Up 15% today, down 10% tomorrow. Bitcoin volatility is one of the scariest things for a cryptocurrency trader or user.

Bitcoin volatility

Why does bitcoin fluctuate? A lot of it has to do with the uncertainty of bitcoin as a viable form of currency or store of value. Sprinkle in questions about how bitcoin is currently being used and unethical trading practices by cryptocurrency exchanges, and you have a recipe for wild price swings. While bitcoin traders don’t mind this volatility, it has generated a host of non-believers who see bitcoin as nothing more than a speculative investment. Yet, some public figures have come out of the woodwork to vocalize their change of opinion on the cryptocurrency, showing a trend toward positive sentiment of the cryptocurrency.

Is bitcoin volatility as big of a concern as it appears? Or, is too much being made of its short-term price fluctuations?

Is Bitcoin too volatile to be a currency?

Bitcoin volatility stems from its uncertain future as a digital currency. When looking at the short term, bitcoin price fluctuation is concerning. Prices can rise and fall upwards of 10% in any given day on the backs of rumors and unsubstantiated news.

When examined objectively, bitcoin does prove to be an improvement over fiat currency and gold, but it still requires mass adoption to become a viable currency and/or store-of-value. Bitcoin might be the best invention since sliced bread, but if it isn’t used on a global scale, it won’t ever be a true alternative to traditional currencies for the masses. After all, much of the general public still has the question what is cryptocurrency.

One advantage bitcoin does have on its competitors is what is known as network effects. A network effect occurs when a good or service increases in value as a direct result of the number of people using that good or service. Think back to when the Internet first started. If you were one of the first people to ever use this new technology, it was probably a novel idea, but in reality, it didn’t provide much value. There was no one you could send email, and nothing more than a few web pages to browse. As the number of people who used the Internet grew, more web pages were created, and more functionality added, increasing its overall value. Fast forward to today and the Internet has skyrocketed in value because of the number of people using the platform.

Bitcoin will succeed or fail based on these same network effects. If people trust bitcoin and choose to transact using it, the currency will hold substantial value, but if not, it will ultimately falter. When more people begin to use bitcoin on a regular basis, it will increase its value and stabilize as a currency. But until then, bitcoin price fluctuation will remain the norm.

Is the volatility of Bitcoin good or bad for trading?

It’s true that bitcoin is becoming more widely used as a global currency. But bitcoin today is still mainly used by investors and traders to profit from regular price swings in the market. These traders are one group of people who don’t ever question cryptocurrency volatility. That’s because volatility is what drives profits for traders, who take advantage of price fluctuations in bitcoin to turn a profit.

