs, gaining all the advantages of fixed-income products in a hassle-free way.

Why include fixed-income investments in your portfolio now

For the last several years, interest rates have been very low. Bond coupons are paid to investors based on fixed interest rates, so these were also low. When combined with high inflation, this devalued bonds’ principal value, making bonds a less attractive option for investors.

But the tide is turning.

The Federal Reserve has been raising rates to combat inflation, leading to higher returns on these investments. This shift is good news for investors.

When interest rates are high, the yields on fixed-income investments tend to be more attractive. This is because bond issuers offer higher interest rates to entice investors, making these investments more appealing.

During high-interest rate periods, fixed-income investments may offer the opportunity to reinvest at higher rates. As existing bonds mature, you can reinvest your money into new bonds with higher yields, taking advantage of the improved interest rate environment.

What are some other benefits of investing in fixed-income assets? These investments can act as a cushion against market volatility. While other investments, like stocks, can experience big price fluctuations, bonds tend to be more stable.

Adding fixed-income investments can help diversify your portfolio, which can help spread risk and enhance the stability of your overall investment strategy.

The different types of fixed-income investments

We already covered how bonds work. Let’s take a closer look at the different types of bonds.

Treasury Bills (T-Bills) are short-term debt securities issued by the US government. You’ll typically buy a T-Bill at a discounted price and get the full value when they mature.

T-Bills typically have maturities of less than one year, ranging from four to 52 weeks. Shorter-term bills usually have less volatility, meaning they’re less likely to be affected by interest rate changes.

Overall, T-Bills are considered very low risk because they are backed by the full faith and credit of the government.

Tip: T-Bills can be a great addition to your portfolio alongside riskier investments like stocks. They help preserve capital and offer predictable returns. Just remember, all investments come with risks, so do your homework before investing.

Long-duration bonds, which are also backed by the US government, have a relatively long maturity period, typically over ten years. While they may experience price volatility, they can still provide a solid return on your investment over the long haul.

Tip: Keep in mind that interest rates, inflation, and currency changes can affect bond values. But if you’re willing to hold onto your investment until maturity, long-duration bonds can be a valuable, low-risk addition to your portfolio.

Corporate bonds are issued by corporations to raise capital. They’re often riskier than government bonds but will offer higher yields to make up for the added risk.

When investing in corporate bonds, keep an eye on bond ratings. These ratings assess the likelihood of repayment. Be cautious of investments like junk bonds, which have low ratings and come with a higher level of risk.

Tip: Bond ETFs offer the advantage of diversified exposure to multiple instruments. This helps minimize the impact of a single entity defaulting if that were to occur.

Bonds aren’t the only type of fixed-income investment. Here are some other popular investments that earn a steady return:

Certificates of deposit (CDs) are fixed-income deposits offered by banks and credit unions. When you buy a CD, you agree to keep your money invested for a specific period or term. In return, you receive a fixed interest rate that is typically higher than regular savings accounts.

Money market funds invest in short-term, low-risk debt securities, such as T-bills, corporate bonds, and CDs.

Preferred stock represents an ownership interest in a company. Unlike common stock, preferred stockholders have a priority on the company’s earnings. Preferred stockholders usually receive fixed dividend payments, similar to bond interest, before common stockholders. Although preferred stock carries less risk than common stock, it still involves some level of risk.

Mortgage-backed securities (MBS) are made up of a pool of mortgage loans, providing a way for investors to earn income from mortgage loans. MBS can be issued by government-sponsored enterprises like Fannie Mae, Freddie Mac or private issuers.

Fixed-income investing terms to know

Here are some key terms to know when investing in bonds and other fixed-income investments:

- Bond market: Where bonds are bought and sold, including primary and secondary markets.

- Face value: The amount the issuer repays to the investor at bond maturity.

- Coupon rate: The fixed interest rate paid by the issuer, expressed as a percentage of the face value.

- Maturity date: The bond’s expiration date and when the investor is repaid.

- Yield to maturity (YTM): Expected annual return if the bond is held until maturity.

- Duration: Measures a bond’s sensitivity to interest rate changes.

- Call option: Allows the issuer to redeem the bond before maturity if rates have fallen.

- Credit rating: Assess the issuer’s creditworthiness, reflecting repayment ability.

- Default risk: The risk of the issuer being unable to repay the bond’s face value.

What are bond ETFs

When it comes to investing in bonds, there are two main options: individual bonds and bond ETFs (exchange-traded funds).

Individual bonds involve buying a specific bond from a company or government, offering a fixed interest rate and maturity date. If held until maturity, investors receive the initial investment plus accumulated interest.

Bond ETFs, on the other hand, hold a diversified portfolio of bonds. They combine the features of bonds and ETFs, providing diversification and liquidity.

When you invest in an ETF, your money is spread across a variety of bonds from different issuers, sectors, and maturities. This diversification helps reduce the risk associated with investing in a single bond.

Because ETFs trade on stock exchanges, you can buy or sell them throughout the trading day. This flexibility allows you to invest whenever you want without worrying about finding a buyer or seller, as can be the case with individual bonds.

