Understanding market capitalisation (or “crypto market cap”) is essential for crypto investors trying to make well-informed investment decisions. This article will explore what cryptocurrency market cap is, and how it can be used to indicate the value of cryptoassets.

Market capitalisation is a relatively straightforward concept, calculated by a simple equation that can help investors to determine the value of a cryptoasset. It is important to understand what insights a cryptoasset’s market cap can provide, and how to apply them to your investment decisions.

What is a cryptocurrency market cap?

Traditionally, market cap indicates the total value of shares of a company’s stock. The crypto industry has adopted

How to calculate a cryptocurrency market cap

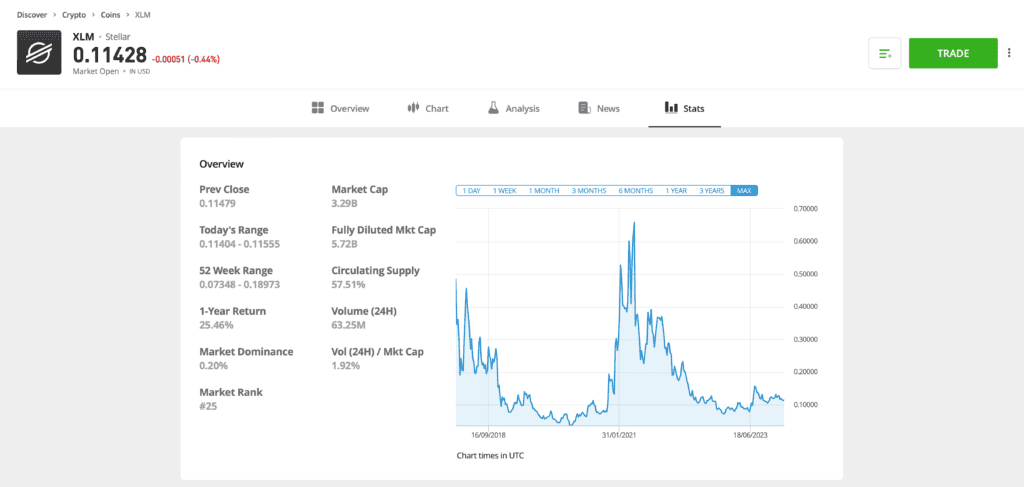

Crypto market cap is calculated by multiplying the price of a coin by the total number of coins in circulation.

For example, in the screenshot below, the price of Solana (SOL) is $160.98 and at the time of writing the number of SOL coins in circulation totalled 524,925,220. If you multiply the current price of SOL by the number of tokens in circulation, you’ll reach a market cap of $84,502,712,257.

Past performance is not an indication of future results

Source: eToro

Why is the crypto market cap important to investors?

It is important for investors to understand what is meant by crypto market cap, as it allows them to see past the price of a cryptoasset to gain a better, overall insight into its value.

Market cap allows for comparison between coins, enabling investors to compare the relative size and value of one cryptocurrency with another. Data from a wide range of cryptocurrencies can further indicate the total crypto market cap, as a measure of how the asset class is performing overall, relative to commodities or CFDs, for example.

This can offer investors wider market insight and can help them to formulate decisions about whether now is the right time to invest.

Investors should also be aware of how market cap can impact the price of an individual cryptoasset by influencing its perceived value and

Maximum vs circulating supply

It is important that crypto investors do not just take market cap metrics at face value. There are several differences between crypto and traditional financial markets that should always be considered.

In traditional financial markets, “free float” metrics can differentiate between shares that are available to be publicly traded, and those that are held in “lock up,” perhaps by company founders, directors or executives. This essentially differentiates between the total (or “maximum”) supply and the circulating supply of shares.

Similarly, in the crypto sector, a coin’s maximum supply can differ from a coin’s circulating supply, but the difference between these two metrics is not always made abundantly clear.

Maximum supply refers to the maximum number of cryptocurrency coins or tokens that can ever exist. Some cryptoassets, such as Bitcoin (BTC), have limits to their maximum supply, meaning a predetermined number of coins will ever exist. Others, such as Ethereum (ETH), have an infinite supply.

On the other hand, circulating supply refers to the number of coins that exist in open circulation (free float) at any given time.

These metrics can differ. As well as a potentially significant volume of privately issued or owned coins held in lock up, there are also coins awaiting release in an ICO. Some coins are lost over time, and others may simply remain stagnant in anonymous wallets.

Tip: Investors should understand how various factors can influence the total and circulating supply of a cryptoasset.

Generally, market cap calculations are determined using circulating supply metrics. But, when calculating or considering market cap, it is crucial to be aware of which metrics have been used, and to understand the implications that either may have on the outcome.

How are crypto market caps categorised?

