In collaboration with

iShares by BlackRock, a global leader in ETFs

ETFs can solve many of the limitations of individual stocks and mutual funds by providing a low-cost, tax-efficient way to diversify your portfolio.

Exchange-traded funds, or ETFs, are a type of investment that typically seeks to tracks the performance of a financial index, industry sector, or asset.

You can trade ETFs at any point throughout the day on a

As we mentioned in our previous article, ETFs offer easy diversification by allowing you to gain exposure to many investments at once. For example, an S&P 500 ETF invests in all the stocks included in the S&P 500, an index measuring the value of the 500 largest US companies.

So instead of investing in all the individual stocks in the S&P 500, each with its own fees and levels of risk, you can invest in a single ETF and get exposure to all of these stocks in one purchase.

ETFs share many similarities to individual stocks and mutual funds. But what really makes ETFs different from other types of investments?

How are ETFs and stocks different?

A stock represents a piece, or share, of ownership in a company.

The value of a company’s stock is typically tied to the company’s financial performance.

If the company performs well, the company’s stock could rise in value, and you might be able to sell the stock for a profit. If the company performs negatively, the company’s stock may fall in value and if you sell the stock in this situation, it could be at a loss (or less than you paid for it).

There are a few benefits to investing in stocks:

- You typically only need to have the price of one share (or less — you can invest in fractional shares for just $10 on eToro) to invest in a stock.

- You can invest whenever you want: Stocks can typically be bought or sold at any point during the trading day.

But there are also limitations:

- With an individual stock, your investment is tied to the company’s performance. And if your money is only invested in the stock of a company that performs poorly financially, you have a greater chance of losing some or all of your investment.

- Buying a bunch of individual stocks to help reduce your risk can be a costly and time consuming process.

- Low cost: You typically only need the price of one share to invest in a stock.

- Convenience: Stocks can typically be bought or sold at any point during the trading day, so you can buy and sell stocks whenever you want.

- Risky: With an individual stock, your investment is tied to the company’s performance. If the company performs poorly, you have a greater chance of losing some or all of your investment.

- Costly to diversify: You could reduce your overall risk by buying a bunch of stocks, but this strategy can be time consuming, as it takes time to research stocks, and costly, as it can be quite expensive to buy a bunch of individual stocks on your own.

But as Samara Cohen, Chief Investment Officer of ETF and Index Investments at BlackRock, notes, “ETFs offer some of the benefits of stocks while also addressing some of their limitations.”:

“ETFs offer some of the benefits of stocks while also addressing some of their limitations.”

Samara Cohen, Chief Investment Officer of ETF and Index Investments, BlackRock

- Less risky: ETFs can hold hundreds, sometimes thousands, of stocks (and other assets), which often makes them less risky than holding one of those investments by themselves.

- Less expensive: Instead of buying a number of individual stocks outright (each with their own transaction fees), you can purchase a single ETF, which often comes with low fees.

- Convenient diversification: ETFs can give you exposure to hundreds of stocks. Some ETFs focus on a specific industry or sector, like healthcare.

How are ETFs and mutual funds different?

There are two main types of mutual funds: active mutual funds and index mutual funds.

An active mutual fund is an investment product that seeks to outperform some financial index. The fund managers handling the active mutual fund will buy and sell various stocks, bonds, and other assets to try and make a profit.

Potential benefits of investing in active mutual funds:

- Active mutual funds give you the opportunity to earn higher returns.

- Like an ETF, you can gain access to hundreds of assets in one active mutual fund investment.

Limitations to investing in active mutual funds:

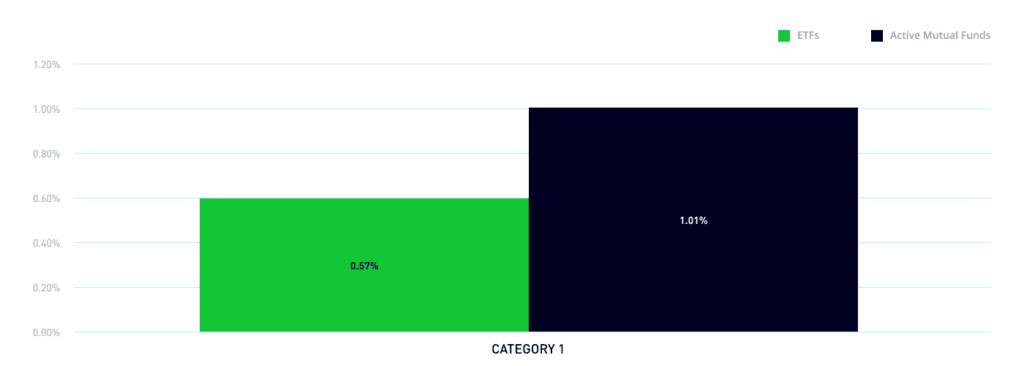

- Because they’re actively managed, these mutual funds cost almost double the amount as ETFs on average. 1

- Assets in an active mutual fund are typically sold more often than in an ETF, which increases the chances of an investor in a mutual fund having to pay a capital gains tax

1Source: Morningstar as of 03/31/2023. Net expense calculated using prospectus net expense ratio data, as reported by Morningstar. Exchange-traded fund (ETF) universe is sized by Morningstar and includes all primary shares classes of U.S. domiciled ETF funds. Category breakdowns, such as equities, fixed-income, and commodities, are based on Morningstar’s global broad category groups. “Total universe” contains all the underlying products across Morningstar’s global broad category groups that meet the above mentioned qualifications.

