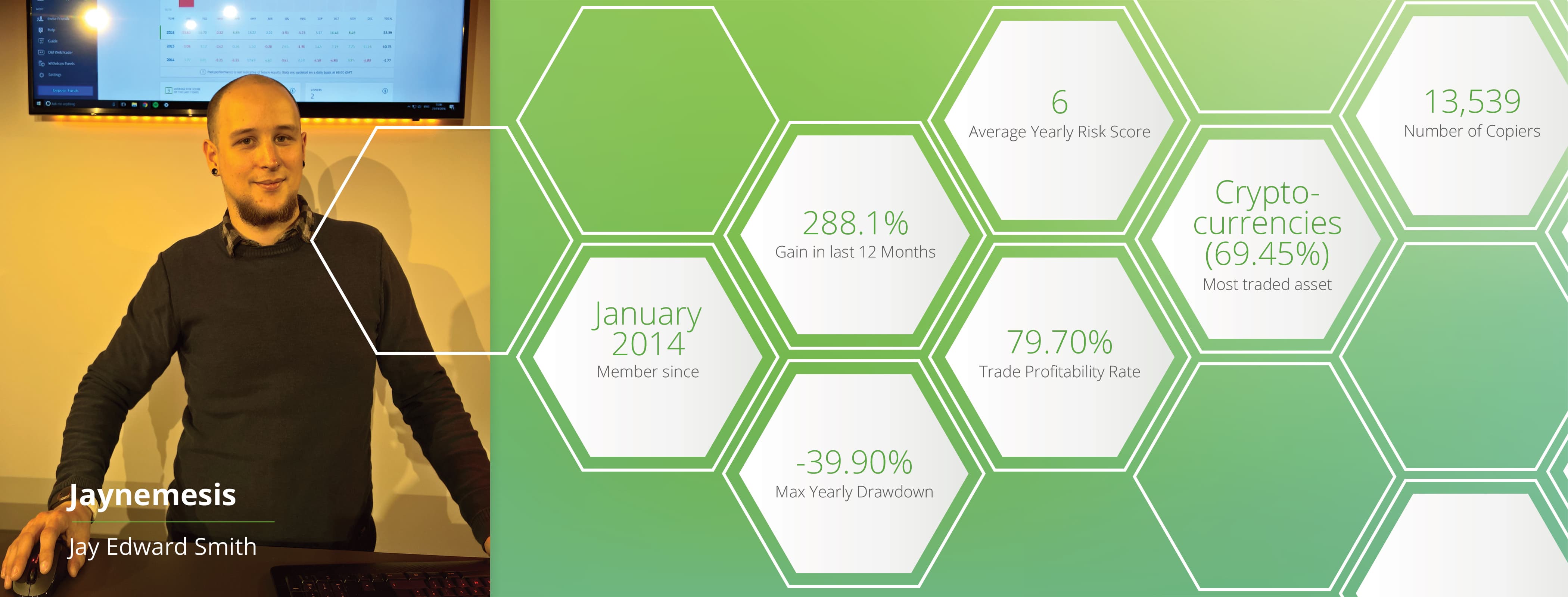

An interview with Popular Investor Jay Edward Smith (jaynemesis)

Jay Edward Smith has been trading since he was old enough to save up his own funds; his interest in finance and economics began during his teenage years. Jay joined eToro four years ago, growing his reputation as a leading authority on cryptocurrencies. “They’re very volatile, with far fewer traditional investors in the space,” says Jay of his favourite trading asset. “Even if [cryptocurrency] does dip in the short term, it just turns into a long-term position.”

Having been an investor for over 9 years, what made you choose eToro as your platform for trading?

In 2012, I heard about Bitcoin; after studying it for a couple of weeks, I was hooked. By mid-2013, I had become obsessive about the potential future of the technology and was investing most of my savings in crypto. eToro was a trustworthy place where I could trade it alongside more traditional instruments, plus the social features were also really appealing to me.

What are the advantages of social trading?

Social trading is an amazing movement in finance that empowers those who would normally feel unable to benefit from the movements of global markets to be put on a level playing field.

The community on eToro is fantastic, in fact I chat with my copiers every day. The other thing which simply cannot be ignored is the potential income as a Popular Investor. When I first joined the program, I never expected to earn more than maybe $500 a month, as a bonus to my own trading income. Instead, it was enough to allow me to leave my job to trade full-time.

What were some of the mistakes that you made as a new trader on eToro?

When my copier numbers first began increasing, I became quite nervous and concerned about ensuring I make them money as quickly as possible. As a result, my trading became sloppy. Eventually, I realised that the best way to look after their money responsibly is to trade exactly as I always have — treat it like it’s all my own money. If I was placing $1,000,000 on this trade instead of $2,000, would I still do it? The answer now is always yes.

What advice would you give to new eToro users?

Even if you plan to trade short term, consider if the investment might be worth holding long term when the trade is not going your way. Buy the dip, almost always. There are so many quotes from top investors which effectively say the same thing. “When there is blood on the streets, buy.” “Buy into fear, sell into greed.” “When others are fearful, be brave, when others are brave be fearful.” You get the idea. And don’t use leverage unless you are extremely confident.

What is your take on cryptocurrencies?

Overall, I believe cryptocurrencies are an invention that could be considered bigger than anything before them, including the Internet. I would urge any investors to assign at least 1% of their portfolios to cryptocurrencies and to spend some time researching the basics, so that they are well-positioned to understand the future debates which will undoubtedly come.

Cryptocurrencies trade very differently to stocks. Generally I find that, unless I am in profit, I try to set some of my stop-losses as low as possible to avoid accidentally selling during flash-crashes. I combine this with some tight SL’s and some loose SL’s. This spreads the risk and means that even with slippage, most will either close in a profit or not close at all.

Realistically, I believe my trading style is exposed to higher drawdown than many traders, but usually it does not last too long. I am very confident in the technology behind the cryptocurrencies I trade, so I don’t worry about these things too much. I also trade almost exclusively in cryptos that I would be happy to hold for a year or more, which gives me the ability to sit on it if the trade goes against me in a long position.

How do you think the long-term future for cryptos will pan out?

I believe that many of the current top ten cryptos will still be here in ten years, but there is certainly a dotcom style bubble pop coming. Many of the recent ICO’s have abused the lack of regulations as a way of fooling investors into backing products which may never be built and almost certainly won’t deliver on their promises. That being said, there will be hundreds of projects that thrive, evolve and mature as crypto-platforms, such as Ethereum. Finally, I believe technologies such as atom swaps and “hyperledgers” will allow cryptos to become more connected than ever before. It will feel more and more like 1 or 2 big networks than the fragmented situation we see today. In terms of value, I expect the cryptocurrency ecosystem will command a market cap of well over a trillion in ten years from now.

Get your free $100K Demo account

Want more top trader tips?

Share Information and Learn From Others

Start for free with a demo account

Anyone Could Do This

The views expressed in this post represent the interviewee’s personal views and not those of eToro. Past performance is not an indication of future results. Cryptocurrencies can fluctuate widely in prices and are, therefore, not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework. This is not investment advice. Your capital is at risk.