Result Found

Results Found

New Buy bitcoin with a debit card

eToro makes it easy to make your first bitcoin debit card purchase in only a few simple steps with low fees. Learn why more traders than ever are using eToro.

New Ethereum 2.0 Network

Ethereum is undergoing a major network upgrade to Eth 2.0. Learn what this upgrade entails, why it’s happening and what it means for you.

New Buy Bitcoin With A Bank Account

Learn how simple it is for first-time buyers to purchase bitcoin from eToro using a bank account. Own your first digital currency in minutes.

Investing Techniques: Course Summary

Now that you have completed our course about key investing techniques, consolidate your knowledge of how to incorporate them into your strategy.

Dollar Cost Averaging

Learn how to use dollar cost averaging as a strategy for long-term investment. Understand the benefits and how they can help you reach your financial goals.

Deciphering Divergences

Learn how to identify and interpret divergences in technical analysis, recognize potential market turning points, and refine your trading strategy.

Short-Term And Aggressive Trading Strategies

Explore short-term and aggressive trading and understand the principles, risks, and strategies available to capitalize on quick market movements.

The Buy-And-Hold Investment Strategy

Dive into the buy-and-hold investment strategy. Understand its long-term opportunities, potential challenges, and how it fits into an investor’s portfolio.

The Compounding Effect

Uncover the power of compounding in investing, understand how it works, and learn ways to harness its potential for maximizing long-term investment returns.

Ethical Investing Methods: SRI, ESG and Impact

Want to improve your portfolios value as well as the world? Learn how to build an ethical investing strategy using SRI, ESG & impact methods. Read on here.

Exploring Alternative Investments

Explore alternative investments (such as real estate, commodities and private equity) and learn how they might diversify and strengthen your portfolio.

Understanding Behavioral Finance

Discover how behavioral finance influences decision-making, and learn how these insights can help to inform your investment choices.

Dividend Investing Strategies: Course Summary

Complete our free online course to learn more about dividend investments and how to incorporate them into your investment strategy.

Creating A Dividend Investing Strategy

Creating a dividend investment strategy allows investors to get the most out of their dividend stocks as part of a wider investment portfolio.

How To Build A Dividend Portfolio

Dividend investments can be maximized with a healthy and balanced portfolio. Learn how to set up a dividend portfolio that works for you.

Dividend Funds vs Dividend Stocks

What are the differences between dividend-paying funds and ETFs vs dividend stocks, and which is right for you? We explain what investors need to know.

How To Identify Dividend Stocks

Identifying the best dividend stocks is key to improving any passive income portfolio. We will explain how to pick the best dividend stocks for your portfolio.

What Is Dividend Yield?

What is a dividend yield, and how do you calculate returns? We explain how yield works and how investors calculate dividend returns.

How Do Dividend Stocks Work?

Dividend stocks offer potential passive and ongoing income, but how do dividend stocks work? We explain what investors need to know.

Stock Investing Strategies: Course Summary

Read this course summary to remind yourself how to find stocks that suit your investment style and how to value them before investing.

What is Hedging and How Does it Work?

Knowing how to hedge stocks can help boost your investment strategy while working as a risk management tool. Here’s how to do it.

How to Develop a Growth Investing Strategy

Identifying growth stocks opens the door to capitalizing on opportunities early on. Learn how to develop a growth investing strategy for your portfolio.

How to Develop a Value Investing Strategy

Value investing focuses on capitalizing on undervalued stocks. Follow this guide to learn how to start value investing.

Passive and Dividend Investment Strategies

Passive investing can help to diversify your portfolio and create steady passive income. Learn how to develop a passive and dividend investing strategy.

Investment Strategies Explained

Strategies are crucial when creating a portfolio, but which investment strategy is right for you? Read about the most popular strategies for investors.

Understanding Valuation Methods

What are stock valuation methods? Learn how to apply key stock valuation methods, including the discounted cash flow (DCF) model, to your trading strategy.

Understanding Multiples and Ratios

Developing an understanding of multiples and ratios allows investors to evaluate a stock’s true value. Learn how to apply them to your trading strategy.

The 3 Financial Reports

Financial statements and reports allow you to better grasp a company's potential. Learn how to incorporate 3 key financial reports into your trading strategy.

Fundamental Analysis for Investing

Conducting fundamental analysis of stocks is a key part of investing. Learn how to use fundamental analysis and apply this to your investment decisions.

Building Your Portfolio: Course Summary

Review what you’ve learned in the free intro to investing course from eToro.

Building a Diversified Investment Portfolio

Learn the different portfolio types and discover how to build your own diversified portfolio.

Investing in Crypto 101: A Beginner’s Guide

Jumpstart your journey into the world of cryptocurrency with our complete guide. Master the basics and discover various ways to invest in the digital currency.

A Guide to Trading and Investing in Stocks

Here’s everything you need to know about the stock market and how to get started investing.

What Type of Investor Are You?

Discover investing styles like active and passive investing, and learn how your risk tolerance can shape your investment choices.

A Guide to Fixed-Income Investing

Discover how to navigate the world of fixed-income investing like a pro. Gain insights, tips, and strategies in this comprehensive guide.

