Any data reported in the tax statement is strictly for informational purposes only.

It is not intended as a tax declaration or as a substitute for legal advice.

We strongly advise you to verify the tax statement with your tax advisor.

eToro does not provide tax advice and this page is for informational purposes only.

On this page, you will find information about the eToro Tax Report, which is a document based on your previous annual trading activity on the eToro platform and is structured in accordance with local tax guidelines.

- Tax Year: 01.01–12.31

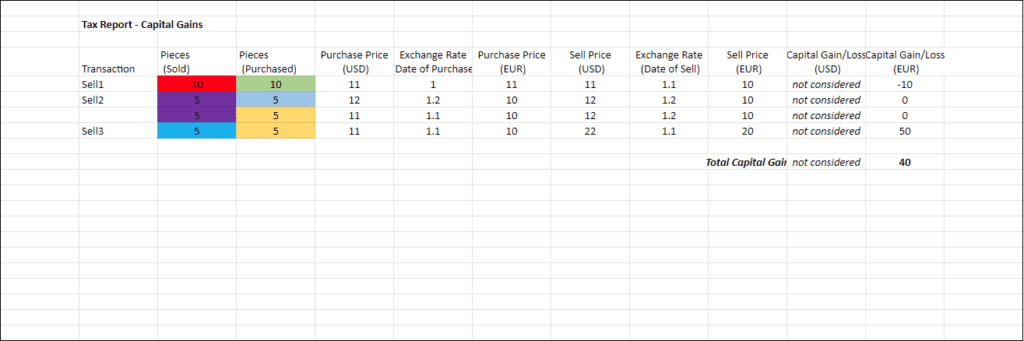

- Reporting Currency: Euro (EUR)

Filing Date: 31 July 2022

- It is possible to extend that deadline

- Electronic filing

Reporting Languages:

- German (DE)

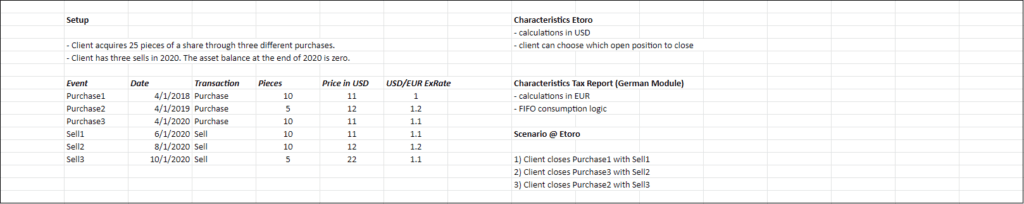

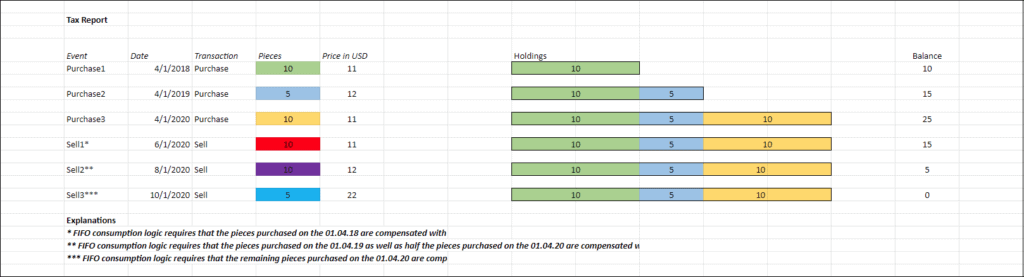

Consumption Logic: FIFO

Taxable Basis

- Income: Dividend income, interest income, other investment income

- Capital Gains: Capital gains from securities and derivatives. Capital gains from cryptoassets or coins and metals only in case the holding period is < 1 year.