- Potential for higher returns: Active mutual funds offer a chance to earn above-average returns.

- Convenient diversification: You can gain access to hundreds of assets in one active mutual fund investment.

- Cost: Active mutual funds cost, on average, almost double the amount as ETFs (see chart below), due to operating expenses and other fees.

- Tax inefficiency: Assets in an active mutual fund are typically sold more often than in an ETF, which increases the likelihood of a capital gains tax liability for the investor.

Average net expense ratio for ETFs vs. active mutual funds*

An index mutual fund is an investment product that seeks to replicate the performance of some financial index.

To do so, fund managers will buy and sell various stocks, bonds, and other assets based on an index’s criteria.

For example, an index fund that seeks to track the S&P 500 would purchase the stocks that are included in that index.

Benefits to investing in index mutual funds:

- In an index mutual fund, an investor can gain exposure to hundreds of investments.

- Because they are passively managed, index mutual funds typically have lower management fees than active mutual funds.

Limitations to investing in index mutual funds:

- Many index mutual funds require a flat-fee minimum investment from investors, which can be as high as $3,000.

- Because holdings are typically disclosed on a quarterly basis, you may not always have insight into how your money is being allocated (though you could review the index’s holdings on the index provider’s website).

1Source: Morningstar as of 03/31/2023. Net expense calculated using prospectus net expense ratio data, as reported by Morningstar. Exchange-traded fund (ETF) universe is sized by Morningstar and includes all primary shares classes of U.S. domiciled ETF funds. Category breakdowns, such as equities, fixed-income, and commodities, are based on Morningstar’s global broad category groups. “Total universe” contains all the underlying products across Morningstar’s global broad category groups that meet the abovementioned qualifications.

- Diversification: Investors can get exposure to hundreds of assets in just one mutual fund purchase.

- Cost: Index mutual funds require relatively less management than active mutual funds, and are therefore typically lower cost.

- Minimum investment: Many index mutual funds require a minimum investment from investors, a flat dollar amount, which can be as high as $3,000.

- Transparency: Index mutual funds typically disclose their holdings on a quarterly basis, which means you may not always have insight into how the fund managers are allocating your money.

While both ETFs and mutual funds offer broad diversification by pooling multiple assets into one investment, ETFs may offer lower costs and more accessibility to investors:

- Lower cost: ETFs, many of which are passively managed, offer lower fees than active mutual funds, allowing you keep more of what you earn.

- Tax efficient: ETFs typically generate less capital gains than mutual funds. Case in point: In the past decade, over half of all mutual funds have distributed capital gains to investors, while only 8% of ETFs have done so.2

- Easily accessible: There’s no minimum investment to buy an ETF, meaning you can buy an ETF for the price of one share (and sometimes even less, thanks to fractional share trading).

- Transparent: ETFs typically disclose their holdings on a daily basis, so you generally always know how your money is being invested.

- Tradability: ETFs trades may be completed at any point during the trading day, while mutual fund trades are only completed at the end of the trading day.

2Source: Morningstar as of 12/31/2022. Average number of mutual funds that paid a capital gain distribution each year over 10 years compared to exchange traded funds. Universe includes all funds incepted before 10/31 in each year and excludes funds that closed before 10/31 in each year. Universe of mutual funds includes all US open ended mutual funds, oldest share class used. Past distributions are not indicative of future distributions. Due to fund structure, mutual fund holders may be subject to taxable capital gains distributions due to other investors’ redemptions directly to the mutual fund. Taxable capital gain distributions can occur to ETF investors based on stocks trading within the fund as the ETF creates and redeems shares and rebalances its holdings. ETFs and stocks may also generate taxable capital gains when an investor sells their own shares. Certain traditional mutual funds can also be tax efficient.

Conclusion

ETFs can be a solution to some of the limitations and disadvantages of stocks and mutual funds, which potentially make them a great way for beginner investors to get started in the stock market.

Want to see how ETFs can fit into your investing plan? Get started learning through eToro’s virtual portfolio.

About iShares by BlackRock

iShares unlocks opportunity across markets to meet the evolving needs of investors. With more than twenty years of experience, a global line-up of 1300+ exchange traded funds (ETFs) and $3.12 trillion in assets under management as of September 30, 2023, iShares continues to drive progress for the financial industry. iShares funds are powered by the expert portfolio and risk management of BlackRock.

This communication is in collaboration with iShares by BlackRock. BlackRock and iShares are trademarks of BlackRock, Inc. or its affiliates (together “BlackRock”). BlackRock does not sponsor or endorse any content outside the ETF Academy and is not affiliated with eToro or any of its affiliates.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation. Any references to past or future performance of a financial instrument, index or packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro encourages its customers to carefully consider the funds’ investment objectives, risks, and charges and expenses carefully before investing. This and other information can be found in the funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting each fund company’s website or www.sec.gov/edgar/search. For iShares Funds, please visit www.iShares.com/prospectus. Read the prospectuses carefully before investing.

Investing involves risk, including possible loss of principal. Diversification and asset allocation may not protect against market risk or loss of principal. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained. Transactions in shares of ETFs may result in brokerage commissions and may generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders.

Securities trading is offered by eToro USA Securities Inc., member of FINRA and SIPC, a self-directed broker-dealer that does not provide recommendations or investment advice. Visit our Disclosure Library for additional important disclosures including our Customer Relationship Summary and order routing information and statistics. FINRA Brokercheck © 2023.