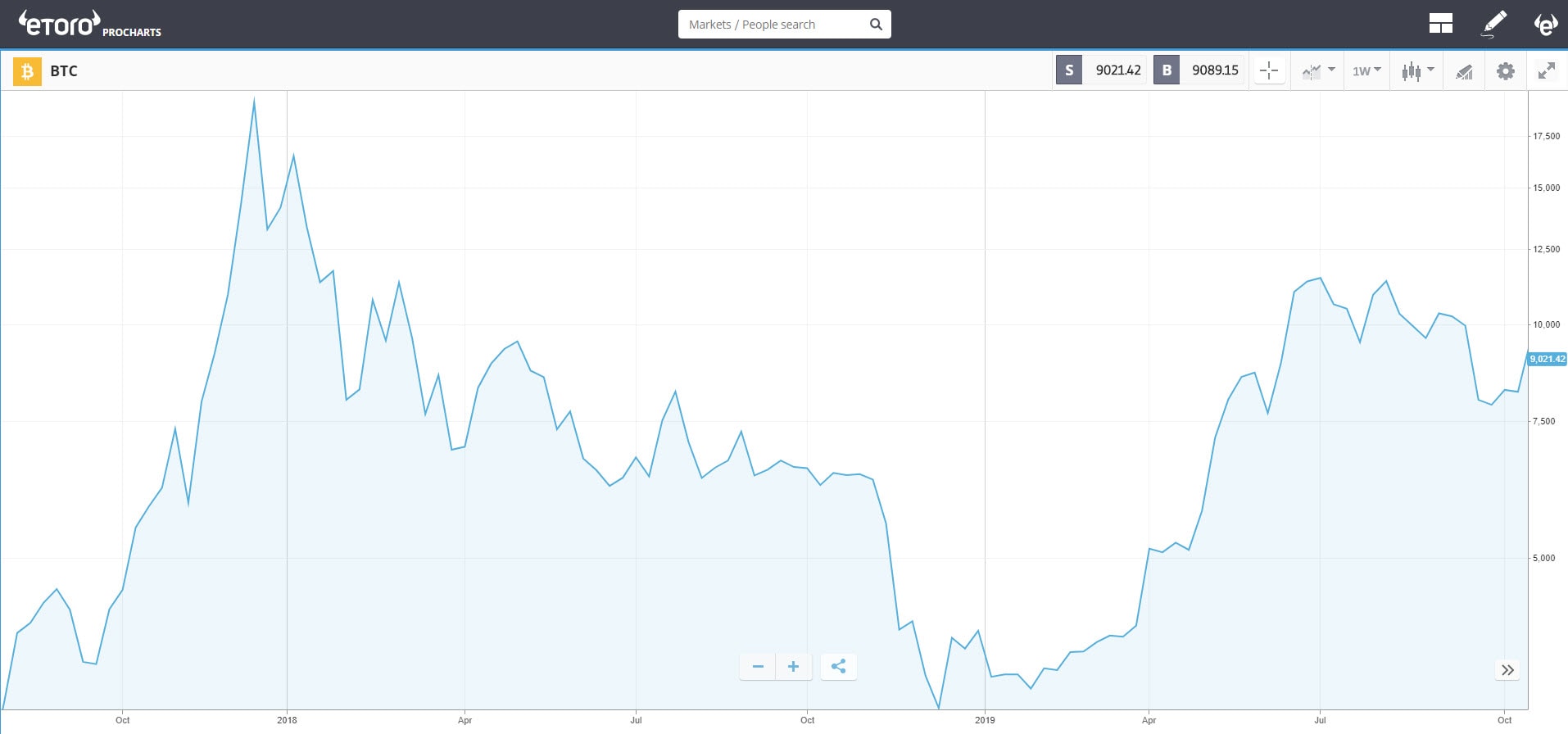

During the period of January 2018–June 2019, the price of bitcoin moved an average of 2.67% each day. Over that time, traders could take advantage of daily price swings as high as 16% on the upside, and more than 18% on the downside. This volatility was more than six times higher than that of gold and fiat currencies.

Investors that are steadfast in their trading strategy can take advantage of fear and uncertainty by knowing how to buy bitcoin and sell it to profit from bitcoin price fluctuations. The 10% daily swings in cryptocurrency volatility, which strike fear into the hearts of many, appear as potential profits for the wisest traders.

What is the bitcoin volatility index?

The Bitcoin Volatility Index is a measure of the upward and downward movement of the price of bitcoin in U.S. dollars. Investors can study the price volatility record in both the short and long term—whether it’s a month or a few years. Traders may only be interested in immediate volatility as expressed in the average daily price change.

Exchange volumes aren’t what you think they are

What determines bitcoin price? A combination of supply and demand for the cryptocurrency which is driven by cryptocurrency exchanges. The only problem is the millions of dollars in bitcoin transactions occurring every day might not actually be real transactions at all.

Research suggests that the bitcoin market is filled with wash trading, a method of market manipulation when a party buys and sells the same asset to inflate trading volumes. Why is wash trading so prevalent in bitcoin? The higher the trading volume on an exchange, the more legitimate it appears to investors. Therefore, some virtual currency exchanges use wash trading as a way to inflate their volumes regularly.

At one point, wash trading was so prevalent it was estimated that some exchanges were inflating their bitcoin trading volumes upwards of 90% via wash trading. This means choosing the right exchange for investors is of paramount importance. Without regulation in place to stop these unethical practices, exchanges were free to run wild and boost their trading volumes and create a questionable exchange rate. Luckily for the entire industry, wash trading has been minimized over the past several months and has decreased by 35% since the beginning of 2019. The hope is this crackdown on wash trading in crypto markets will, in turn, result in lower bitcoin price fluctuations.

The 2017 bull run and aftermath

There is no better example of bitcoin price fluctuation than in the 2017 bull run and aftermath. The price of bitcoin began the year at about $1,000, pushing the entire cryptocurrencies market past a $16 billion valuation. To many, this seemed like a solid valuation for bitcoin at the time. By May of the same year, the price grew to over $1,300, a positive sign for bitcoin, but nothing to write home about. Then, in the summer of 2017, the bulls rushed in.

The price of bitcoin began to steadily rise over the fall months and into the winter. By the beginning of December, bitcoin was worth $10,000. If that wasn’t enough, a few weeks later the price ballooned to nearly $20,000. Bitcoin was breaking through every price barrier in its way.