- No Wealth taxation

External Data

- “WM Datenservice” is in general, the data provider for German tax data

Tax Forms

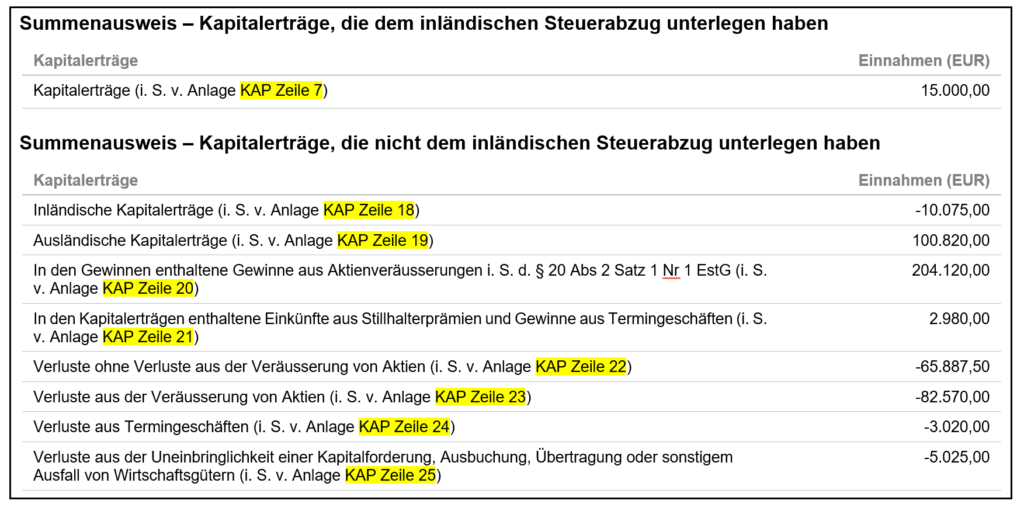

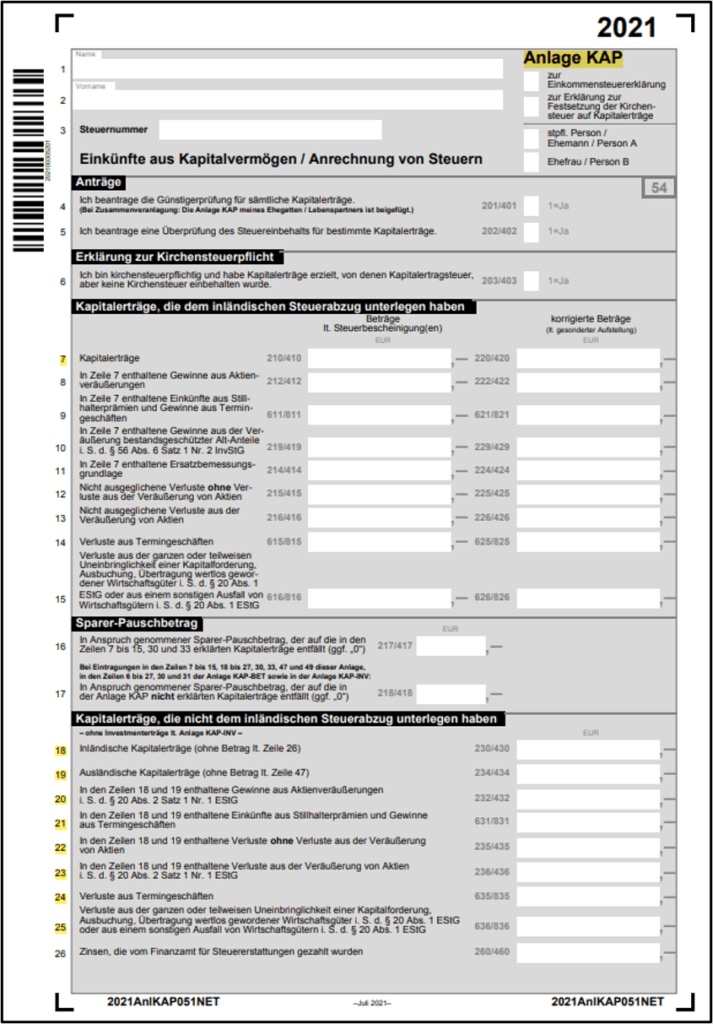

Form Anlage KAP

- Tax form “Anlage KAP” is intended for the declaration of income from capital assets

- Summarises foreign/domestic income and capital gain that have not been subject to tax deduction

- This tax form covers all instruments (shares, bonds, derivatives, etc.) except for funds and income/capital gain from private sale transactions such as for coins/metals, FX or cryptoassets.