Demystifying Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is an evolution of traditional financial services that operate using Ethereum smart contracts. Read on to learn more.

Understanding Crypto Market Caps

Understanding market caps can help investors to make informed decisions. Learn what crypto market caps are and why they are important for cryptocurrency investors.

Coins vs Tokens: What’s the Difference?

Understand the nuances of cryptocurrency coins and tokens: Learn about their use cases, advantages, and more, in this comprehensive guide.

A Guide to the Crypto Fear and Greed Index

The Crypto Fear and Greed Index assesses the sentiment of the crypto market. Learn how to understand the Index and what it means for investors.

A Guide to Crypto Portfolio Management

A well-managed crypto portfolio is key to the success of any cryptocurrency investor. We explain elements of successful crypto portfolio management below.

Cryptocurrency Investment Strategies

Having a strong strategy can take your cryptocurrency investing to the next level. Learn how crypto investing and trading strategies work and how to apply them.

Crypto for Beginners: Course Summary

Review the different elements of the crypto for beginners course. Remind yourself of the fundamentals of crypto and how investors can approach the market.

Beginner’s Guide To Cryptocurrency Wallets

Learn more about the different types of cryptocurrency wallets, their unique features, and tips on how to keep your cryptoassets secure in this guide.

Intro to Options: Course Summary

Review the basics of options learned in this online course and test your knowledge.

The 10 golden rules of investing

Learn how to create an investment strategy based on your goals, diversify your portfolio, and make smart long-term decisions.

Investment terms you need to know

New to investing? Knowing some common terms can help better understand the world of investing.

Behavioral finance in investing

From understanding cognitive biases to recognizing emotional tendencies, get an in-depth look at the study of behavioral finance and how it affects your investing decisions.

How to become financially independent

Financial freedom means having enough passive income to pay for your own expenses without relying on anyone else.

How to build a diversified portfolio

By spreading your investments across various industries and asset classes, you can protect against the risk associated with any one investment.

How to invest in stocks

Discover how to invest in stocks in this beginner's guide. Learn about the advantages, risks, and strategies for investing in stocks to help you reach your financial goals.

Investing 101: Course Summary

Review what you’ve learned in the free intro to investing course from eToro

How to manage risk while investing

Risk is a part of investing, but there are ways to reduce your exposure, including diversifying your portfolio and taking a long-term approach.

What should I invest in?

Stocks, bonds, and cryptocurrency are just a few assets you can invest in.

Why should I invest?

Investing can help grow your money and build wealth. Learn how to set and manage your investment goals.

The Bitcoin Halving: Course Summary

Review the different elements of the Bitcoin Halving. Remind yourself how the four-year cycle works and why it impacts investors.

The Bitcoin Halving: Trading on eToro

With the Bitcoin halving on the horizon, it is important to understand how to use eToro to trade bitcoin and other cryptoassets.

Understanding Bitcoin’s Four-Year Cycle

Using lessons learned from the last Bitcoin halving, it is possible for traders and investors to identify opportunities ahead of the next BTC halving event.

The Four-Year Bitcoin Halving Cycle

The Bitcoin halving involves the amount of BTC generated by the creation of a new block being halved. Learn how the typical four-year halving cycle works.

Beginner’s Guide to the Bitcoin Halving

The Bitcoin halving is an event that marks the point at which the BTC generated by the creation of a new block is halved. Learn the fundamentals of the Bitcoin halving.

Trading Strategies and Technical Analysis

Technical analysis is a powerful tool for traders and investors, but should be utilized within a well thought-out trading strategy.

Technical Analysis in the Trading Process

Technical analysis is used throughout the trading process. Learn how to create a fundamental and technical analysis trading strategy

Technical Analysis and Asset Classes

Understanding the characteristics of different asset classes can help to maximize returns. Learn how to use technical analysis to analyze classes and markets.

Understanding Charting and Candlestick Patterns

Candlestick patterns are a popular chart type for displaying price movements, but what do the different chart patterns mean and how do investors use them?

Technical Analysis: Course Summary

Review the elements of technical analysis. Remind yourself how charts work and how technical analysis impacts trading strategies and risk management.

Managing Trades with Technical Analysis

Careful trade management is important for traders and investors looking for long-term success. Learn how technical analysis can help trade planning.

Using Charts in Technical Analysis

Learn how you can use technical analysis to understand charts of trading data, including support, resistance and trends.

Indicators and Tools for Technical Analysis

There are a wide range of technical indicators and tools associated with trading. We explain which indicators work best as part of technical analysis.

Technical Analysis for Risk Management

Risk management is an important aspect of trading. Learn how to use technical analysis and key indicators to improve your risk management.

Economic Cycle: Stock Sectors and Factors

The economic cycle consists of four distinct stages. Learn how each of these stages can uniquely impact the performance of stock sectors and factors.

Economic Factors and How To Measure Them

Learn more about the factors that influence economic performance. Discover the different economic factors, common examples and how you can measure them.

Macro Matters: Importance of Macroeconomics

Macroeconomics focuses on the study of economies as a whole. Learn more about the importance of macroeconomics and its influence on markets and beyond.

Macroeconomics: Course Summary

Review the different elements of macroeconomics. Remind yourself how economic cycles work and why macroeconomic characteristics differ between regions.

Market and Economic Cycles: How They Work

Market and economic cycles both include periods of contraction and expansion. Find out how they work, the key stages, and distinctive characteristics.

Regional Characteristics of Macroeconomics

Global markets and economies exhibit unique characteristics. Discover the market and macroeconomic traits of regions such as the United States, Japan and China.

What is Macroeconomics?

Wondering what macroeconomics is? Find out more about the topic, including a definition of the term, its general focuses, what it can tell us and more.

ETF Investing Strategies: Course Summary

Review the different investing strategies that ETFs can be used in and test your knowledge.

3 Ways to Use ETFs During Market Volatility

Investing in ETFs can be a great way to navigate market volatility and build a diversified investment portfolio. Learn how.

Thematic investing with ETFs

Looking to get in on the latest trends? Find out how you can invest in thematic areas like AI, electric vehicles, and renewable energy through ETFs.

Income Investing with ETFs

ETFs can generate income by seeking to track financial indices that contain fixed-income securities or stocks that pay dividends.

How to Invest Sustainably Using ETFs

Learn how ETFs can help simplify the process of investing sustainably by using ESG ETFs.

ETF Investing 101: Course Summary

Review the basics of ETFs learned in this online course and test your knowledge.

Finding The Right ETF

Learn how to choose the right ETF for you, including understanding fees, analyzing performance, and evaluating risk.

How To Build A Diverse Portfolio With ETFs

Discover how to build a diversified investing portfolio with ETFs.

What is an ETF? A Beginner’s Guide

Discover what ETFs are and how they work with this beginner's guide. Learn about the benefits, risks, and how to invest to help you reach your financial goals.

Types of ETFs

Learn about the various types of ETFs available, including stock ETFs, bond ETFs, thematic ETFs, and sector ETFs.

ETFs, Stocks, and Mutual Funds: What’s the difference?

Take a deep dive into the pros and cons of ETFs, stocks, and mutual funds, and learn which type of investment is best for you.

How to Invest in ETFs on eToro

On eToro, you can find an easy way to invest in different kinds of ETFs.

What is Technical Analysis?

Technical analysis is a key aspect of trading and investing, but how and where can technical analysis be used? We explain all you need to know.

Options 104: What are option spreads?

A guide explaining what an options spread is, how it works, and why you might want to consider one. Learn more about options on the eToro Academy.

Psychology of Investing

Psychology plays a major part in investing, especially in terms of emotions. This guide explains emotional investing and how to manage this when investing.

How to trade options on eToro

Learn how to trade options on eToro Options in this step-by-step guide.

Options Trading 103: The Greeks, explained

Greek symbols are used to help options traders know more about the underlying stock. Learn what they all mean to inform your options strategy.

Options 102: Put vs. call — What’s the difference?

Call and put options are two sides of options trading, allowing investors to bet for or against specific securities. Read our guide to find out more.

Options 101: Options Trading Explained

Options are contracts that give investors the option to buy or sell a security at a specific price. Learn everything you need to know about options on eToro.

What is bitcoin?

Bitcoin is the most popular and well-known cryptocurrency on the market. But what is bitcoin, and how did it get to be where is today?

What is an ICO – The complete guide

Everything you need to understand an initial coin offering. Learn how ico works and the pros and cons of this fundraising technology.

What Is Blockchain and How Does It Work?

Discover what blockchain is and how it works. Learn about how blockchain is linked to crypto and the potential risks of blockchain technology.

What is Ethereum? A Beginner’s Guide

All you need to know to get started trading Ethereum. Discover how Ethereum works and what makes it different from bitcoin and other cryptocurrencies.

What Is Cryptocurrency and How Does It Work?

Looking to understand crypto better? We explain what cryptocurrency is, look at crypto mining, and explore some of the top cryptocurrencies on the market.

Show All

Sorry. No results match your search criteria.

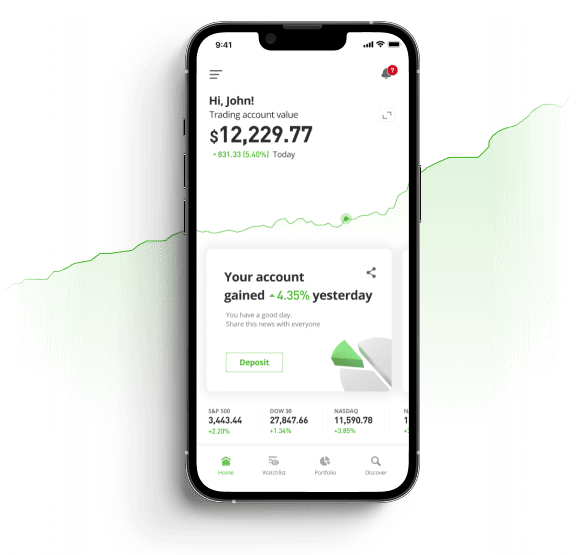

Sign up to eToro!

Open your investment account today and start putting your newfound knowledge to work. Registration is free!