Bond ETFs often have lower investment minimums compared to buying individual bonds. This makes them more accessible to a wider range of investors.

Choosing between individual bonds and bond ETFs depends on investment goals and preferences. Individual bonds suit those seeking predictability, while bond ETFs offer diversification and accessibility.

Many retail investors may find investing in bond ETFs more accessible, as they require less capital.

Tip: Ultimately, investors should consult with an independent financial advisor and carefully consider their investment goals, risk tolerance, and other factors before making a decision.

Fixed-income investing risks to know

Like any investment, bonds do carry risks. Here are some key considerations:

- Interest rate risk: Bond prices can fluctuate based on changes in interest rates.

- Inflation risk: Inflation can diminish the value of fixed interest payments.

- Call risk: The issuer may redeem the bond before maturity, potentially affecting returns.

- Liquidity risk: Some bonds may be difficult to sell or may not have enough buyers in the market.

- Credit risk: There’s a chance that the issuer may not fulfill their payment obligations.

Before diving into bonds, it’s important to assess these risks and their potential impact on your investment.

| Credit rating | % of funds |

|---|---|

| U.S. Government | 67.40% |

| AAA | 3.60% |

| AA | 2.90% |

| A | 12.00% |

| BBB | 14.10% |

Investing in bond ETFs has a perk: diversification. By spreading your investment across multiple instruments, the risk of a single entity defaulting is minimized.

Diversifying your portfolio with fixed-income investments

Before you invest in any asset, determine your risk tolerance and investment goals. Fixed-income investments tend to be less volatile than stocks, making them suitable for conservative or income-focused investors.

Once you understand your risk tolerance, decide on the percentage of your portfolio that you want to allocate to fixed-income investments.

A common rule of thumb is to subtract your age from 100 to determine the percentage of your portfolio that should be allocated to stocks, with the remainder allocated to fixed-income investments.

The U.S. bond market is massive, worth over $50 trillion, offering various fixed-income investment opportunities. Bonds are a popular choice — and include government bonds, corporate bonds, municipal bonds, and international bonds. Each type has its own risk and return profile, so consider diversifying across different bond types to spread risk.

If you prefer a more diversified approach to fixed-income investing, bond ETFs can be a good option.

Once you’ve diversified your portfolio with fixed-income investments, it’s important to regularly review and rebalance your investments. Market conditions, interest rate changes, and your investment goals may require adjustments over time.

Rebalancing ensures that your portfolio remains aligned with your risk tolerance and investment objectives. Remember, diversification does not guarantee profits or protect against losses, but it can help lower overall risk.

Final thoughts

Bonds, valued at around $130 trillion globally, are the most traded asset class. While they previously lost popularity due to low interest rates and high inflation, there are new investment opportunities now that interest rates and beginning to rise.

Bond ETFs offer an appealing option for investors, combining the benefits of bonds and exchange-traded funds, including diversification and liquidity.

Visit the eToro academy to learn more about investing.

FAQs

- What is fixed-income investing?

-

The practice of investing in assets that provide a steady stream of income. These investments typically include bonds, bond ETFs, and other debt instruments that generate regular interest or coupon payments.

- Why should you include fixed-income investments in your portfolio?

-

Fixed-income investments provide a stable source of income, making them suitable for individuals seeking regular cash flow. They’re also generally considered to be lower risk compared to stocks, making them valuable for diversifying a portfolio and reducing overall investment risk.

- What are the different types of fixed-income investing?

-

Some common examples of fixed-income investments include government bonds, corporate bonds, municipal bonds, Treasury Inflation-Protected Securities (TIPS), and certificates of deposit (CDs).

- What are Bond ETFs?

-

Bond ETFs, or Exchange-Traded Funds, are investment funds that trade on stock exchanges and provide exposure to a diversified portfolio of bonds.

- Are fixed-income investments suitable for all types of investors?

-

Fixed-income investments can be suitable for a wide range of investors, including those who are seeking stable income, preserving capital, or diversifying their portfolios.

- What are the risks associated with fixed-income investments?

-

Credit risk, interest rate risk, and inflation risk are common risks associated with fixed-income investments. There’s also the risk of default by the issuer, particularly with corporate bonds.

- How do I assess the creditworthiness of a bond issuer?

-

Ratings such as AAA, AA, A, and so on signify the issuer’s ability to meet their debt obligations. Higher-rated bonds are generally considered lower risk, while lower-rated bonds carry higher risk but may offer higher yields.

- Can I lose money with fixed-income investments?

-

While fixed-income investments are generally considered less risky than stocks, there is still the potential for losses. Factors such as changes in interest rates, default risk, and inflation can impact the value of fixed-income investments.

- Are fixed-income investments affected by changes in interest rates?

-

When interest rates rise, the market value of existing fixed-income securities tends to decline as newer bonds with higher interest rates become more attractive. Conversely, when interest rates fall, the value of existing fixed-income securities may increase.

- Can I sell my fixed-income investments before maturity?

-

Yes, fixed-income investments can be sold before maturity. However the market value of the investment may be higher or lower than the initial purchase price, depending on various factors such as changes in interest rates, credit quality, and market conditions.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments.

This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.