- Link to official tax form: https://www.formulare-bfinv.de/ffw/catalog/openForm.do?path=catalog%3A%2F%2FSteuerformulare%2Fest%2Fest21%2F034024_21&setCurrentFolder=true

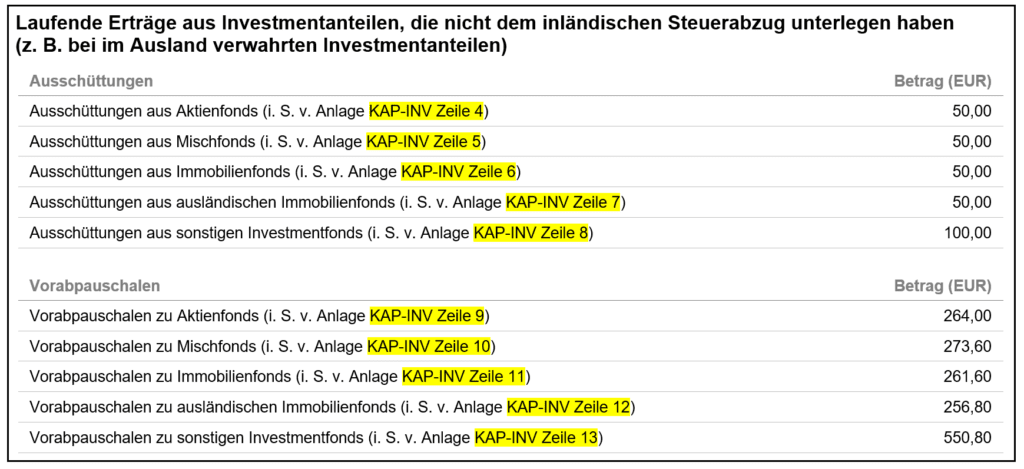

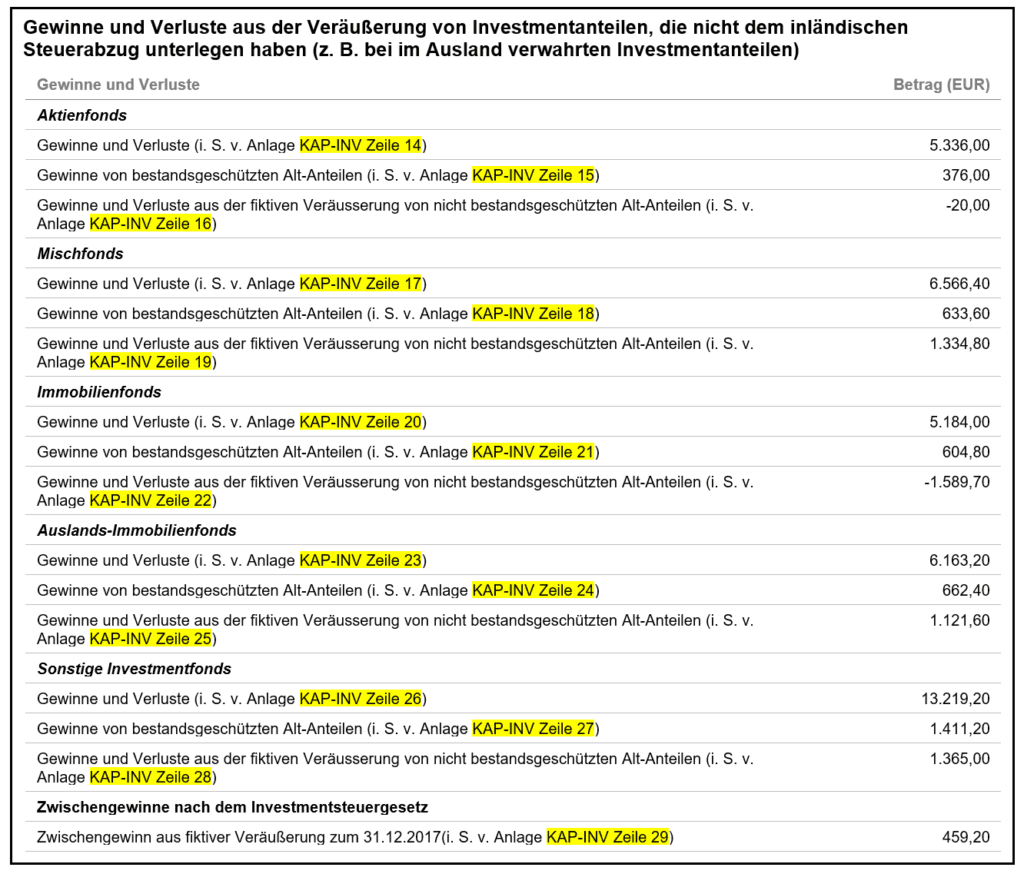

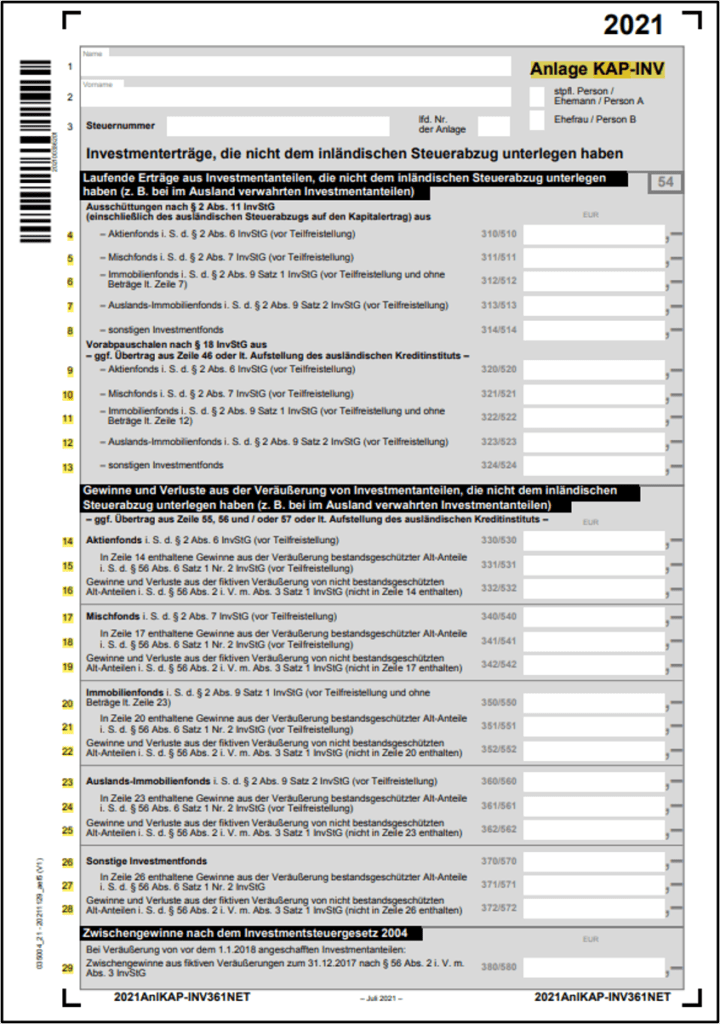

Form Anlage KAP-INV

- This tax form was introduced in 2018 and covers investment fund income and capital gain.

- Fund distributions, advanced lump sums, and disposal of investment units that have not been subject to domestic tax deductions need to be reported in this formula.

