The Crypto Fear and Greed Index is used to measure the mood of the market, categorizing crypto sentiment from extreme fear to extreme greed. This article explores the Index further, considering what it is, how it works, and how it can be used by investors.

The cryptocurrency market can be incredibly volatile and, as a result, investors often react with emotion. The Crypto Fear and Greed Index is a tool used to track these emotions and enable investors to gain an insight into market sentiment.

What is the Crypto Fear and Greed Index?

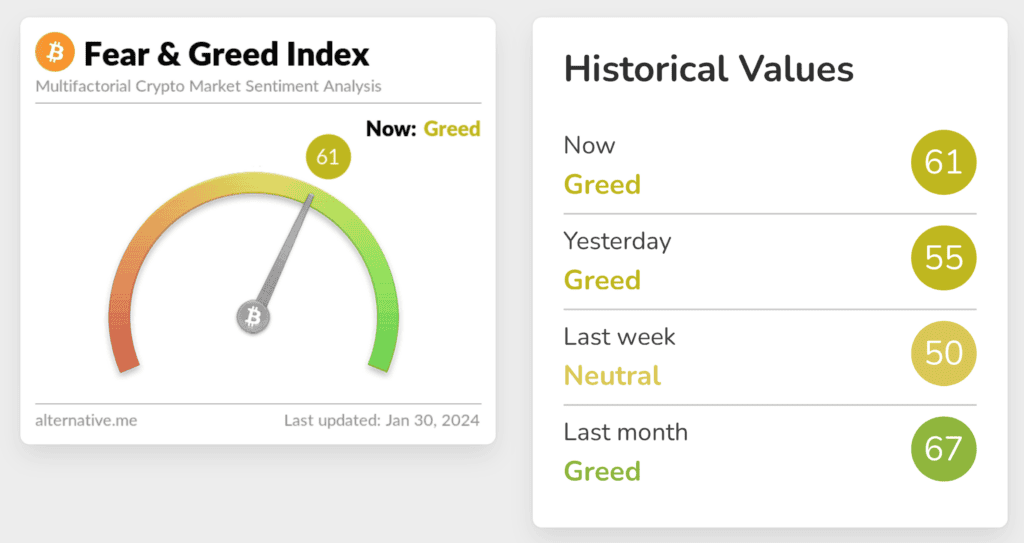

The Crypto Fear and Greed Index is an indicator used to measure the mood of the market and the primary emotions of the investors influencing it. It categorizes crypto market sentiment between 0 to 100, from extremely fearful (lower values) to extremely greedy (higher values). Investors can use the Index in line with their crypto investment strategy to identify market trends, understand how others are trading, and better time their own market entry or exit.

Source: Alternative.me

The index is categorized into four sections:

- 0–22: Extreme fear

- 23–49: Fear

- 50–74: Greed

- 75–100: Extreme greed

How Is the Crypto Fear and Greed Index Calculated?

The Fear and Greed Index collates data from a wide range of sources, including market volatility, trading volumes, and social listening for large-cap cryptocurrencies, to provide a comprehensive indication of overall investor sentiment.

| Market Volatility | Times of high market volatility often coincide with times of high fear, as price movements become unpredictable. Sharp price declines can promote fear and trigger crypto sell-offs, while fast price increases can catalyze greed or incite emotional investing. In crypto, this is often referred to as “FOMO” (fear of missing out). |

| Market Volume | Higher trading volumes can indicate higher greed, while lower volumes may signal hesitancy among investors. This is usually a sign of fearful sentiment. |

| Dominance | A rise in the trading volumes of large-cap cryptocurrencies, such as bitcoin (BTC) or Ethereum (ETH), can be considered an indication of a fearful market. This is because investors start to rely on cryptoassets that they consider to be less risky. Reduced dominance of large-cap cryptoassets, or a rise in trading volumes of small-cap cryptocurrencies, may indicate greed as investors become willing to increase their exposure to risk. |

| Social Media and Search Trends | Social monitoring offers insights into popular and public opinion regarding crypto. Positive discussions about crypto on social media, or positive reactions to global news, events, or relevant legislation, can trigger greed. On the other hand, negativity within online crypto communities can make people more fearful. Search data can also indicate where market curiosity, or concern, lies. |

Tip: Increased search volume for “bitcoin scam” might indicate extreme fear, while “bitcoin bull run” could signal optimism and greed.

How Should Investors Use the Crypto Fear & Greed Index?

The Crypto Fear and Greed Index can help investors identify trends within the crypto sector and better time their own market entry or exit.

When investors are fearful, crypto prices are often — although not always — lower, or experiencing a downtrend. Times of fear can suggest overselling and can often present opportunities for investors to buy into the market and open a position.

Although the Fear and Greed Index is typically used to identify short-term opportunities, during times of prolonged fear, investors may use insights from the Index to consider longer-term positions.

Alternatively, times of extreme greed can lead to higher prices or signal a market uptrend. Sustained periods of greed can indicate that a market has been overbought, and act as a sign for investors to remain cautious, sell positions, or take advantage of short-term trading prospects.

Warren Buffett advocates for investors to use the Fear and Greed Index to their advantage by contradicting it. It is also important to note that the Index should be taken with a pinch of salt. Many experienced investors warn against attempts to time the market and advocate instead for crypto investing strategies led by dollar-cost averaging or technical analysis in order to avoid emotion-led investing.

“Be fearful when others are greedy and greedy when others are fearful”

Warren Buffett

Risk management

While the Fear and Greed Index demonstrates how the crypto market can behave in unpredictable and volatile ways, when the Index is understood, it can actually be used by investors to assist with risk management.

Investors can use the Index as a signal to counterbalance, or diversify, their own portfolio. Times of extreme greed may encourage investors to act with more caution, and times of prolonged optimism can signal investors to prepare for a potential upcoming market correction.

The Index also serves as a reminder to investors to avoid being swept up in the emotions associated with either a positive or negative market, and to stick to their own investment strategies.

Final thoughts

The Fear and Greed Index is a useful tool to better inform investment decisions. Although human behavior cannot be predicted with accuracy or measured by a single metric, it can certainly be influenced by wider global and macroeconomic events, and interpreted in line with psychology.

By understanding how to use the Index alongside an investment strategy, investors can more effectively use market sentiment to their advantage, and better protect their assets from risk in times of extreme greed.

Visit the eToro Academy to learn more about cryptocurrencies.

FAQs

- How often is the Crypto Fear and Greed Index updated?

-

Generally, the Index is updated on a daily basis to allow investors to continuously gauge accurate insights into the market. This allows investors to identify any changes, relative to wider geopolitical events or global news stories.

- Can I analyze a specific cryptoasset with the Fear and Greed Index?

-

Although the Index primarily uses large-cap cryptocurrencies to determine the market sentiment for the wider crypto market, investors can indirectly apply its signals to any specific cryptocurrency as part of their market research.

- Where can I find the Crypto Fear and Greed Index?

-

The Crypto Fear and Greed Index is available on a number of different platforms, especially those that offer crypto market analysis. Alternative.me offers one of the most widely used Fear and Greed Indexes.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments.

This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.