The Bitcoin halving has historically brought new investors into the crypto space. Learn how to use eToro to trade bitcoin and other cryptoassets around the next Bitcoin halving event.

Investing in crypto has become a lot more mainstream since the creation of Bitcoin in 2009. As the industry has matured, brokers such as eToro have developed platforms that combine user-friendly functionality with powerful trading tools.

With the Bitcoin halving generating additional interest in the crypto sector, there are a range of things that traders and investors can do to try and make the most of any potential opportunities.

Tip: It is possible to trade cryptoassets on the same account as stocks, commodities, forex, and other instruments on eToro.

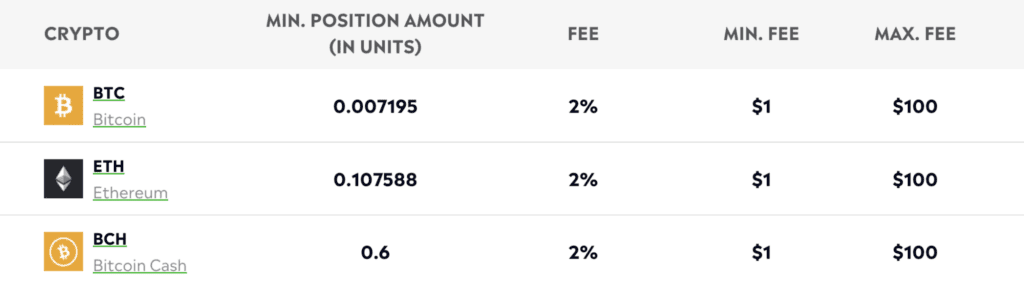

Bitcoin trading on eToro

It is possible to trade bitcoin and other cryptoassets on the eToro platform. Accounts are able to hold multiple assets, meaning that eToro can be used to trade and hold bitcoin and other asset classes in the same place, and it is possible to open and close bitcoin positions on a 24/7 basis.

The “Portfolio” area of the dashboard allows traders to monitor the performance of their portfolio as market prices change. This, in turn, enables them to make important decisions regarding risk management and portfolio diversification.

The eToro Money crypto wallet is an app-based product that comes with the same security features as the trading platform, such as two-factor authentication. eToro Money uses the same login details as the trading platform, although there are additional functionality features to be found on the app, specifically designed for those interested in crypto:

- The eToro Money crypto wallet supports everyday crypto transactions, allowing you to send and receive bitcoin, Litecoin, and other cryptoassets to and from external wallets.

- It is possible to transfer certain cryptoassets to theeToro Money crypto wallet and either store them there or move them to an external wallet. These cryptoassets include bitcoin, Ethereum, Litecoin, Bitcoin Cash, Stellar, Tron, XRP and Cardano.

Tip: You can transfer cryptoassets from your trading account to the eToro Money wallet, but not the other way around.

Key bitcoin trading tools on eToro

The functionality of the eToro platform can help to simplify the bitcoin trading process, allowing traders to focus on optimising returns.

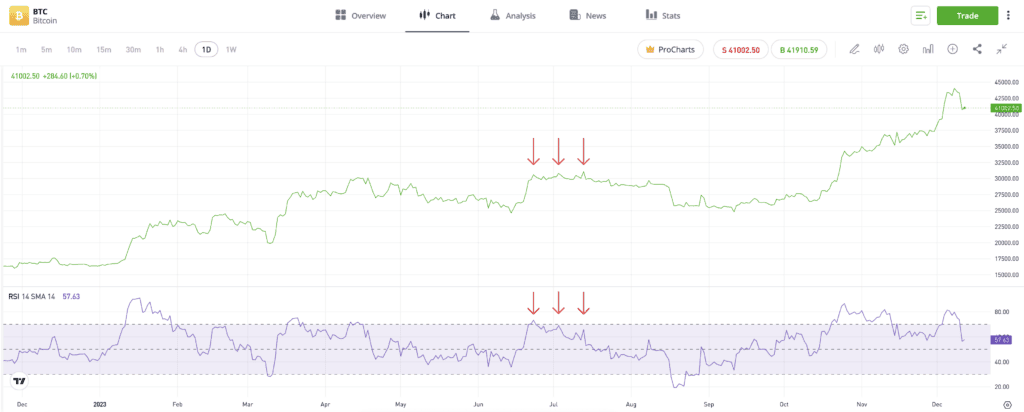

Price charts can offer an opportunity for traders and investors to get a feel for a market. For example, the long-term price chart for bitcoin highlights the relatively high levels of price volatility associated with the market.

