In collaboration with

iShares by BlackRock, a global leader in ETFs

Investors can navigate market volatility by investing in ETFs, which are cost-efficient, flexible, and offer the opportunity to diversify portfolios across industries, regions, and asset classes.

Learn how investing in ETFs can be a great way to navigate market volatility and build a diversified portfolio.

The stock market can be unpredictable and volatile, which can make investors nervous and even lead some to sell out of their investments completely. But this can be costly.

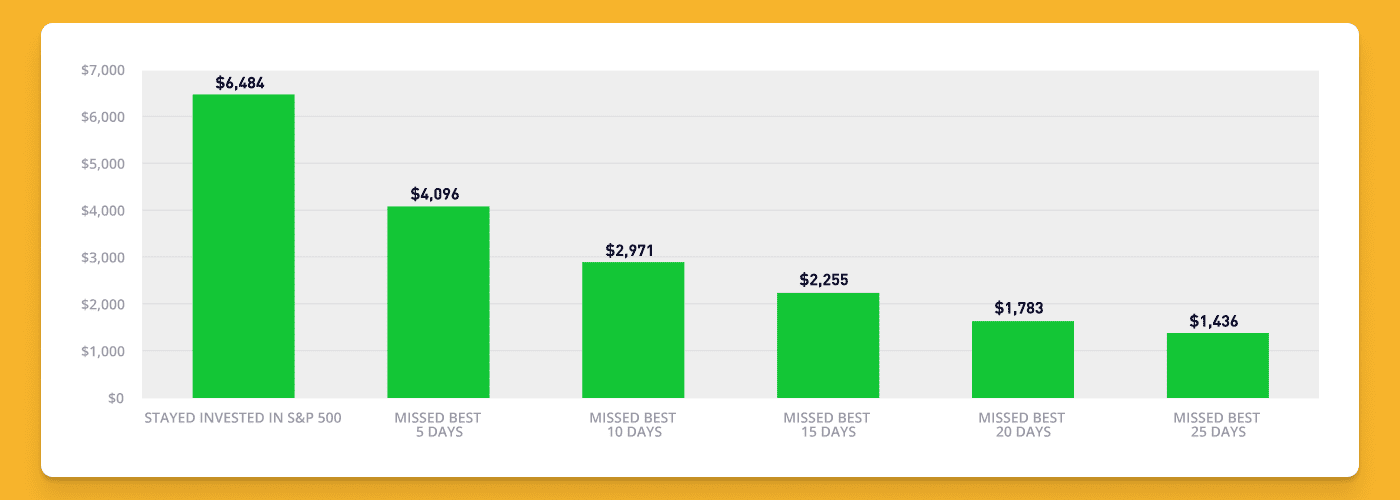

For example, if you invested $1,000 in the S&P 500 20 years ago, your investment would have earned a 6x return (see chart below).

But if you sold your investments during any of the market downturns during that 20-year period, you could have sold at a loss and missed out on future price increases.

But if you missed the market’s five best performing days, the final value of your investment could be almost 40% less. And if you missed the 25 best performing days, your investment would be almost the same value that you started with.1

Hypothetical investment of $1,000 in the S&P 5001

1Source: Morningstar as of 05/19/2023. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

When it comes to long-term investing, it’s about time in the market, not timing the market, even in periods of market volatility.

Attempting to time the market is notoriously difficult and often results in missed opportunities. Historically, major market crashes have eventually recovered over time, and selling during a dip could mean missing out on the eventual rebound.

In this guide, we’ll discuss some strategies to help you invest during periods of market volatility and how ETFs can help.

A quick refresher on ETFs

ETFs, or exchange-traded-funds, are a type of investment product that typically seeks to track the performance of a financial index.

ETFs allow you to purchase a diversified portfolio of stocks or other assets with a single transaction. This means that if one stock or sector takes a hit, your entire portfolio may not suffer as much.

These investments can also be bought and sold throughout the day, which means you can quickly react to changes in the market and make adjustments to your portfolio as needed.

Now, let’s break down the three key ETF investing strategies you can adopt during market swings.

Rebalancing

During market volatility, the strategy of rebalancing can help investors stay on track towards their long-term goals.