- Link to official tax form: https://www.formulare-bfinv.de/ffw/catalog/openForm.do?path=catalog%3A%2F%2FSteuerformulare%2Fest%2Fest21%2F035004_21&setCurrentFolder=true

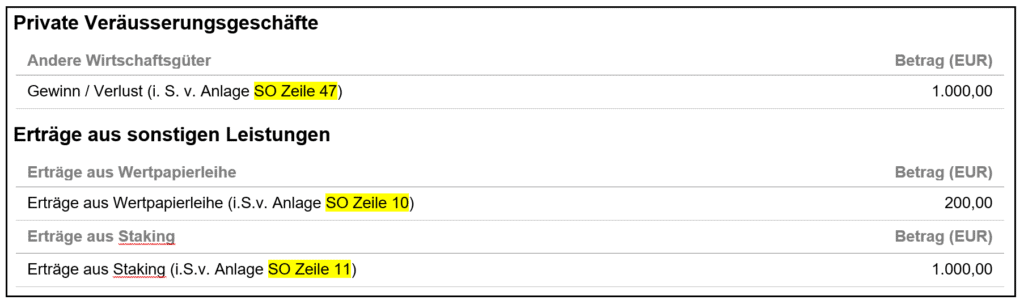

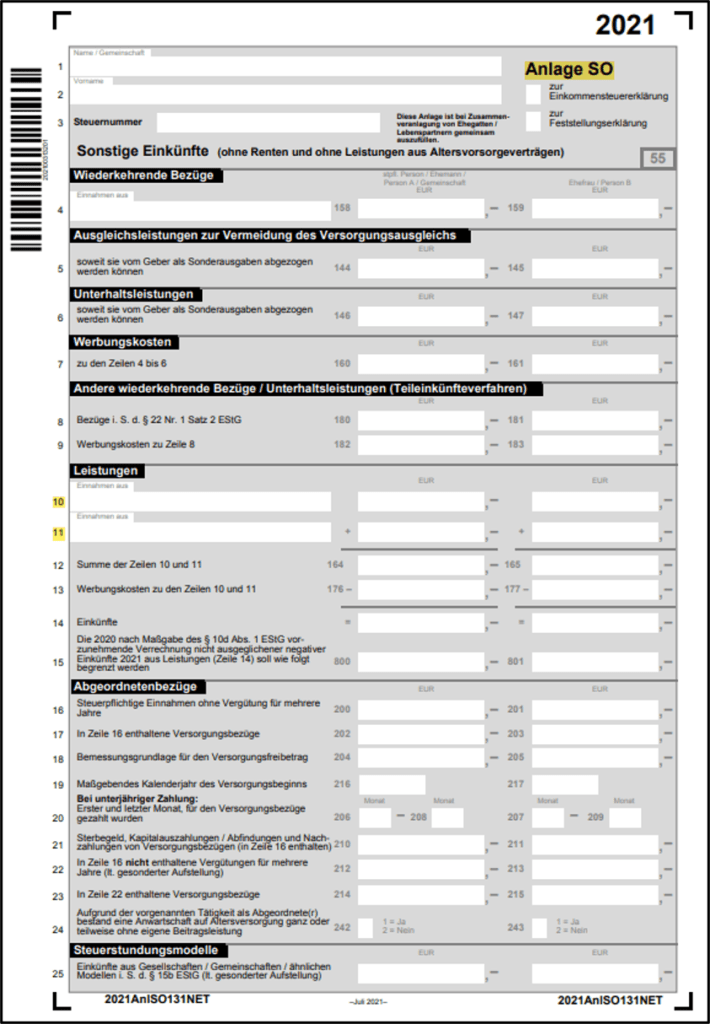

Form Anlage SO

- Income from private sales transactions is declared in “Anlage SO.”

- This is income or sale proceeds from cryptoassets, coins/metals or FX-transactions. Individual tax rate up to 45% on this income is applied.

- Link to official tax form: https://www.formulare-bfinv.de/ffw/catalog/openForm.do?path=catalog%3A%2F%2FSteuerformulare%2Fest%2Fest21%2F034029_21&setCurrentFolder=true

Official Tax reports: