-

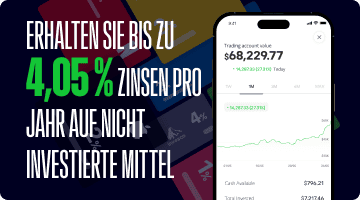

Traden & Investieren

Mehr Möglichkeiten zum Investieren

Es bestehen Kredit- und andere Risiken, bitte lesen Sie die Nutzungsbedingungen.

-

Warum eToro

-

Lernen Sie

-

Unternehmen

- Hilfe

US users please click here to be directed to the eToro US website.

Continue