Regardless of your risk-return profile, the core principles of charting analysis can be used to identify trade entry and exit points. Charting is a particularly useful tool for those interested in researching the noticeable and potentially repetitive price moves that occur over a four-year Bitcoin halving cycle.

For illustration purposes only. Past performance is not an indication of future results.

Source: eToro

eToro also offers its users access to the highly regarded TradingView service, as well as a range of powerful trading indicators. These technical analysis tools can be used to analyse historic bitcoin market data to give insights into current trading conditions and the potential direction in which price might move next.

For illustration purposes only. Past performance is not an indication of future results.

Source: eToro

Fundamental analysis can be used to identify the “real world” reasons behind bitcoin’s price movements. These reasons can include changing regulatory frameworks, the reduced number of new bitcoins entering the market, or wider macroeconomic factors.

Updates on these price drivers can be accessed from the extensive library of research materials offered by eToro. This includes both written research and educational videos.

Bitcoin trading best practices

Although the Bitcoin halving could provide some unique opportunities, making a positive return still requires traders to follow some of the core principles of investing.

To trade the Bitcoin halving successfully, it is imperative that you first determine what your investment aims are. From there, establish what type of strategy you believe will help you to meet these goals.

For those interested in trading around the Bitcoin halving, it is important to have a well-thought-out bitcoin trading strategy that factors in your personal risk appetite, investment time horizon, and the resources that you have available to you.

It is worth noting that bitcoin day trading, for example, is a more time-consuming strategy than a long-term buy-and-hold approach, although both can be utilised when attempting to trade around the four-year cycle.

The Bitcoin halving – as well as the general nature of the crypto market – can lead to relatively high levels of price volatility, so it is important to employ risk management techniques in order to avoid emotional investing.

Social and Copy Trading on eToro

The Social features on eToro allow traders to share ideas with other traders. For beginner investors, it can be beneficial to understand the thought processes of more experienced bitcoin investors.

The eToro trading dashboard has a dedicated area that provides a live feed of updates on market news and new research.

Developing a better understanding of other traders’ opinions can offer insights into market sentiment and help you to identify and back new trends. The Copy Trading features on eToro allow you to copy the crypto trading decisions of other traders, with trades being booked to your account automatically.

The performance of Copy Traders is ranked, and their profiles include information regarding their trading ideology, which will make it easier to select a Copy Trader to follow.

Final thoughts

For those interested in investing in bitcoin, either in general or specifically around the Bitcoin halving, it is important to utilise a user-friendly platform with no hidden fees and plenty of tools available. Social trading can help you to gauge other people’s opinions about any potential bitcoin price movements, while the ability to monitor charts can be useful for those interested in technical analysis, among other things.

Always make sure that you conduct significant research before committing real money to a trade, and consider accessing a demo account before doing so.

To learn more about Bitcoin and the halving event, visit the eToro Academy.

FAQs

- Is bitcoin trading on eToro regulated?

-

eToro is a regulated platform that offers crypto markets to its clients as part of a broader service as a multi-asset broker. It is important to note that crypto trading itself is not currently regulated, although it is still possible to safely trade bitcoin and other cryptoassets, as long as you are aware of the risks.

- How do I install the eToro Money app?

-

The eToro Money app can be downloaded using Android and iOS devices, and the process is similar to any other app. Locate eToro Money in the App Store or the Play Store and download it. Once downloaded, use your eToro account details to login and then verify your account.

- Can I use technical analysis on eToro?

-

Yes, it is possible to use technical, fundamental and quantitative analysis on eToro. To use technical analysis specifically to analyse the price of bitcoin, visit the BTC chart page. From here, it is possible to annotate the chart, and users have access to various tools and indicators such as bollinger bands, moving averages and price oscillators.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply.