Financial independence means being in control of your money and your financial future. Being financially independent can mean different things for different people, depending on your goals and personal situation.

- ֵWhat is financial independence?

- Is it possible to achieve financial independence?

- Five levels of financial independence

- Practical approaches to achieving financial independence

- How to retire early

- What is the FIRE method for early retirement?

- Types of FIRE investing strategies

- Invest wisely for financial independence

- Final thoughts

- Quiz

- FAQs

With some effort, planning, and financial knowledge, it is possible to start working towards financial independence.

ֵWhat is financial independence?

Financial independence is being in control of your finances, creating your own sources of money, and living off your passive income, independent of an employer, the government, or anyone else.

But, being independent can mean different things for different people, depending on what your goals are. Financial independence could be:

- Not having to depend on a job or someone else to meet your everyday needs

- Living without debt

- Being able to afford a certain lifestyle

- Being able to retire early

- Working because you want to, not because you have to

Achieving financial independence requires investors to make smart financial decisions to increase their wealth, such as investing in stocks,

Is it possible to achieve financial independence?

Becoming financially independent can be achieved with dedication, knowledge, and proper planning.

Many investors start their journey by setting achievable financial goals that help them stay on track. This includes saving a certain amount of money each month or investing in stocks or mutual funds. But before you start, it’s important to develop an understanding of basic financial concepts such as risk and return and portfolio

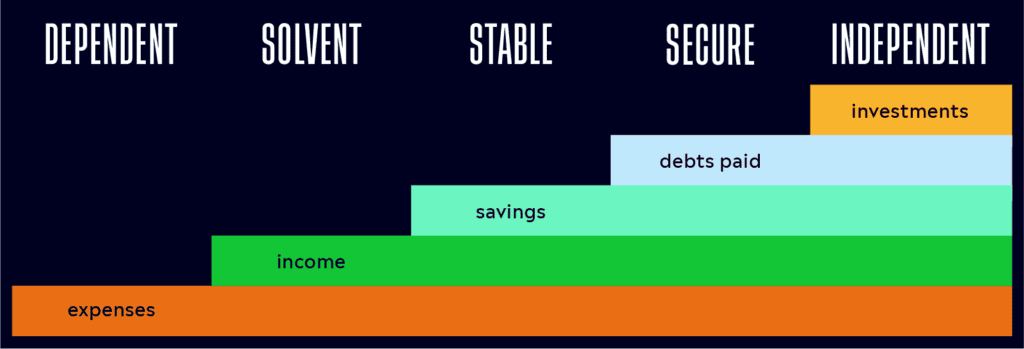

There are five levels to financial independence, ranging from financially dependent to financially independent, along which people progress towards the ultimate destination of financial freedom.

But keep in mind financial independence isn’t always the end goal. Even reaching the next level beyond where you’re at now comes with lots of financial benefits.

Five levels of financial independence

The five levels of financial independence (sometimes referred to pyramids) are a set of guidelines that categorize a person’s level of financial freedom. These levels range from dependent – a lack of savings, paycheck-to-paycheck living – to independent – owning diversified investments, no need to work.

Everyone will fit into the levels, and may even bridge different levels throughout their lifetime. Knowing which level you sit in can help you to visualize and actualize the necessary investment steps to gain more financial independence.

Let’s break down each level into distinct financial features.

| Level | What it means |

|---|---|

| Financially dependent | -Have low (or no) income and are reliant on someone or something else financially. -Usually living paycheck-to-paycheck. -Basic necessities (like food, housing, and healthcare) may be covered, but unable to think long-term due to current financial needs. –Not financially prepared for any sort of emergency. |

| Financially solvent | -Have income that’s just sufficient enough to meet financial needs without any outside help to cover regular expenses. -Typically have a steady income, but they still rely on their job to make ends meet. -May be able to pay loans or bills on time. -Able to build a small amount of savings. |

| Financially stable | –Income can easily cover all basic living expenses and provide a financial buffer against unforeseen events. –Built an emergency fund of three to six months’ worth of expenses. Have not yet begun saving for the longer term. -May be carrying some larger debt, student loans or mortgage. -Maybe have some investments, but not necessarily prepared for retirement. |

| Financially secure | -Have multiple sources of income outside of their job. –Can afford most luxuries without worrying about how they will pay for them. -Usually well-prepared for retirement. -Saved up enough money to live comfortably for a few years without relying solely on their job. |

| Financially independent | -Have made solid, long-term investments that continue building your wealth. -Investment income can cover desired lifestyle for the rest of their life. –Don’t need to work. |

Practical approaches to achieving financial independence

There are many approaches to achieving financial independence, as each person’s needs and comfort levels vary. For example, you could begin by budgeting, limiting credit card expenses, and focusing on investment strategies.

