The Bitcoin Halving (also known as the “Halvening”) is a crucial event that occurs approximately every four years, coinciding with the addition of another 210,000 “blocks” to the blockchain. During this event, the reward that Bitcoin miners receive for validating transactions and securing the network is cut in half.

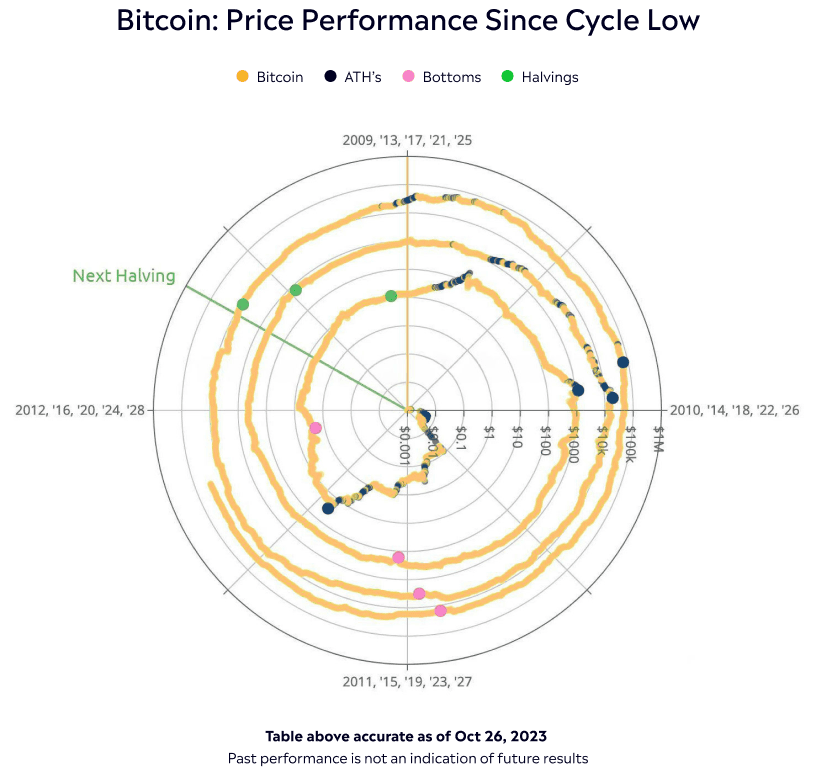

This reduction has a twofold impact: it slows down the rate at which new Bitcoins are created, thereby decreasing the supply of Bitcoin entering the market, and consequently impacting the price. The four-year cycle of the halving has historically influenced Bitcoin’s price movements and market dynamics, making the halving an eagerly anticipated event in the crypto realm.

What the Halving could mean for your investment

Historically, the halving has had a substantial impact on the price of Bitcoin, and has led to a considerable rise in price, making it an exciting time for investors and traders alike.

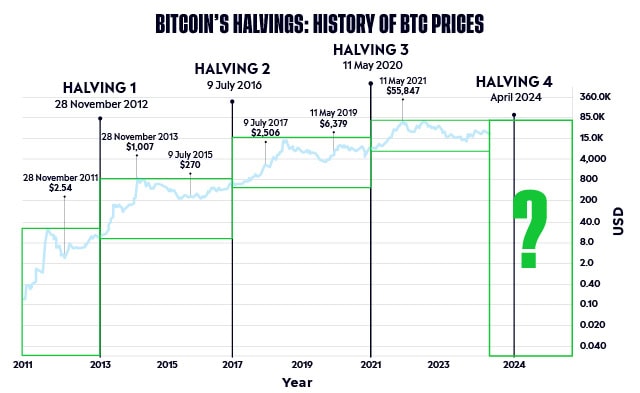

A look back at the four year cycle of the previous halvings shows clearly how each time the supply was tightened, how it caused a bull run – and the price of Bitcoin massively surged. In terms of price, the current cycle seems to be closely mirroring past market cycles.

While the impact of the upcoming halving is still uncertain, many crypto experts believe that Bitcoin’s price dynamics could be similar this time, meaning that once again we would see a sizable increase after the event.

It’s also important to note that the crypto market has changed a lot since the last halving in 2020, and the likelihood of the price going up depends upon how people buy bitcoins during the halving.

Detailed in the table below are the range of price, from the lowest point prior to the halving, to the highest peak following it, according to percentage, in the years following the previous halving cycles in 2012, 2016, and 2020.

What the Halving could mean for your investment

Cryptoassets are unregulated & highly speculative. No consumer protection. Capital at risk.

FAQ

- When does the next Bitcoin halving occur?

-

The next Bitcoin halving is due to take place in 2024, currently estimated to be in April. The specific timing of each halving is determined by the block height, which is based on the number of blocks mined rather than a fixed date. Historically, halvings have occurred every 210,000 blocks, roughly every four years. The first halving occurred in 2012, the second in 2016, the third in 2020, and so on.

- Why does the Bitcoin halving happen?

-

The halving is built into Bitcoin’s protocol as a way to control its supply and mimic the scarcity of precious metals. By reducing the block rewards over time, the total supply of bitcoins is capped at 21 million, making it a deflationary asset.

- How will the halving impact Bitcoin’s price?

-

The Bitcoin halving is often associated with speculation about its potential impact on the price. Previous halvings in 2012 and 2016 were followed by substantial price increases, but this pattern doesn’t guarantee future results. Price movements are influenced by a complex array of factors, including supply and demand dynamics, market sentiment, macroeconomic trends, and more.

- Does the halving affect blockchain transaction fees?

-

The reduction in block rewards can potentially lead to increased transaction fees becoming a more important source of income for miners. As block rewards decrease, miners might prioritise transactions with higher fees, potentially affecting the speed and cost of transactions.

- Should I buy or sell before the halving?

-

Predicting short-term price movements around the halving can be challenging, and attempting to time the market can be risky. Investors should focus on their long-term investment goals and consider a diversified strategy rather than making decisions solely based on the halving event.

- Does the halving affect altcoins or other cryptoassets?

-

While the Bitcoin halving specifically impacts Bitcoin’s supply and mining ecosystem, it may also indirectly influence the broader cryptocurrency market sentiment. If Bitcoin experiences significant price movements, other cryptos could also be affected, however the effects can vary widely.

- Will there ever be more than 21 million Bitcoins?

-

No, the maximum supply of Bitcoin is capped at 21 million coins due to the halving mechanism and the fixed issuance schedule. This scarcity is one of the fundamental reasons why Bitcoin is often compared to digital gold.

- How does the halving impact the rate of new Bitcoin creation?

-

Before a halving, new Bitcoins are created and added to circulation at a higher rate. After the halving, the rate of new issuance is reduced by half, leading to a slower increase in the total supply of Bitcoin.

- Can the Bitcoin halving be predicted?

-

The Bitcoin halving can be predicted with a high degree of accuracy based on the block height and the time it takes to mine blocks. However, the precise date and time can vary due to the unpredictable nature of mining, which can result in slight variations from the expected schedule.

- Is the halving the only factor affecting Bitcoin’s supply and price?

-

While the halving is a significant event in the Bitcoin ecosystem, it’s important to note that other factors, such as technological developments, regulatory changes, macroeconomic trends, and market sentiment, also play a role in shaping the supply and price dynamics of Bitcoin.