When the market experiences sudden and abrupt fluctuations, a portfolio’s asset allocation can become imbalanced.

Rebalancing typically involves selling some of your investments and using the money generated to buy other investments.

By doing so, your portfolio is brought back in line with your original asset allocation, ensuring that the level of risk they’re exposed to remains consistent.

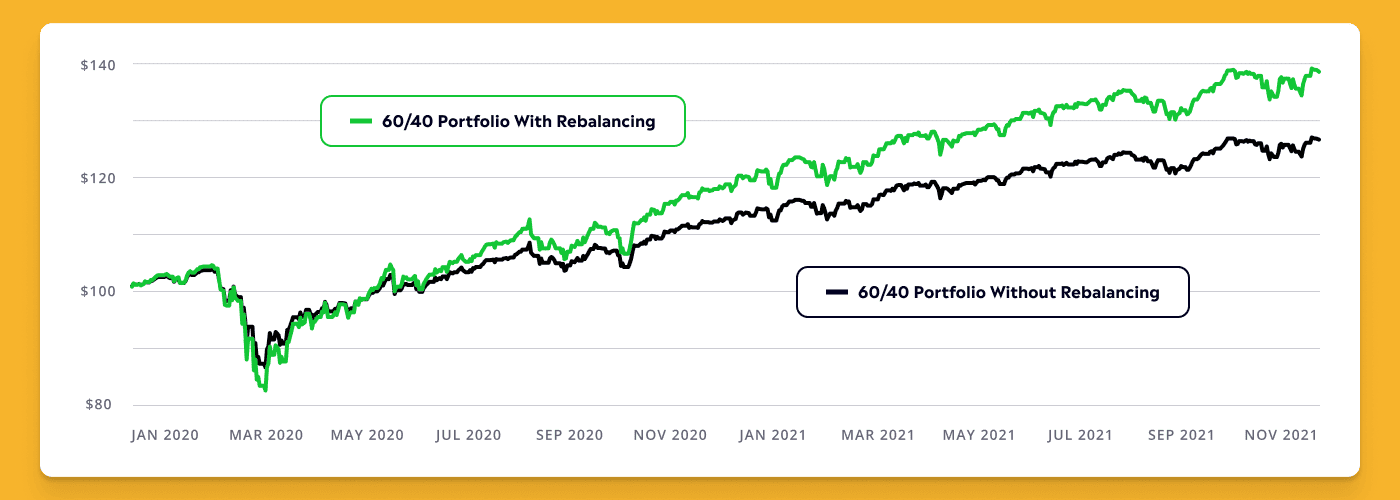

Let’s take a $100 portfolio in 2020, with an allocation of 60% stocks and 40% bonds.

In early 2020, at the start of the COVID-19 pandemic, the stock market declined significantly and many stocks lost value. As a result, that portfolio’s allocations shifted to 50% stocks and 50% bonds. (See the chart below.2)

This portfolio is now unbalanced, meaning it doesn’t meet the allocation originally chosen by the investor based on their goals, time horizon, and risk tolerance. To rebalance the portfolio, you would need to sell some of your bonds and buy more stocks.

This strategy of periodically rebalancing a portfolio can help increase returns over time whilst managing your risk.2 Case in point: The stock market rapidly recovered after the initial dip in March 2020.

Investors who rebalanced their portfolio to the 60/40 allocation would have earned more money during the market recovery than those who did not rebalance their portfolio.2

The value of rebalancing during market volatility2

2Source: Morningstar as of 12/31/2022, based to 100, using total return which assumes the reinvestment of dividends. Both portfolios start the year 60% invested in the S&P US Total Market Index and 40% invested in the Bloomberg US Aggregate Bond Index. The 60/40 portfolio rebalanced back to its target weights effective at the close of 3/31/2020. This information does not represent the actual current, past or future holdings or portfolio of any investor. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

When you invest in individual stocks, you may feel the need to constantly monitor their performance and adjust your holdings accordingly. This can be time-consuming and stressful. ETFs can simplify the process of rebalancing because they:

- Save you time: ETFs, on the other hand, can provide instant diversification across multiple companies and sectors.