Cryptocurrency market caps are typically broken down into three categories, “Large-Cap”, “Medium-Cap”, or “Small-Cap”. Cryptos can move between categories when their market price and the amount of coins in circulation changes causing changes to the size of their market cap.

Tip: The terms large, medium, and small cap are applied to other markets as well, for example stock market capitalisations.

Large-cap cryptocurrencies

Large-cap cryptocurrencies have a market cap of over $10 billion. They are generally considered lower risk investments, as they have more liquidity and are better able to withstand market volatility. BNB Chain (BNB) is a good example of a large-cap cryptoasset.

Medium cap cryptocurrencies

Mid-cap cryptocurrencies have a market cap of between $1 billion and $10 billion. They are widely considered to be medium-risk investments, because although they are more volatile than large-cap cryptoassets, many investors believe that untapped opportunities lie within coins of this category.

Small-cap cryptocurrencies

Small-cap cryptocurrencies have a market cap of lower than $1 billion, and are deemed to be the riskiest investments. Whilst they have greater upside potential, small-cap coins are most susceptible to market volatility and generally have lower liquidity to withstand sudden, or high-volume, market movements.

Tip: You can use market cap league tables to monitor the relative size of different cryptos.

What are the largest crypto market caps?

The chances are, even for those new to crypto, investors will be familiar with some of the largest market cap cryptocurrencies.

- Bitcoin (BTC) is the largest crypto by market cap. It was the world’s first cryptocurrency and has revolutionised

decentralised finance . According to eToro data, as of June 2025, it had a market cap of $2,178 billion. - Ethereum (ETH) is the second-most-popular cryptoasset, popularised by the ability to build upon its blockchain and facilitate the use of

decentralised applications (dApps) . According to eToro data, as of June 2025, it had a market cap of $334 billion. - XRP (XRP) assists with currency exchange and cross-border payments. It allows businesses to send money overseas quickly and affordably. According to eToro data, as of June 2025, it had a market cap of $135 billion.

- Solana (SOL) is the native token of the Solana blockchain, which can facilitate the creation of dApps. The SOL token itself can be used within the Solana network to pay transaction fees and run

smart contracts . According to eToro data, as of June 2025, it had a market cap of $84 billion. - Dogecoin (DOGE) is an altcoin (or a “meme coin”) that gained popularity during the COVID-19 pandemic as a result of social media. It is infinite in supply, and according to eToro data, as of December 2023, had a market cap of $12.76 billion.

- Cardano (ADA) is the native token of the environmentally friendly,

Proof of Stake (PoS) , Cardano blockchain. According to eToro data, as of June 2025, it had a market cap of $24 billion.

Comparing crypto market caps to those of other assets

When you consider the thousands of altcoins which are also in circulation you find that the combined global crypto market has a market cap of $3.31 trillion. Putting that into perspective, the market cap of gold, calculated by multiplying the amount of above ground gold reserves by the gold price, is $22.10 trillion.

Final thoughts

Crypto market cap should not be misunderstood as a direct indication of value, but when considered in line with a well-thought-out investment strategy, market cap can help crypto investors to understand more about the perceived value, size and stability of a cryptoasset.

Market cap can offer valuable insights into the wider context of many cryptoassets, but is best used in conjunction with other types of analysis.

Learn more about investing in crypto by visiting the eToro Academy.

Quiz

FAQ

- Is market cap alone enough to determine a good investment?

-

No, market cap alone should not be used to determine the strength of a coin’s investment potential. It should be used as an insight, alongside consideration of other factors such as use case potentials, ownership and development structure, and the underlying blockchain technology.

- What is meant by the term “Volume %”?

-

Volume % is usually shown alongside market cap and price data to demonstrate the trading volume of a cryptocurrency within the last 24 hours. The percentage shown will be the percentage change in trading volume, either positive or negative.

- Are coins with large market caps always more stable?

-

Generally, coins with larger market caps are considered to be more stable than those with smaller market caps. However, even the price of large-cap coins, such as bitcoin, can be highly volatile. As with all asset classes, it is sensible to diversify your portfolio across the small-, mid- and large-cap cryptoassets, to help manage your risk.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.

AU disclaimer: eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Crypto assets are unregulated and highly speculative. There is no consumer protection. You risk losing all of your capital. Refer to our Terms and Conditions. See full disclaimer

UK disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

Spain: Investments in crypto–assets are not regulated. They may not be appropriate for retail investors and the full amount invested may be lost. It is important to read and understand the risks of this investment, which are explained in detail in this link.

France: Cryptoassets investing and custody are offered by eToro (Europe) Ltd as a digital asset service provider, registered with the AMF. Cryptoasset investing is highly volatile. No consumer protection. Tax on profits may apply.

Rest of CySEC: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.