Unfortunately, as quickly as bitcoin rose in price, it began to fall. Investors started to take their profits off the table and the same questions surrounding the cryptocurrency before the bull market—like its scalability and transaction costs—were still yet to be resolved. Bitcoin was just as unpredictable at a price of $20,000 as it was at $1,000. This made investors anxious. So, in the beginning of 2018, the price of bitcoin started to fall. By the end of the year, bitcoin sank below $5,000, showing investors that bitcoin price fluctuations run both ways.

Bitcoin non-believers

For years, popular culture has led the public to believe that bitcoin fluctuation made it an unpredictable, volatile asset. News outlets like CNBC and Bloomberg only reported on cryptocurrency volatility as a way of scaring investors away from the new asset class. There is even one website that has compiled a list of bitcoin obituaries: when major news outlets have declared bitcoin dead. According to the site, bitcoin has been declared dead 379 times and counting.

Sadly, many financial pundits are stuck in archaic ways of thinking that don’t allow them to be open to the idea of bitcoin as a global currency. Outspoken opponents of bitcoin include:

- Nouriel Roubini – The world-renowned economist has gone out of his way to degrade bitcoin and the cryptocurrency industry as a whole. Whether it be speaking in front of the United States Senate or on cable television, Roubini doesn’t waste any time bashing bitcoin as the “mother of all scams.”

- Warren Buffet – Maybe the most well-known financial guru of our time, Buffet has called bitcoin a “mirage” and warned the public to stay away from the asset amid cryptocurrency volatility. What remains to be seen is how much Buffet actually knows about bitcoin and his understanding of its technology.

- Paul Krugman – Krugman wrongly predicted the demise of the Internet, and now he has his sights set on bitcoin. The economist sees a total collapse of the entire industry as not only a possibility, but imminent, because of high transaction costs and cryptocurrency volatility.

- Jamie Dimon – The JPMorgan CEO once called bitcoin a “fraud,” yet his company is heavily invested in blockchain technology.

Sadly, it’s to be expected that those firmly entrenched in the world of finance would be weary of the bitcoin network. These economists and finance professionals have a pretty sweet deal, making millions, if not billions, of dollars from the current financial system. They have no incentive to endorse a new, radical financial concept which would only stand to hurt them personally. For this same reason, most financial advisors and wealth managers scoff at the idea of advising their clients to hold bitcoin as a legitimate asset. This has kept bitcoin as a fringe investment for finance professionals and pundits who have more to gain than to lose from a new form of currency.

Recent changes in opinion of bitcoin

It’s been a long time coming, but many people who were once fearful of bitcoin are now changing their tune. The longer the currency remains in the public consciousness and proves its worth, the more people are softening their stance on bitcoin which boasts the largest market cap of all digital currencies.

U.S. Federal Reserve Chairman Jerome Powell recently compared bitcoin to gold, a bold statement given that the United States government has been concerned about bitcoin volatility and its lack of control over the cryptocurrency. Even Nouriel Roubini has changed his tune, saying that, “maybe bitcoin is a partial store of value.” For someone with the nickname Dr. Doom, this comes as high praise.

Billionaire Richard Branson had every right to hate bitcoin after scammers were impersonating him to extract bitcoin from victims. But this hasn’t stopped Branson from now saying that bitcoin is a bold technology that is revolutionizing currency.

The change in public perception has become so apparent that even traditional broker-dealers are now saying owning some bitcoin is not only not crazy, it’s a good idea for a diversified portfolio.

Is Bitcoin doomed to be volatile forever?

At the end of the day, bitcoin volatility is something that should not only be expected, but embraced during these early years of the cryptocurrency. The fate of bitcoin as a currency is still yet to be determined, meaning bitcoin price fluctuation will likely remain. Unfortunately, for now, volatility remains a point of contention among the financial community.

When the Internet was built, it didn’t take a straight line to prominence. In fact, it experienced its own ups and downs before becoming the World Wide Web we know today. It could take years, or even decades before bitcoin becomes the new standard in global currency.

As they say, Rome wasn’t built in a day, and the same is true of bitcoin. But the longer bitcoin remains a safe, valuable network, the less its price will fluctuate. The hope is, eventually, bitcoin will settle on a price that accurately represents its network value. Until then, bitcoin will continue to see its price rise and fall.

Get started on eToro to follow bitcoin’s price movements and explore our halving course for more information on the upcoming event.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.