- Save you money: Most ETFs trade commission-free, which can save you money when buying and selling investments while rebalancing.

- Work with your schedule: Because ETFs can be bought or sold at any point during the trading day, you can execute your rebalancing strategy whenever markets are open.

Dollar-cost averaging

Another strategy to consider during periods of market volatility is dollar-cost averaging (also known as systematic investing).

Dollar-cost averaging is the process of investing a fixed dollar amount over a set period of time.

When the market declines, your fixed dollar amount buys more shares and when the market rises, your fixed dollar amount buys fewer shares, which lowers your average-cost-per-share and a lower average-cost-per-share = potential higher returns.3

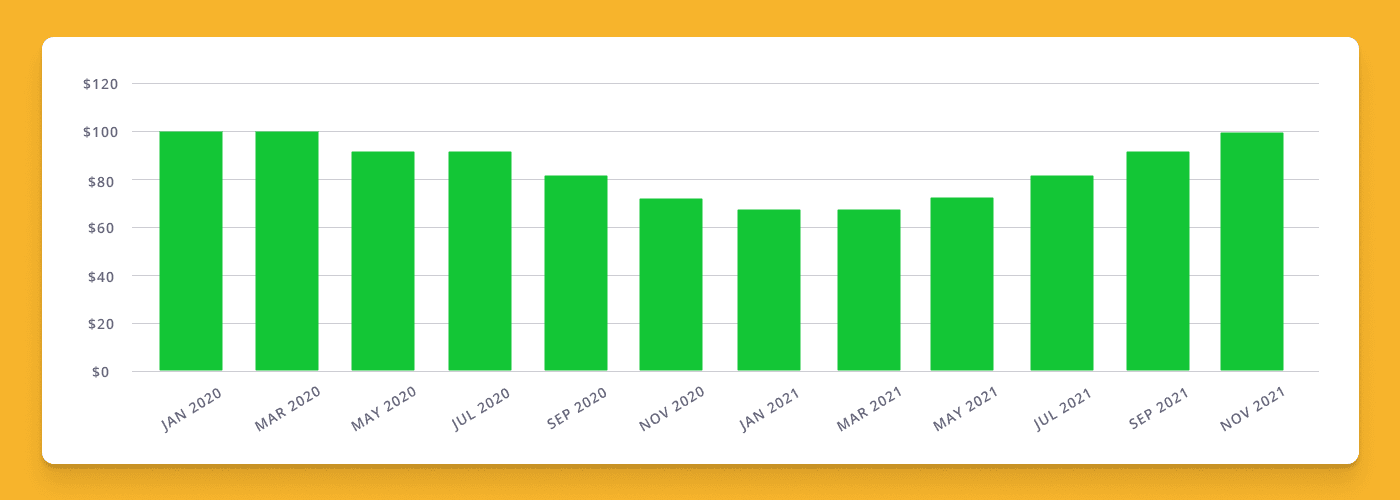

How does this work? Consider this example (see chart below).4

Let’s say that an investor has $1,200 and wants to buy an ETF worth $100 per share.

The investor could buy 12 shares of the ETF outright (known as lump-sum investing). Or, they could invest $100 each month, regardless of how the ETF performs over the course of the year.

Let’s say that over the course of the year, the ETF declines to $67.10 in August before recovering and to $100 in December.

The investor who used dollar-cost averaging would have acquired more shares (14.5) than the investor who invested with a lump sum (12), and would have realized a greater gain ($249 or a 20% increase) compared to the investor who used a lump sum ($0).

As the example shows, dollar-cost averaging can be especially effective over the long term, as it helps smooth out the effects of market fluctuations and allows you to benefit from the compounding effects of reinvesting in the market over time.

ETFs are excellent tools for dollar-cost averaging since they often can be purchased through fractional shares, meaning you can regularly invest in an ETF with an amount that you are most comfortable with.

Plus, with fractional shares, you can invest an amount you’re comfortable with.

3Systematic investing does not assure a profit and does not protect against loss in a declining market.

