Hi Everyone,

Going from local to global has been the norm throughout history but crypto has changed that in a very sudden way, leaving financial regulators at a bit of a loss. Well, it seems they’re hitting back now.

For the first time in history, we have an entire asset class which is global in nature. As there is no financial regulation that has effective authority over the entire world, so far each country has had to scramble to write their own rules.

The Financial Assets Task Force (FATF) in France now seems to feel like they have what it takes to crack down on those who might use crypto to launder money.

As Bloomberg reports, on June 21st FATF will publish a note asking all crypto exchanges to comply with international banking laws.

Depending on what is announced, this has the potential to shake up the entire financial world, not even just crypto. Compliance with the new regulations could be costly for exchanges, but also could have a knock-on effect on traditional financial institutions or even countries who have limited resources to begin with. Non-compliance with these type of regulations often causes small countries to end up on blacklists and doing further damage to their economies.

Furthermore, it’s difficult to understand what FATF is exactly trying to accomplish here. Cryptocurrencies operate independently of financial institutions, no rules or regulations are likely to change that. All they’re likely to end up doing is to make things more difficult for legitimate players and force the criminals further underground.

Will this be the first cannon fired in a prolonged war between new and traditional finance? I guess we’ll find out next week.

Today’s Highlights

- June Rally is Back on

- What Moves Crypto Prices

- LocalBitcoin’s Trend

Traditional Markets

Stocks are rebounding today after showing some signs of weakness yesterday and this morning, it seems everything is back on track by midday.

The square in front of the legislative council in Hong Kong has been cleaned up and by now there is no sign of yesterday’s clashes, save for the footage circulating the web. Leaders have decided to hold off on the extradition debate for the time being, which does seem like a win for the protestors even if it’s not the annulment they were looking for.

As of this writing, the June rally in global stocks seems to be back on.

What Moves Crypto?

The answer might shock you.

According to researchers at Indexica, nothing.

It seems that even though the asset class is maturing at a rapid pace Zak Selbert and his team were not able to find any real market drivers, claiming that crypto markets don’t really react to breaking news like traditional stocks.

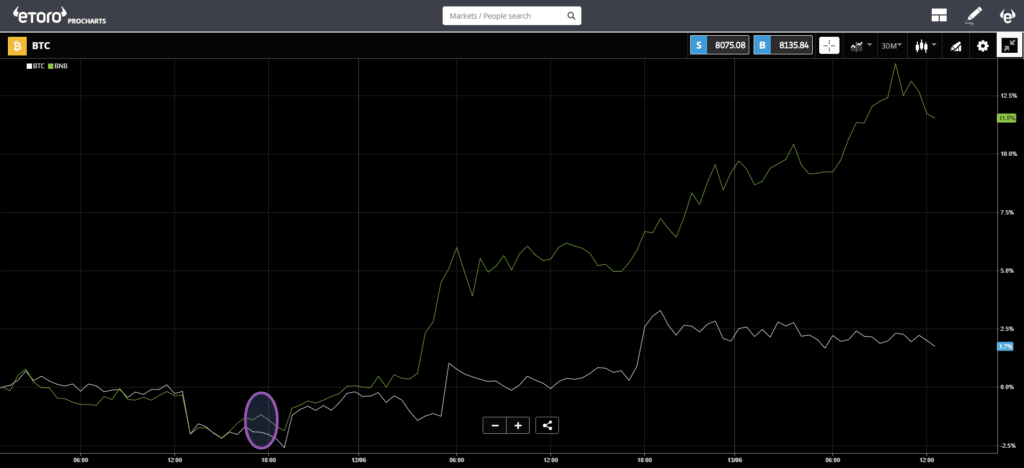

Case in point, since the Bloomberg article mentioned in our opening note was published (purple circle), the price of Bitcoin has barely budged and Binance Coin (green line) has marked a new all-time high.

Still, even though cryptos might not behave like a stock or a commodity, I personally feel that their patterns do have both rhyme and reason. We simply need to go back to the basics.

Those of you who’ve been reading know that I try to stress very simple technical indicators and very deep fundamentals.

A simple moving average or a strong support/resistance line is really enough. For example, take a look at the way Binance Coin has interacted with the level $32.50.

What Really Moves Crypto Prices?

Of course, for long-term investors and hodlers what really matters is adoption. Sentiment and momentum are clearly king but what tends to drive them are adoption rates and real-world usage.

For example, we can see the transactions on the Bitcoin blockchain or new wallet addresses as a very good indication of the level that it’s being used.

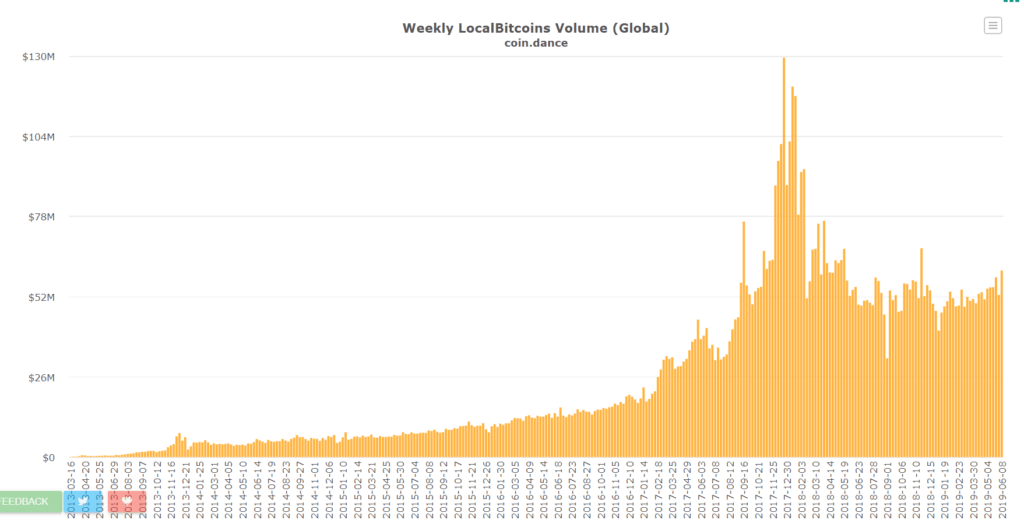

We also like to monitor the level of volumes across exchanges but the type of data that really helps are the volumes from peer-to-peer sites like LocalBitcoins.

Here we can see the long-term chart of global volumes there, which seems to be growing strong lately despite the site being banned in Iran and despite them discontinuing their crypto for cash options.

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.