But all roads to financial independence come down to two things: decreasing expenses and increasing income. Most strategies for gaining financial independence will combine approaches from each category to maximize your progress and minimize time it takes to get there.

Examples of decreasing expenses include stricter budgeting and reducing debt.

Unfortunately, many households use credit to live beyond their means, a habit that should be addressed before any financial independence goal can realistically be set. Living a more frugal lifestyle and tracking expenses consistently is necessary in order to get basic expenses under control.

Tip: If you have high-interest debt, it may make sense to create a debt payment strategy before focusing more on long-term investing.

There are two common ways to increase your income: through investing or growing your earned income. Investing can include buying stocks, real estate, or a business, while increasing earning income includes a job promotion, increasing your professional skills in order to charge higher fees, or expanding into new niches of business.

Each of these approaches requires dedication and creativity. Financial independence is certainly something everyone would like to achieve, but only taking practical steps will actually help you progress towards your goal.

How to retire early

The term “financial independence” has often come to mean early retirement. For some, the goal is retiring in their forties, or perhaps even younger.

There are many different approaches and strategies to retiring early. The first step is figuring out how much money you need to retire early and maintain your desired lifestyle.

Although there are many factors that could influence that number, an online retirement calculator can give you an initial estimate.

According to the FIRE method, which we will cover next, you will need to build up a net worth of 25 times your estimated annual spending in order to achieve this level of financial independence.

What is the FIRE method for early retirement?

FIRE, which stands for “Financial Independence, Retire Early” basically involves extreme saving — as much as 50-70% of your annual income — and then investing those savings to produce passive income.

The idea is that over time, these investments will provide enough money to cover your living expenses so you can retire at a young age.

The FIRE savings rate is aggressive. To put it in perspective, most experts recommend saving 10-15% of your income.

At a savings rate of 10%, it would take around nine years of work to save for one year of living expenses. A savings rate of 50% would take you only one year to save for one year of living expenses. While the short-term sacrifice could be high, the accumulated long-term benefits are obvious.

The FIRE movement has risen in popularity in recent years, a sign that many young people are tired of financial uncertainty and the conventional “rat race” of working just to pay the bills. Its popularity also, for some time, coincided with a sustained

Types of FIRE investing strategies

Beyond the traditional FIRE method, there are several variations of the movement that adapt to different financial goals and lifestyles:. These include Lean, Fat, Barista, and Coast.

- LeanFIRE: This is FIRE on a budget. If you expect your living expenses to be below average for the long term, you can retire earlier than if you were planning for an average lifestyle.

- FatFIRE: In contrast to the LeanFIRE, with FatFIRE you are planning on living in luxury in retirement and are expecting higher-than-average expenses.

- BaristaFIRE: Consider this variation as part-time FIRE. You are saving enough now so that you can quit your day job and take on part-time work or a side hustle that you ideally enjoy more.

- CoastFIRE: This type of FIRE has you investing aggressively from an early age, so that you don’t need to continue investing later in life. CoastFIRE uses the power of compounding to cover your expenses, aka “coasting.”

Invest wisely for financial independence

The freedom to not work is not an impossible dream, but it does require consistent discipline and dedication. It also usually requires a smart investment strategy that includes a variety of assets, such as stocks and ETFs, that can stand the test of time and pay healthy long-term dividends.

No matter what your goals are, it’s always important to always make these investment decisions wisely. Get started with an eToro virtual portfolio.

Final thoughts

Financial independence will look different to everyone, and it’s important to remember that reaching financial independence should be relevant to your lifestyle.

Ultimately, gaining financial freedom means you are in control of your finances, own diverse and long-lasting money sources, and are able to live off of passive income. It is a state that takes dedication and time to reach, but is worthwhile and beneficial for you in the long-run.

You can start your journey to financial independence by learning more at the eToro Academy.

Quiz

FAQs

- What types of assets can I invest in?

-

There are a range of assets available to invest in, including stocks, bonds, ETFs, commodities and cryptoassets. The convenience, variety, liquidity and cost-effective nature of the financial markets make them an obvious choice for investors. Alternatively, you could consider investing in different markets, such as property assets.

- What kind of returns can I make through investing?

-

The S&P 500 stock index is often used as a benchmark measure of investment returns. Between 2004 and 2024, the average annualized return of the index was 10.43%. Between 2014 and 2024, the average annualized returns were 13.70%. Nothing is guaranteed in the financial markets, and it is always possible to lose money on your investments, but this is a good indicator for beginner investors.

- What is asset allocation?

-

Asset allocation is the process of deciding how much capital is to be invested in different financial instruments. You can adjust your asset allocation, rebalancing your portfolio, in response to changes in market conditions or your investment aims.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.