Dollar-cost averaging: Offer value in market volatility4

4Source: BlackRock. Hypothetical example for illustration purposes only and is not meant to represent the performance of any particular investment. Systematic investing does not guarantee a profit and does not protect against loss in declining markets. Systematic investing involves continuous investing, so investors should consider their ability to make periodic payments in all market environments. Investing involves risks. Including the possible loss of all your principal.

Tax-loss harvesting

Tax-loss harvesting is a method used by investors to reduce their taxes by selling their assets at a loss. This may sound counterintuitive, but it can be a smart move for those who want to make the most of market volatility.

As Jay Jacobs, US head of thematics and active equity ETFs at BlackRock, explains, “tax loss harvesting may provide a silver lining in down markets.”

“Tax loss harvesting may provide a silver lining in down markets.”

Jay Jacobs, US head of thematics and active equity ETFs, BlackRock

How does this work? When you sell an investment for more than you bought it for, you would have a capital gain — you’ll owe taxes on the profit, or the difference between what you bought it for and what you sold it for.

If you sell an investment for less than you bought it for, also known as your cost basis, it’s a capital loss. During a market downturn, you may see the value of your portfolio decrease significantly.

If you have both capital gains and capital losses in the same year, you may be able to use your capital losses to reduce your capital gains, which can lead to a lower tax bill.

You may also be able to use that capital loss to reduce other income you earned, which can also potentially lead to a lower tax bill.5

Consider this hypothetical example.

Let’s say you invested $10,000 in stock for your favorite company, Toastr — which is an imaginary manufacturer of smart appliances.

If Toastr’s stock declined 10%, the value of your stock is now $9,000. You could sell that investment and realize a $1,000 ($1,000 = $10,000 – $9,000) loss, which you can use to help offset realized capital gains in your portfolio.

You could then immediately re-invest the $9,000 in an ETF that provides exposure to Toastr, so you don’t miss out on any market recovery.

ETFs can simplify the process of tax loss harvesting strategy because they:

- Can be bought or sold at any point during the trading day: This means that you can execute tax-loss harvesting when it’s most convenient for you.

- Have wide exposure: With over 8,000 ETFs available, you’re likely to find an ETF that can help you maintain the exposure you are looking for.

As with most tax considerations, you should speak with your tax professional to see if any of your investments are eligible and if tax-loss harvesting is right for you.

*Trading may have tax consequences. eToro does not offer tax advice.

5Source: IRS Topic No. 409. https://www.irs.gov/taxtopics/tc409.

Conclusion

Even periods of market volatility are ripe with potential investing opportunities.

Embracing these investing strategies through ETFs can help you mitigate your risk exposure through diversification and stay on track in pursuit of your long-term goals.

Want to test some of these strategies? Get started experimenting with eToro’s virtual portfolio.

About iShares by BlackRock

iShares unlocks opportunity across markets to meet the evolving needs of investors. With more than twenty years of experience, a global line-up of 1300+ exchange traded funds (ETFs) and $3.12 trillion in assets under management as of September 30, 2023, iShares continues to drive progress for the financial industry. iShares funds are powered by the expert portfolio and risk management of BlackRock.

This communication is in collaboration with iShares by BlackRock. BlackRock and iShares are trademarks of BlackRock, Inc. or its affiliates (together “BlackRock”). BlackRock does not sponsor or endorse any content outside the ETF Academy and is not affiliated with eToro or any of its affiliates.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation. Any references to past or future performance of a financial instrument, index or packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro encourages its customers to carefully consider the funds’ investment objectives, risks, and charges and expenses carefully before investing. This and other information can be found in the funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting each fund company’s website or www.sec.gov/edgar/search. For iShares Funds, please visit www.iShares.com/prospectus. Read the prospectuses carefully before investing.

Investing involves risk, including possible loss of principal. Diversification and asset allocation may not protect against market risk or loss of principal. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained. Transactions in shares of ETFs may result in brokerage commissions and may generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders.

Securities trading is offered by eToro USA Securities Inc., member of FINRA and SIPC, a self-directed broker-dealer that does not provide recommendations or investment advice. Visit our Disclosure Library for additional important disclosures including our Customer Relationship Summary and order routing information and statistics. FINRA Brokercheck © 2023.